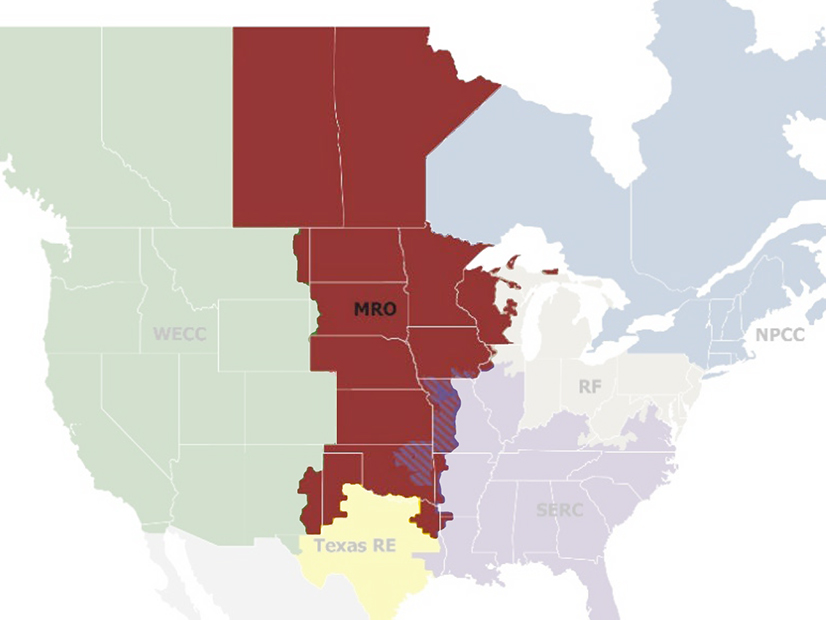

Balancing authorities in three of the four Midwest Reliability Organization subregions are likely to face capacity shortfalls this summer requiring external energy assistance or other emergency measures, the regional entity warned in its Regional Summer Assessment.

MRO conducts its regional assessment each year as a complement to NERC’s Summer Reliability Assessment and to identify potential issues on a “more granular” level, MRO Principal Reliability Assessments Engineer Salva Andiappan said in a webinar on Thursday. The RE’s assessments also analyze historical data from previous summers to spot trends that could impact grid reliability in coming seasons.

MRO’s summer forecast includes the months of June through September. Like NERC’s summer assessment, released in May, MRO warned that SPP and Saskatchewan Power are both at elevated risk of energy emergencies, while the MISO North and Central areas are at high risk. (See West, Texas, Midwest at Risk of Summer Shortfalls, NERC Says.) Only Manitoba Hydro indicated it possesses sufficient resources to meet the subregion’s reserve margin requirements under both normal and extreme demand scenarios.

Highest Risk for MISO North, Central

The normal demand scenario, also called the 50/50 scenario, represents a prediction with a 50% chance of being exceeded, while the extreme scenario, also called 90/10, has a 10% chance of being exceeded. Under the first, MISO, SPC and SPP anticipate reserve margins of 3.2%, 2.6% and 12.3% respectively, well below the requirements of 17.9%, 11% and 16%.

Under extreme conditions, the margins for all three drop below zero, leading to a high risk that the BAs will have to issue energy emergency alerts and implement operating mitigations including non-firm imports, demand response and short-term load interruption, a likelihood that is low for Manitoba Hydro in both conditions.

MISO’s projection is based on results of the RTO’s recent Planning Resource Auction, which MRO said indicated “insufficient capacity to cover anticipated summer peak demand and increased risk of needing to implement temporary, controlled load sheds” under extreme conditions. (See MISO’s 2022/23 Capacity Auction Lays Bare Shortfalls in Midwest.) The RTO’s shortfall of more than 1.2 GW was caused by increased load forecast coupled with retirements of existing generation resources and their replacement with new resources with lower capacity.

MRO 2022 summer peak capacity by fuel types | MRO

MRO 2022 summer peak capacity by fuel types | MROOne bright spot in this forecast is that some units that “did not qualify for reserve capacity in the PRA” might still be able to help MISO serve energy during the summer. However, MRO still said the shortfall in the month of July could reach as high as 5 GW.

SaskPower, meanwhile, is expected to strain under a 7.5% increase in peak demand driven by “the economy returning to pre-pandemic levels” as well as oil and gas development. The subregion should be able to meet normal demand but may need “external assistance” in conditions of above-normal generator outages; this is also the case for SPP, where the elevated risk is attributed to drought conditions affecting water sources needed for generation and cooling.

For Manitoba Hydro, on the other hand, the scenario is quite rosy; the subregion reported it anticipates no unexpected rises in load, unlike last summer, while new generating units coming online at the Keeyask hydroelectric station are expected to expand the margin comfortably. The fifth and sixth units are expected to enter service this summer, and the last should be online by winter, MRO said.