CAISO’s Board of Governors has approved the ISO’s 2024/25 transmission plan to build out 31 new projects in the region over the next eight to 10 years.

Of the 31 approved projects valued at $4.8 billion, 28 are for reliability purposes for $4.6 billion. By 2039, California will need 76 GW of additional capacity to meet increasing building electrification and electric vehicle loads, CAISO wrote in the plan.

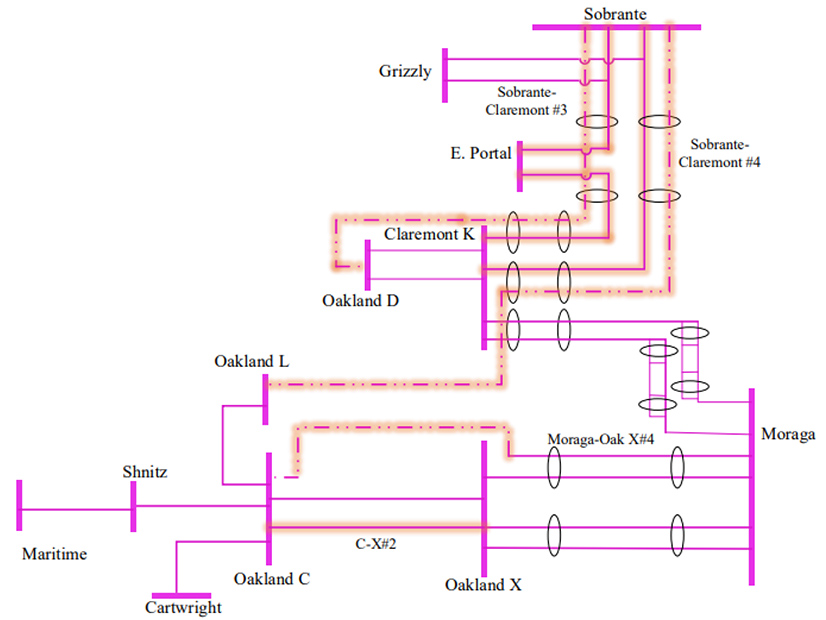

The plan’s most expensive project is the North Oakland Reinforcement Project, estimated at $1.1 billion and with an online date by 2032. The project includes the Port of Oakland, which is experiencing rapid load increase due to industrial and commercial growth, EV charging and electrification loads.

The project is meant to meet increasing demand without relying on local Oakland thermal generation units, CAISO wrote in the plan. Demand is forecast to increase from 377 MW in 2024 to 458 MW by 2039 in the region. CAISO and Pacific Gas and Electric should attempt to accelerate the completion of the project prior to 2032, Teri Dean Alderson, assistant general manager at Alameda Municipal Power (AMP), said in comments to CAISO.

The second-most expensive project in the plan is the $700 million Greater Bay Area 500-kV Transmission Reinforcement project, which has an online date of 2034. The area could have a deficiency of about 5,000 MW by 2039, which significantly surpasses the available transmission resources and internal generation capacity, CAISO said in the plan. The forecast supply shortage is caused by the potential loss of two of the three 500/230-kV transformer banks at Metcalf or loss of the two 500-kV sources to Metcalf and Moss Landing substations, CAISO said.

About $290 million of the remaining funding is allocated for three policy-driven transmission projects. Policy-driven transmission projects enable the grid to support local, state and federal directives, with most of these projects focused on meeting California’s renewable energy goals, CAISO said.

From a systemwide resource assessment, CAISO is going into a period of greater uncertainty as load growth continues to accelerate, Neil Millar, CAISO vice president of transmission planning and infrastructure development, said at the May 22 Board of Governors general session meeting.

“Not only are the peak loads growing, but our load factor and winter peak loads are growing, which is a success of building and transportation electrification,” Millar said. “Those are creating additional challenges that the state agencies are taking into account.”

Having more transmission project options is important because “we don’t know what things are going to look like four years from now [at the federal level],” Millar said. However, CAISO also must follow state policies and cannot afford to let transmission projects be a barrier to achieving state policy goals, he said.

At the same time, CAISO should consider the risk of policy changes affecting expensive transmission projects, such as two transmission projects in the North Coast region, which are to support future offshore wind power in Humboldt County, Millar said. CAISO has selected Viridon to build these future OSW transmission projects for up to $4.1 billion over the next eight to 10 years. (See CAISO Chooses Viridon to Develop Humboldt OSW Transmission Projects.)

The projects were designed to be the right first step, but CAISO recognizes that the resource requirements for the lines can grow beyond their initial design, Millar said.

“We were also very clear in bidding those projects that there is inherent uncertainty in those resource types and as a result those projects have a higher risk of potential cancellation,” Millar added.

The transmission plan also emphasizes non-transmission alternatives, such as energy efficiency and demand response programs, renewable resources and energy storage systems. Battery energy storage has made up the vast majority of new resources in CAISO’s region in recent years. As of April, more than 12,000 MW of battery storage capacity is online in CAISO’s region, with an additional 15,000 MW planned to be available by 2028.

Stakeholders Applaud, Question Plan

In comments to CAISO, Caitlin Liotiris, principal at Energy Strategies, said one notable enhancement to this year’s transmission plan is the additional transparency regarding CAISO’s process for reserving deliverability for long lead-time resources.

“The [plan] specifies the long lead-time resources in the base portfolio and the amount of deliverability that is being reserved for them,” Liotiris wrote.

However, staff with California Wind Energy Association (CalWEA) said CAISO’s transmission plan “does not fulfill … CPUC’s request to plan transmission for the 5.2 GW of in-state wind energy.”

“CalWEA is primarily concerned with the Southern California Edison Northern and San Diego Gas & Electric study areas where wind development interest is currently the strongest,” CalWEA staff said.

In the SCE Northern area, CPUC requested that CAISO plan for 564 MW of full capacity deliverability status. Of this 564 MW, only 100 MW has been awarded that status. CAISO therefore must plan for 464 MW, CalWEA staff wrote.

In next year’s transmission plan, there likely will be a fairly heavy emphasis on load-growth related reliability projects as CAISO transitions to a higher long-term expectation of growth, Millar said.