Clean energy investments plateaued in the second quarter of 2025 and the pipeline of new project announcements has contracted sharply, a new report shows.

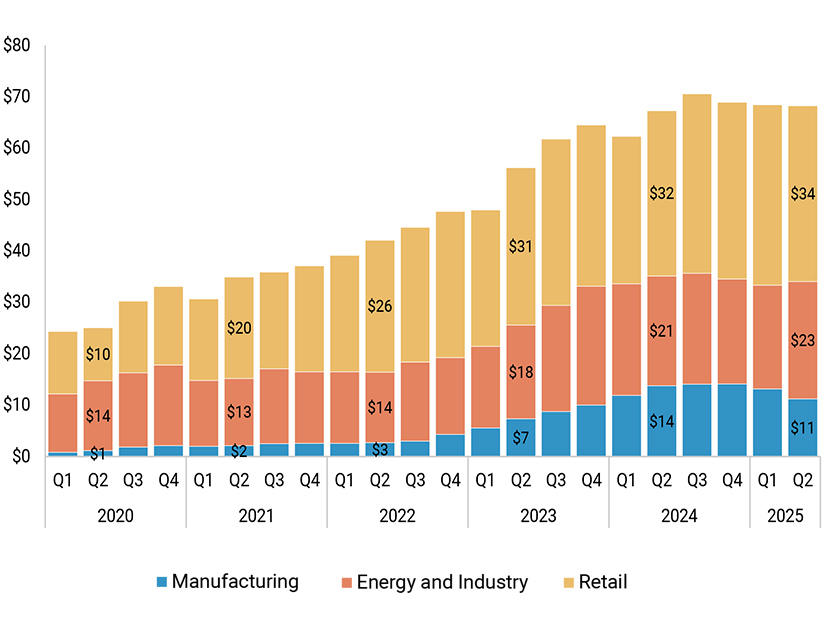

In an Aug. 28 update, the Clean Investment Monitor said U.S. clean energy and transportation investment totaled $68 billion for April-June 2025, down 0.3% from the preceding quarter but up 1% from the same quarter a year earlier.

Individual segments within the broad category showed wider fluctuations:

-

- Retail consumer purchases and installations totaled $34 billion, 6% more than the preceding quarter but 3% less than a year earlier.

- Industrial decarbonization and utility-scale clean energy investments totaled $23 billion, 13% more than the preceding quarter and 7% more than a year earlier.

- Manufacturing investments totaled $11 billion, 15% less than the preceding quarter and 19% less than a year earlier.

- The Clean Investment Monitor is a joint effort of Rhodium Group and MIT’s Center for Energy and Environmental Policy Research.

The data in the Clean Investment Monitor update has been influenced by the pro-fossil, anti-renewable policy changes President Donald Trump has made since his return to office in January. A notable development in the second quarter of 2025 was the debate and enactment of the One Big Beautiful Bill Act, which spelled out just how significantly certain clean energy and transportation initiatives would be harmed.

The number and scope of new projects announced during the second quarter gives an indication of how these policy changes were received:

-

- Utility-scale clean-energy announcements totaled $21 billion, 51% lower than the first quarter.

- Industrial decarbonization announcements totaled $2 billion, 17% lower than the first quarter and 38% lower than a year earlier.

- Manufacturing project announcements totaled $4 billion, 59% lower than the first quarter and 44% lower than a year earlier. (Manufacturing project cancellations totaled $5 billion, exceeding the value of new announcements for the first time.)

The report places total investment in new clean energy generation and technology manufacturing facilities at $351 billion in the three years since enactment of the Inflation Reduction Act in 2022 and indicates $517 billion worth of announced investments have yet to be spent.

The authors note that OBBBA will affect the clean energy investment landscape.

“The tax credit eligibility changes may influence how quickly announced investments materialize [into] actual capital expenditures,” they write. “The early sunset for EV, heat pump and distributed energy consumer tax credits could reshape the composition of U.S. clean investment, which has been strongly driven by the retail segment, in the quarters ahead.”