The Northeast Power Coordinating Council’s 2024 Summer Reliability Assessment, released last week, shows the region “will have an adequate supply of electricity this summer” under most conditions, with a forecast peak demand about 200 MW lower than last summer.

The regional entity’s predicted peak week begins Aug. 11, though this represents an overall high for the territory. Subregions have a range of peak-week starts ranging from June 2 for New England to Sept. 22 for the Maritimes.

NPCC said coincident demand in its footprint — which includes the six New England states, New York, Québec, Ontario, New Brunswick and Nova Scotia — should peak at 105,014 MW in its 50/50 forecast, which represents a prediction with a 50% chance of being exceeded. This compares to the 105,200-MW peak in the RE’s summer assessment last year, for the week beginning Aug. 20. (See NPCC Warns of Tight Summer Margins in Ontario.)

Under the 90/10 forecast — indicating a 10% chance of being exceeded — coincident demand would peak at 112,011 MW, while the RE’s extreme case predicts demand of 117,598 MW for a peak week beginning July 21. Total capacity for the 50/50 and 90/10 scenarios is 162,006 MW, dropping to 161,973 MW in the extreme forecast. Predicted net margins are 12,382 MW for 50/50 and 5,385 MW for 90/10, and a 5,923-MW deficit in the extreme, indicating that energy imports and operating procedures would be necessary to maintain reliability.

According to the assessment, the “single most important variable” impacting demand in NPCC’s footprint — which is winter-peaking — is ambient weather conditions. This means subregions can experience widely different patterns of demand, reflected in the range of peak week dates and conditions predicted by each reliability coordinator.

As a result, the RE suggested it is unlikely multiple subregions will experience tight margins at the same time, meaning neighbors will likely be able to help each other out when needed. Québec in particular should “be able to provide assistance to other areas if needed, up to the transfer capability available,” NPCC said.

While expected demand is lower than last year, NPCC acknowledged that the predicted capacity has also declined slightly, from 163,338 MW in last year’s assessment. The RE noted several resource retirements, the largest of which is the Mystic Generating Station combined cycle Units 8 and 9, representing a total nameplate capacity of 1,515 MW, which went offline May 31. The Mystic retirement “accounts for nearly a 5% reduction in New England’s installed capacity compared to” the 2023 assessment, NPCC said.

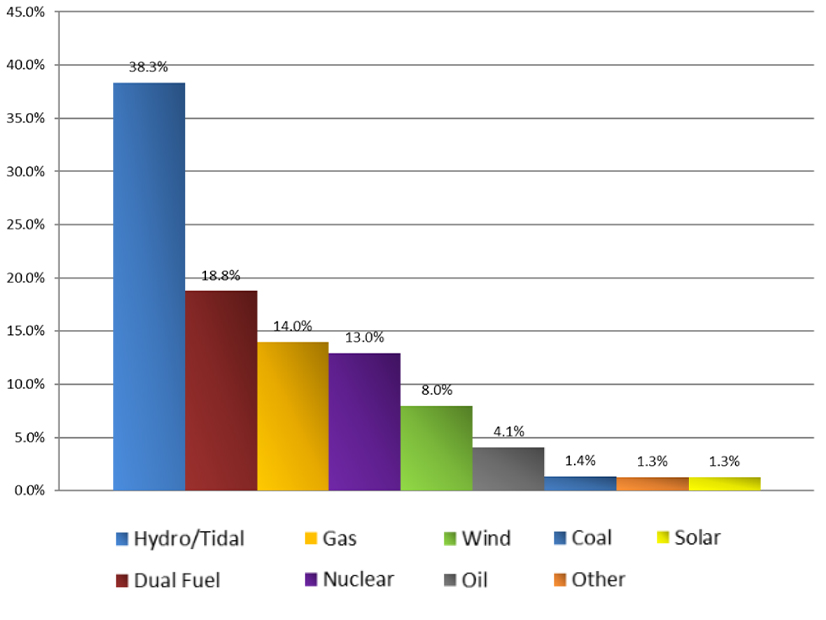

Hydro and tidal power continues to account for the majority of generation in peak weeks, although NPCC noted this figure is skewed by Québec, where this resource makes up 89% of generation. In other subregions, hydro and tidal make up no more than 23% of generation (Ontario), to as low as 11% (New England).

Dual-fuel generation is projected to be the second most common in the region, though this total is also affected by New York, where dual-fuel makes up 50% of the generation mix, and New England, where it makes up 30%. It also makes up the biggest share of generation in both subregions.

The Maritimes subregion has the greatest diversity of resource types in the assessment, with coal taking the largest share at 22%, and wind, oil and hydro each accounting for at least 10%. In Ontario, nuclear power leads all other resource types with 34% of generation capacity.