Solar power generation will expand strongly but not uniformly in Southeast states through the 2020s, the Southern Alliance for Clean Energy says in its annual solar report.

Solar power generation will expand strongly but not uniformly in the Southeast through the rest of the decade, the Southern Alliance for Clean Energy said in its annual solar report.

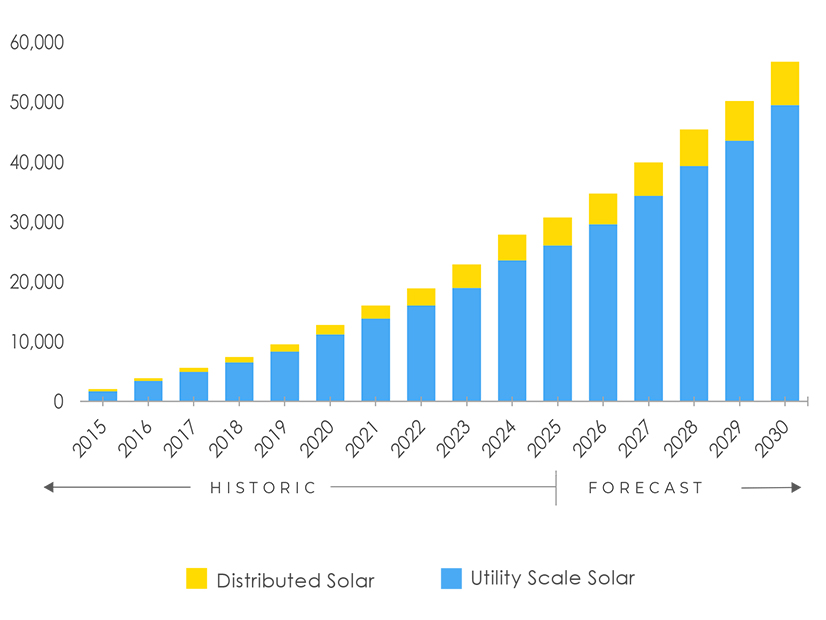

The seven-state region ended 2024 with 27.84 GW of installed capacity in areas outside PJM and MISO territory and is expected to reach approximately 54 GW in 2030, SACE reported.

“We are very bullish on solar power; have been for a long time,” SACE Executive Director Stephen Smith said during an Oct. 29 webinar, “and as you’ll see in this report, we’re beginning to see that some states are really starting to make big bets in solar and break away and make it a workhorse technology that we think is necessary.”

