With the start of production at an ingot and wafer factory in Michigan, all components of a photovoltaic solar module can now be sourced from U.S. manufacturers.

With the start of production at an ingot and wafer factory in Michigan, all components of a photovoltaic solar module now can be sourced from U.S. manufacturers.

Every major piece of the solar supply chain has been reshored, the Solar Energy Industries Association said Oct. 29 as it marked this latest milestone in a solar manufacturing renaissance.

The news comes at a pivotal time for the solar power industry, given the federal policy changes engineered by President Donald Trump that will make solar power more expensive to develop and, in some cases, more difficult to site.

SEIA said 65 solar and storage component production facilities have come online or been expanded in 2025 through an investment of $4.5 billion. But more than 100 manufacturing projects and $31 billion in additional investments are at risk from the Trump administration’s attacks on the solar sector, SEIA added.

U.S. solar generation capacity has been soaring: It accounted for more than half of all new capacity added nationwide in the first half of 2025. Given its relatively low cost and relatively high speed to deploy at a time when other generation is slow and expensive, new solar arrays are not expected to suddenly stop being built. But the rate of growth is expected to slow.

Corning subsidiary Hemlock Semiconductor announced Oct. 30 it had started production in the third quarter at the largest solar ingot and wafer facility in the U.S. and is anticipating a steady stream of revenue from it, as it accelerates production from thousands of wafers per day to more than 1 million per day through the fourth quarter.

The new ingot and wafer factory is co-located with the Hemlock, Mich., polysilicon facility owned by Corning, which plans to build its solar business to a $2.5 billion annual revenue stream by 2028.

Corning said it has secured purchases of more than 80% of available polysilicon and wafer capacity for the next five years.

Hemlock said solar wafers have not been produced in the U.S. in nearly a decade. In its announcement, the company quoted Moustafa Ramadan, head of market research at PV Tech Research: “For the first time, a module can be completely U.S.-made, from polysilicon to the module. This is probably the first time in a long time that this is possible. It might not be sufficient to meet demand, but it is a big step for U.S. manufacturing.”

SEIA framed the development as a variation on the renewables-are-good-for-America theme the U.S. clean energy sector began broadcasting late on Election Day 2024, after Trump was elected on a pro-fossil fuel platform.

“This growth is a testament to the power of American innovation,” SEIA President Abigail Ross Hopper said in a news release. “We’re building factories, hiring American workers and showing that solar energy means made-in-America energy.”

But she added a caveat: “This industry has proven what’s possible when businesses have the certainty to invest. If the administration does not reverse their harmful actions that have undermined market certainty, energy costs will rise even further, and the next wave of factories and jobs could be at risk.”

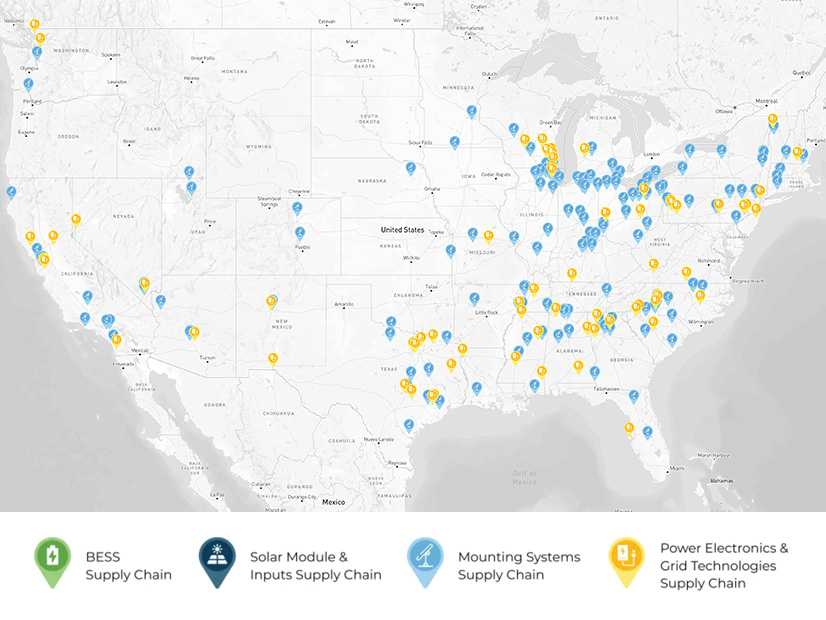

In its latest update, SEIA’s Solar & Storage Supply Chain Dashboard shows $36.6 billion in U.S. solar manufacturing investments publicly announced since supportive federal policy changes in 2022 — $13.1 billion of which are operational, and $9.2 billion of which are under construction.

These facilities were expected to create 50,100 manufacturing jobs — 23,321 at facilities that are operational and 7,700 at facilities under construction.

Of the storage facilities announced since the Inflation Reduction Act’s passage, 21.8 GWh of battery cell and 69.4 GWh of battery pack manufacturing capacity have come online. Production facilities for components such as solar mounting systems, power electronics and grid technologies also have come online.