SPP says accelerating load projections will result in a 2025 transmission plan that dwarfs the previous year’s record $7.65 billion portfolio — so much so that it is considering deferring some projects until 2026.

Staff said during a Sept. 23 education session on the 2025 Integrated Transmission Planning assessment that they may recommend delaying construction permits for five 765-kV projects, totaling more than $5 billion in building costs, to the 2026 ITP.

Having only received approval for its first 765-kV project in February 2025, Southwestern Public Service’s 354-mile transmission line crossing the New Mexico-Texas border, SPP staff have experienced firsthand the vagaries of the facilities’ high costs.

The project initially was projected to cost $1.69 billion. SPS revised the estimate to $3.62 billion in June. It took several months and more meetings and discussions with stakeholders before the Board of Directors eventually approved the revised cost estimate in September. (See SPP Board Approves 765-kV Project’s Increased Cost.)

“We realize that these projects are very costly … we do expect to continue to show some additional cost sensitivities,” transmission-planning manager Kirk Hall said during the Markets and Operations Policy Committee’s education session. “We’ve talked a lot about the costs of the portfolio and obviously, affordability is top of mind. We’ve heard that loud and clear from stakeholders. We realize this is a significant investment.”

“You can add as many projects as you want, and you are going to get some benefit, but at some point, that amount of reliability is not affordable to customers,” Oklahoma Gas & Electric’s Brad Cochran said, referring to the discussions over the SPS project. “You guys did a good job of putting some deferrals in there, but we need to make sure that not only [are we] making the system reliable, but we’re making it affordable so that customers can actually pay their bills.”

SPP said the draft portfolio costs $19.1 billion but provides about $80 billion in benefits, a benefit-cost ratio of between 5.8 and 9.5. That doesn’t include reliability benefits or the cost of outages.

Having identified the need for 765-kV transmission in the 2024 ITP, staff developed the EHV overlay and shared it with the board, state regulators and members in September. (See SPP, Members Developing 765-kV Transmission Overlay Plan.)

Hall said staff will vet their deferral recommendation with the Transmission and Economic Studies working groups before MOPC’s October meeting.

SPP told the committee that the 2025 portfolio is the result “of our most comprehensive ITP process in history.” Staff began with more than $20 billion in projects identified to meet all needs. It may end up with between $14 billion and $18 billion in projects that are issued notifications to construct, more than double the 2024 portfolio.

Casey Cathey, SPP’s vice president of transmission, said the hefty portfolio is necessary. He recalled a time less than 10 years ago, when SPP was “excited” by 1.2% load growth year over year.

“We’re seeing more than double that today, and we’re seeing a lot higher, accelerated growth in the future,” he said.

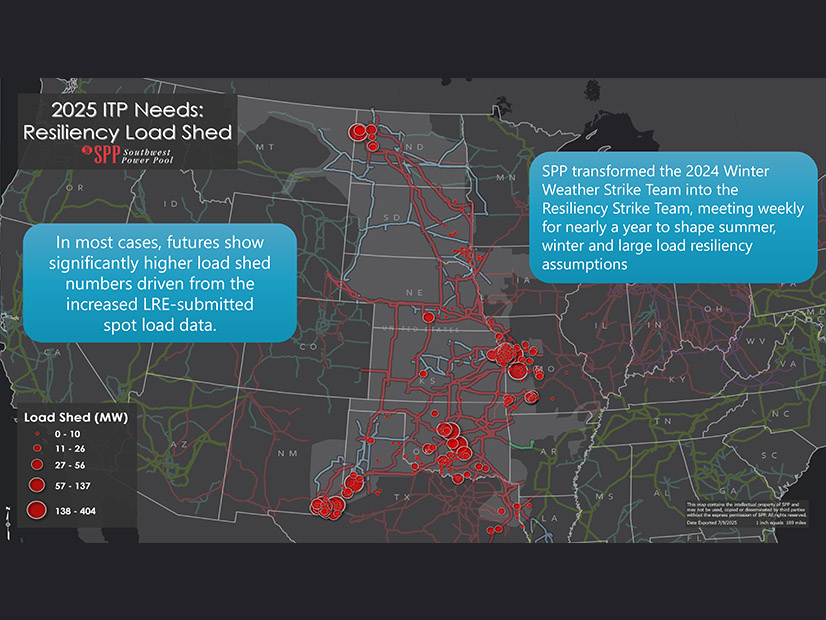

Cathey told MOPC that the 10-year firm load projections for 2033 that drove the record 2024 portfolio are expected to occur six years earlier in the latest forecasts. He pointed to voltage and transfer issues the grid operator faces, three load sheds in 2025, three winter peaks in the past five years and load-responsible entities forecasting new large loads that will require more transfer capacity: “We currently peak at 56 GW, and adding the amount of load that we have on the horizon … is, quite frankly, breaking the system. We will need to build transmission. Generation alone cannot solve our challenges.”

The RTO expects future loads to increase. Staff referenced President Donald Trump’s executive order to “pursue bold, large-scale industrial plans” that “vault” the U.S. “further into the lead” on critical manufacturing processes and the Department of Energy’s Speed to Power initiative.

According to the DOE, data centers used 58 TWh in 2014. That number increased to 176 TWh in 2023, 4% of all U.S. electricity. By 2028, the agency expects data centers to need between 325 and 580 TWh, which would be 6 to 12% of the nation’s annual energy.

Data centers account for 23% of SPP’s large loads in the ITP (2.5 GW of 11 GW), but oil and gas electrification in the Permian Basin and the Dakotas is responsible for double that. Combined, projected large loads are equivalent to 20% of the grid operator’s current peak.

“There is heavy pressure to ensure that we’re not only reassuring critical manufacturing but also doing what we can to provide bold infrastructure plans for large loads,” Cathey said. “We’re looking at this and seeing what opportunities we might have as we continue to plan the system out, not only for 765 kV but, just ultimately, the overall transmission infrastructure that we need.”

The grid operator plans to release the ITP draft report Sept. 24.