Dominion Energy announced July 8 that it is positioning itself to potentially build another wind farm near its Coastal Virginia Offshore Wind.

It has agreed to buy the lease area where Avangrid’s Kitty Hawk North has been in the planning stages.

As part of the deal, Dominion would rename it CVOW-South. Avangrid would retain rights to the Kitty Hawk name, and plans to continue developing the adjacent lease area, which it calls Kitty Hawk South.

The deal requires the approval of the U.S. Bureau of Ocean Energy Management and the city of Virginia Beach. The two companies expect to close the transaction in the fourth quarter of 2024.

The deal is valued at about $160 million, which is substantially more than the original lease price but reflects development expenditures in the seven years since the auction.

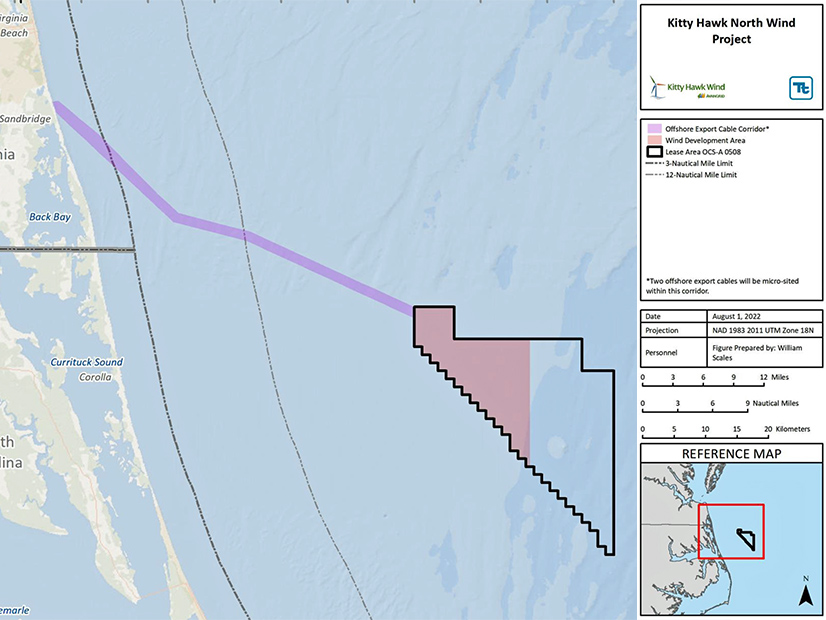

In a March 2017 BOEM auction, Avangrid Renewables LLC beat out three other bidders in 17 rounds with a $9.07 million bid for the 122,405-acre lease area designated OCS-A 0508 and began planning what it called the Kitty Hawk Offshore Wind Project.

In 2022, Kitty Hawk Wind LLC divided it into two projects in two areas: Kitty Hawk North in the newly designated OCS-A 0559 and Kitty Hawk South in the remainder of OCS-A 0508.

In the construction and operations plan submitted to BOEM, Kitty Hawk North is proposed to have up to 69 wind turbine generators, one offshore substation, one onshore wind station and export cables making landfall in Virginia Beach. It would stand 24 nautical miles off the northern part of the barrier island that forms the North Carolina coastline.

Kitty Hawk South and Kitty Hawk North still have a long way to go in their permitting processes, and they need to overcome local opposition.

In late 2023, the city of Virginia Beach rejected the cable landfall routing. Three months later, Avangrid appealed to the region’s pocketbook, issuing a 29-page report estimating that the two Kitty Hawk projects would bestow a $4.8 million economic benefit on Virginia over their operational lives and that a quarter of that would flow to Virginia Beach, which would reap $274 million in tax payments alone.

Dominion said if CVOW-South were approved and built, it would have a roughly 800-MW capacity and would feed into the Dominion transmission grid. It offered no estimates of in-service date or construction budget.

Both companies acknowledged the potential roadblock in Virginia Beach.

Dominion said it’s aware of community concerns about the export cable’s proposed landing site and is committed to working closely with the community, the city and the state.

Avangrid said Kitty Hawk South could generate up to 2.4 GW of power and could be delivered to North Carolina, other states or private companies, not just to Virginia.

The two companies already have steel in U.S. waters, and both can lay claim to the mantle of “largest.”

Avangrid owns 50% of Vineyard Wind 1 under construction off the Massachusetts coast. With 10 turbines connected to the grid, it is by a tiny margin the largest offshore wind farm by capacity in the United States.

Dominion owns 50% of CVOW, which with a nameplate rating of 2.6 GW is by far the largest offshore wind farm approved in the United States.

Dominion CEO Robert Blue said in a news release: “With electric demand in our Virginia territory projected to double in the next 13 years, Dominion Energy is securing access to power generation resources that ensure we continue to provide the reliable, affordable and increasingly clean energy that powers our customers every day.”

Avangrid CEO Pedro Azagra said in a news release: “As Avangrid continues the construction of our nation-leading Vineyard Wind 1 project and the development of our diverse portfolio of offshore and onshore renewable projects, this transaction advances our strategic priorities by providing significant capital infusion for reinvestment.”