The storage industry set a record of 12.3 GW in installations in 2024, according to the U.S. Energy Storage Monitor report that was written for the American Clean Power Association by Wood Mackenzie.

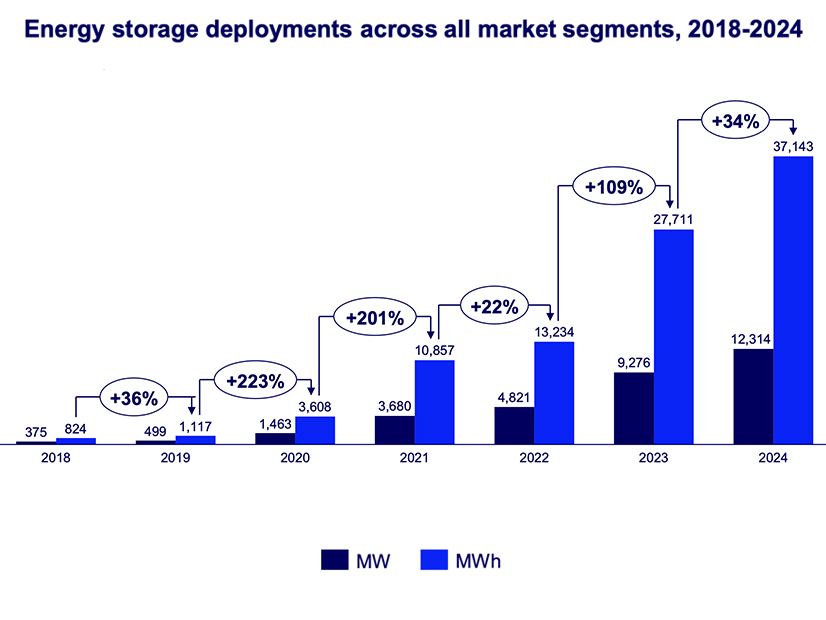

Developers installed a total of 12,314 MW, or 37,143 MWh, increases of 33% and 34%, respectively, over 2023.

“After another year of record deployment, energy storage is solidifying its place as a leading solution for strengthening American energy security and grid reliability in a time of historic rising demand for electricity,” ACP Vice President of Energy Storage Noah Roberts said in a statement. “The energy storage industry has quickly scaled to meet the moment and deliver reliability and cost savings for American communities, serving a critical role firming and balancing low-cost renewables and enhancing the efficiency of thermal power plants.”

Texas and California led the way with installations, representing 61% of the total with the other 39% being spread across 13 states. Most of the installations in the fourth quarter were utility-scale, with Texas seeing 1,185 MW installed, California 857 MW, New Mexico 400 MW, Oregon 292 MW, Arizona 185 MW and North Carolina 115 MW.

Overall, fourth-quarter installations were down 20% from the fourth quarter of 2023, which the report said was caused by the delay of 2 GW of projects in late-stage development that should be installed this year.

Distributed storage saw high levels of installation as well, with 1,250 MW installed for the residential sector — a new record. Residential installations set a fourth-quarter record as well at 380 MW, a 6% increase over the previous quarter. Installers across the country are working to install more storage at consumer homes, with Arizona seeing a spike in activity as more firms sought to combine solar with storage.

Storage for the community-scale, commercial and industrial (CCI) sectors was up 22% on the year to hit 145 MW in 2024, with California, Massachusetts and New York accounting for 88% of that capacity.

The report forecasts 13.3 GW, or 43.2 GWh, of installations this year, a 22% increase from 2024, with the forecast going up by 11% from the last quarterly report because of the 2 GW of delays.

“Over the next five years, utility-scale installs will total 68.2 GW/256 GWh, a very similar total buildout to last quarter,” the report said. “This sustained outlook is due to political uncertainty impacting the midterm forecast being offset by storage’s role in meeting unprecedented load growth.”

Residential storage is expected to grow by 47% this year and 223% by 2029. The national attachment rate (linking solar with storage) is expected to flatten in 2025 and 2026 and then drop in future years. Attachment rates are expected to rise in every state, but solar will grow in net metering states like Florida faster than in high-attachment states like California and Puerto Rico.

CCI storage is a high-cost business, where sales and development can be more challenging than other market segments. State policy could create significant upside to the sectors by 2030s, but that is too far out to influence the forecast.

The report includes several sensitivity cases for the next five years, with a high growth one adding 10 GW over that period, which would require federal tax incentives to stay in place, avoiding additional tariffs under President Donald Trump, renewables firmed with storage deployed to meet load growth, and barriers to finance and interconnection eased.

The low case would cut installations by 22% over the rest of the decade, which assumes no more tax credits, higher tariffs on Chinese batteries, an expanded supply chain for natural gas generation and favorable treatment for it in queues, while financing and interconnection issues for storage are not addressed.

“It’s still too early to determine the final form of IRA tax incentives over the coming year,” Wood Mackenzie Global Head of Storage Allison Weis said in a statement. “The combination of new tariffs on China and other countries with continued [Section] 45X and domestic content bonus adder incentives would make U.S.-based systems more competitively priced. However, many domestic providers are not set up to meet quick demand. If higher pricing is combined with ITC tax incentives phasing out beginning in 2028, it could lower our five-year deployment outlook by as much as 19%.”