In a preview of WECC’s 2021 Western Assessment of Resource Adequacy (WARA), Branden Sudduth, the regional entity’s vice president of reliability planning and performance analysis, said the document will aim to provide readers “a better understanding of how increasing variability … is really forcing us to rethink resource adequacy in the interconnection.”

WECC introduced the WARA last year to supplement NERC’s Long-Term Reliability Assessment (LTRA), which Western stakeholders had complained did not capture all the risks that the Western Interconnection faced in 2020, such as rolling blackouts caused by record-setting heat waves in California. (See Western RA Planning Must Change, WECC Says.) This year’s WARA will be published concurrently with the LTRA, which is set to be released next Friday.

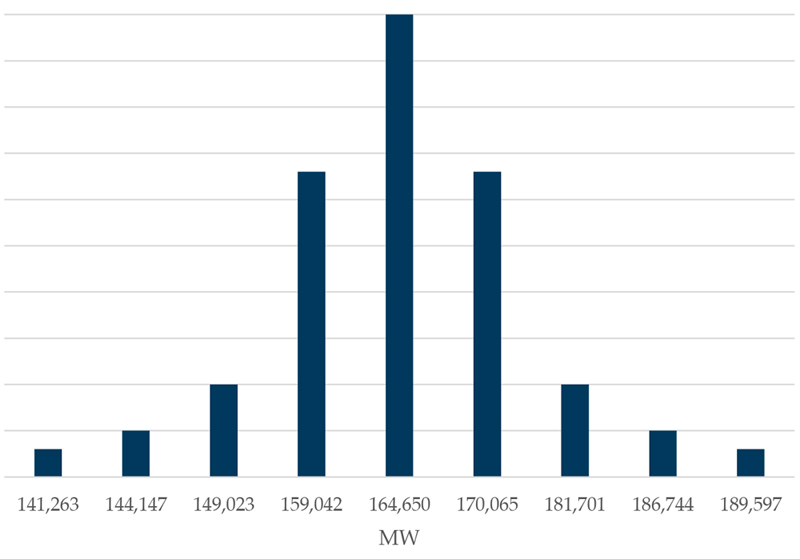

Peak hour demand variability across the Western Interconnection | WECC

Peak hour demand variability across the Western Interconnection | WECCSudduth told attendees of WECC’s Board of Directors meeting on Wednesday that the WARA seeks to account for variability in setting its projections. While expected peak demand in 2022 is set at around 165 GW (an increase of 15.7% from last year), weather and other factors mean there are a wide range of possible outcomes. A peak of more than 181 GW is a 10% possibility, and there is a 3% chance of a 190 GW peak, which Sudduth linked to a “one in 33 years type of event” similar to the August 2020 heat wave.

The range of possibilities widens out as the WARA’s projections extend into the future, representing the broader scope of possibilities to contend with. At the same time, demand overall is expected to continue shifting upward. By 2031, under the most likely scenario, peak demand will hit around 179 GW, with a 3% chance of reaching as high as 208 GW.

“The underlying load forecasts … will most certainly change over time, as we get closer to the time horizon,” Sudduth said. “But it illustrates the importance of being flexible and responding to any deviations from what we expect, because if we’re fairly good in our forecasting, and come close to that expectation, when the actual hour occurs there’s still a range of 29 GW above and below that will have to be accounted for with real time energy if an extreme weather event occurs.”

Variability Also Seen in Generators

A growing variability in the generation resource mix is also central to the WARA. Sudduth said that solar and wind resources continue to increase their share of the Western Interconnection’s generating fleet. Looking out to 2031, these resources are projected to grow by 101.7% and 25.4% respectively. By contrast, baseload generation is set to increase by 4.5% and hydro by 4.2%.

The behavior of wind and solar under extreme circumstances is another cause for concern. Under a similar projection modeling the most and least likely scenarios, solar and wind were found to experience a much steeper drop-off in availability than baseload. Solar experienced a 42% loss under the 10% likelihood scenario and wind experienced a 94% loss, while baseload dropped by only 12%.

Sudduth said that these projections, which are based on the peak-hour demand and resource availability, only tell part of the story. The full report will delve deeper into the unique behaviors of each resource under the range of possible scenarios.

“When the peak-hour demand is expected, during the middle of the day, these solar resources … are available to meet the growing variability for that hour,” Sudduth said. “The problem, as we’ve seen, is what is available in the evening hours, after the solar resources become less available and demand still remains high. This is why the assessment spends a good portion of the report discussing the risk over all of the hours and not just focusing on the peak demand hour.”