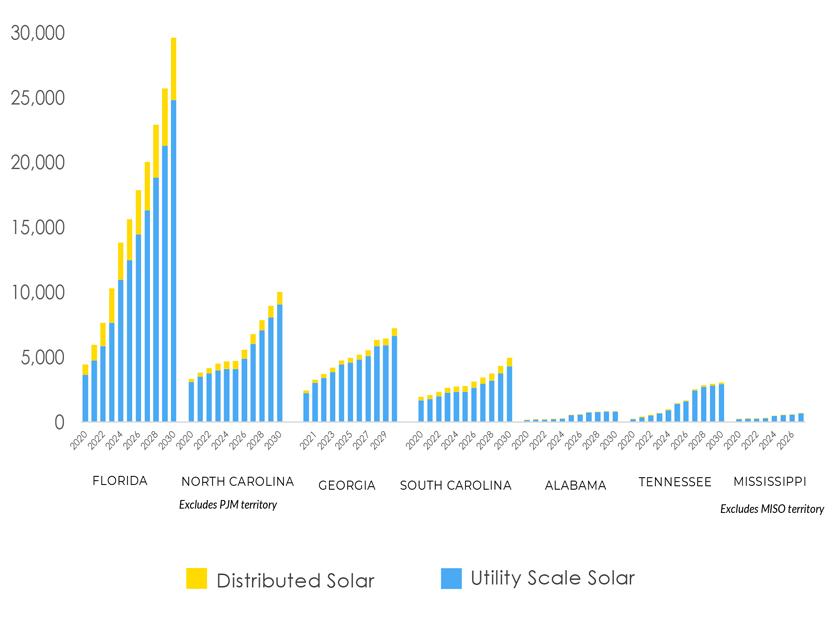

“Solar in the Southeast” shows Florida leading the region’s buildout, with nearly 14 GW installed in 2024 and 29.5 GW expected by 2030. It says the steady growth in the Carolinas and Georgia is driven by the large projects of just a few major utilities. And it says Tennessee, Alabama and Mississippi bring up the rear, at least in part from the Tennessee Valley Authority’s challenging requirements for solar additions.

“There’s actually several utility-scale projects that are coming online from TVA in the next couple of years,” Senior Energy Policy Manager Heather Pohnan said. “However, the historical lack of ambition from the utilities that operate in these states really makes it difficult to keep pace with the rest of the region.”

The bulk of installed solar capacity is in utility-scale projects, and three utilities accounted for much of the 27.84 GW: FPL (8.38 GW), Duke Energy (8.22 GW) and Southern Co. (4.04 GW).

FPL also has the biggest ambitions among utilities studied, as judged by their integrated resource plans: 8.5 GW of new solar by 2030, or 64% of its planned capacity additions. The next-largest planned solar additions are TVA’s 2.83 GW, which would be 32% of its total. Least ambitious are Alabama Power and Santee Cooper, which plan solar to be just 9 and 7%, respectively.

The SACE report adds a caveat about TVA’s stated intentions: President Donald Trump has purged its board of directors and nominated new members who could change the solar plans. (See Trump’s TVA Nominees Reject Privatization.) Those nominees are before the full Senate after being advanced by the Environment and Public Works Committee on Oct. 29.

Speakers in the webinar praised FPL for its strong solar ambitions and track record in meeting them. SACE Clean Energy and Equity Director Stacey Washington pointed to FPL’s goal of 17,500 MW.

“This is a large goal, but FPL has demonstrated that it is capable of adding a lot of solar to the grid at a steady pace. With 2,250 MW coming online in 2024, FPL has established a process to source and build utility-scale solar at a fast pace.”

An audience member at the webinar questioned why praise was being showered on FPL.

“Let’s just be really clear,” Smith said: “Florida Power & Light has laid down the most ambitious solar deployment program of any utility in the Southeast, by far, and … probably one of the most ambitious programs of any utility across the United States.

“It needs to be recognized,” he said, “and it needs to be called out, and we need to hold other utilities accountable, because this utility is actually moving away from fossil gas. They’re still highly dependent on it, but you’re actually seeing the reductions. You’re seeing the deployment.

“What we don’t have is — in Georgia and in the Carolinas, and definitely at TVA — a real commitment to this technology.”

There are practical impediments to solar deployment, such as transmission constraints and disappearing federal subsidies.

“Transmission has become a roadblock to solar; in many places, it’s quite significant. In other places, it’s just a matter of time, it seems,” said SACE Research Director Maggie Shober.

Washington recited the list of 2025 federal program cuts and tax credit phaseouts and said distributed solar would feel the impact before utility-scale solar.

Distributed solar already has a difficult path in the Southeast, Shober said, even with FPL. There is a bias toward utility-scale, she said, and there is not a good net-metering program that can make small-scale solar more attractive.

“I think the utility business model in our region is set up that utilities are inherently against rooftop solar and customer-based solar,” she said, “not because they don’t like it, but just because it’s not in their financial interest to encourage it, and so they are setting up as many roadblocks as they can.”

Smith said electricity costs are rising to the point of an affordability crisis, so the industry should focus on the capacity it can add in the least time at the lowest cost: solar and storage.

He also put in a plug for utilities and regulators to embrace energy-efficiency programs. “The greenest electron [and] most cost-effective electron is the one that you never use.”

SACE drew data for the report from the utilities’ integrated resource plans and U.S. Energy Information Administration reports on currently operating utility-scale and distributed solar resources.