Hydrogen transportation is struggling to find momentum in California, with the number of open fueling stations decreasing again last year, while fuel prices continue to increase.

Hydrogen transportation is struggling to find momentum in California, with the number of fueling stations decreasing again in 2024, while fuel prices continue to increase, a state government report found.

Hydrogen fuel prices went up from about $15/kg in 2022 to more than $35/kg in 2024. The large jump could be the result of higher natural gas prices, increasing labor and materials costs because of inflation, and reduced value of the state’s low carbon fuel standard credits, the report said. The report is published annually by the California Energy Commission and the California Air Resources Board (CARB).

The CEC has allocated about $234 million to developing public hydrogen fueling infrastructure in the state through its Clean Transportation Program. Forecasts estimate about 20,000 fuel-cell electric vehicles (FCEV) will be on the road by 2030, down from a previous forecast of 62,600 by 2029. There currently are about 14,415 FCEVs in the state.

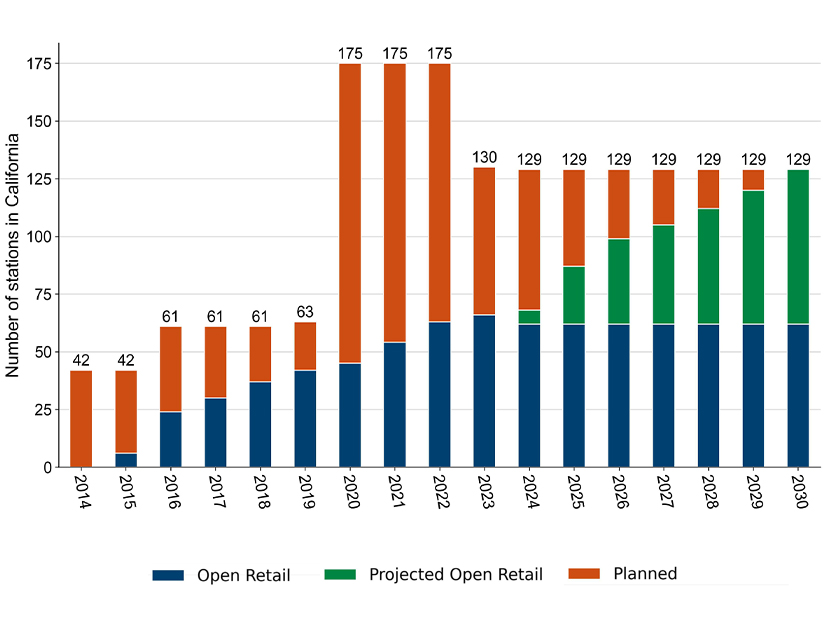

California now has 62 hydrogen stations, but 20 of these are considered temporarily non-operational, leaving 42 stations open. Thirteen stations in Southern California were affected by a supply disruption and are not open to the public, the report says.

Shell closed seven stations in 2024, which left the Sacramento Area with one open station. This station cannot handle the increased demand without requiring a “mandatory 10-minute wait time between fills to avoid equipment failure,” the report says.

“As a result, drivers could spend hours waiting for an opportunity to refuel,” the report says.

The number of planned new stations also is down. Equilon Enterprises, under Shell Oil Products U.S., canceled its $41 million grant agreement in 2024, which would have funded 50 new stations and one station upgrade, the report says.

Even so, by 2030, California is projected to have 129 hydrogen stations open to the public, which could support about 195,000 FCEV — more than nine times the fueling needs of the projected FCEV population in 2030, according to the report.

“When assuming 80% of nameplate capacity, these stations are capable of supporting nearly 156,000 FCEVs, which is more than seven times the fueling needs of the projected FCEV population in 2030,” the report says.

The number of stations isn’t the only reason for the slow uptake in the Golden State. FCEV drivers “continue to suffer from lack of confidence in fuel availability because of stations being unavailable and unreliable,” the report says.

From the third quarter of 2023 to the second quarter of 2024, the average availability of open retail stations was about 62%, due to maintenance, equipment failures, supply chain constraints and hydrogen supply disruption. Recent station unavailability has been caused mostly by unexpected equipment failure, spare parts shortages and hydrogen supply disruptions, the report says.

Most of the hydrogen fueling — 64% — takes place in the Los Angeles region. About 28% occurs in the San Francisco Bay Area. Hydrogen fueling infrastructure and FCEVs are part of California’s zero-emission vehicle goals in Gov. Gavin Newsom’s Executive Order N-79-20.