Soaring electricity demand across the SERC Reliability footprint is squeezing the region’s reserve margins, with more than half of SERC’s subregions expected to fall below NERC’s 15% reference margin in the coming decade, the regional entity said in its Long-Term Reliability Assessment released March 11.

SERC publishes its LTRA each year as a companion to NERC’s LTRA — which is published the preceding December — and as a tool for industry, regulators and policymakers “to support the decision-making necessary to ensure the reliability of the [grid] during the planning horizon.”

The RE gathered, independently validated and verified data from all SERC entities to develop the report, while also conducting a stakeholder review process in collaboration with industry experts.

This year’s report covers the years 2024-2034, based on data on generation and transmission resources, planned outages and demand projections on an hourly basis. SERC staff considered historical weather events, system outages, load levels in peak and off-peak scenarios, and generating resource levels.

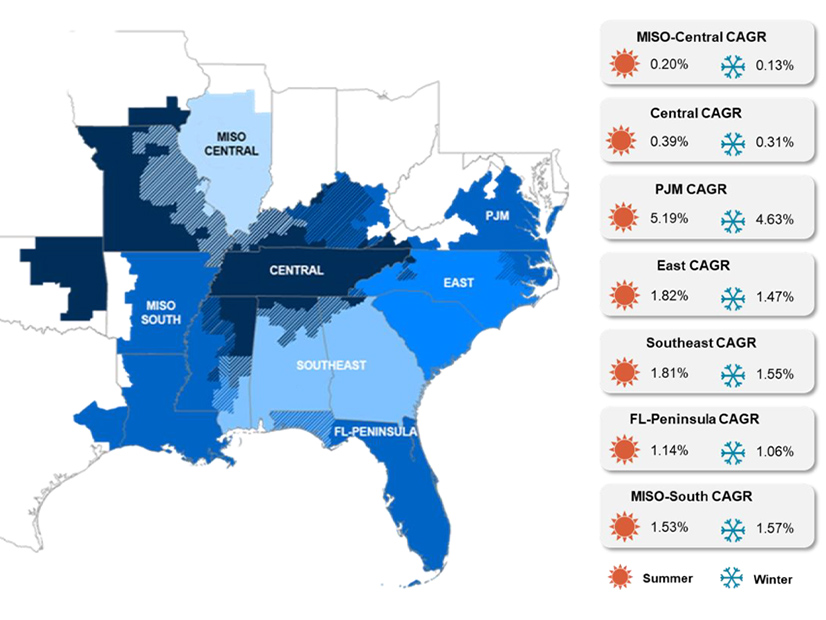

Current peak demand in the region is 260 GW in summer and 251 GW in winter, according to the assessment. These figures are projected to grow by 48 GW and 41 GW over the next 10 years, respectively, representing an overall compound annual growth rate of 1.7% in the summer months and 1.5% in the winter months. This calculation is based on a 50/50 projection, meaning that there is a 50% chance the actual load will be lower or higher than the forecast.

The subregion with the highest predicted CAGR is SERC-PJM, with 5.19% and 4.63%. The subregion contains parts of Virginia, North Carolina and Kentucky.

SERC-MISO Central, which includes all or parts of Illinois, Iowa, Kentucky and Missouri, has the lowest predicted CAGR with 0.20% and 0.13%.

To meet this demand, total generating capacity for the summer months is expected to grow from 315.3 GW in 2024 to 332.1 GW in 2034. However, winter generating capacity is projected to fall over the same period from 318 GW to 312.9 GW.

The decline in winter capacity is due largely to the expected retirement of nearly 18 GW of coal generation, causing coal to fall from 20% of on-peak winter capacity to 14%. Most other generation types are projected to shrink slightly or grow; natural gas should grow from 157.3 GW in 2024 to 165.4 GW summer capacity in 2034, and solar generation is expected to nearly double, from 22.8 GW to 41.7 GW in summer across the SERC footprint.

However, SERC noted that the expansion of solar does not provide equal benefits from season to season. While solar as a share of summer generation is expected to rise from 7% to 13%, its share of winter capacity is projected to grow from 3% to just 5%. The report acknowledged that solar’s variability and “lack of essential reliability services makes it less than a one-for-one replacement for the retiring coal capacity.”

Sounding the Alarm

With demand rising faster than generating capacity, many of SERC’s subregions are expected to fall below NERC’s reference margin in the coming decade, the RE said. This represents a significant shift from last year’s LTRA, when only SERC MISO-Central was expected to show such a decline. (See SERC Highlights DERs, Extreme Weather Challenges in LTRA.)

In this year’s report, SERC MISO-South, SERC-PJM and SERC-East all show sub-15% anticipated reference margins in either summer or winter, or both, for at least part of the decade. SERC-PJM has the highest projected deficiency at -22% for winter and -12% for summer.

MISO-South also is expected to hit negative margins in both summer and winter in 2033 and 2034, while MISO-Central will have negative summer margins in 2024 and 2025 before rising above 0% in 2026. SERC noted that the MISO and PJM subregions can draw on resources from the greater MISO and PJM footprints.

The RE called the falling margins a “marked deterioration and a trend that bears watching,” and urged grid planners to carefully coordinate the retirement of existing resources with the introduction of new ones. SERC also said regulators and policymakers “should pay close attention to whether proposed retirements shown in integrated resource plans will be replaced in time to meet projected load without falling below reference margins.”

“A key purpose of forward-looking reports like this is to sound the alarm early enough so that something can be done while there is still time to take meaningful action,” SERC said. “SERC looks forward to working with federal and state policy makers and regulators, SERC registered entities and … technical committees and working groups to continue to identify, understand and address reliability and security concerns across the SERC region.”