In an ongoing high-stakes analysis, CAISO has determined that transactions between PacifiCorp’s two balancing authority areas can “materially” affect parallel flows on certain CAISO transmission constraints, an ISO representative told market officials and stakeholders.

The finding is part of CAISO’s analysis of congestion revenue allocation during parallel flow situations within the ISO’s Extended Day-Ahead Market (EDAM). EDAM is to begin operation next year, with PacifiCorp as an initial participant.

The subject of how to allocate congestion revenues under parallel — or loop — flows took priority at CAISO in February after Powerex argued the EDAM model contains a “design flaw” with potentially $1 billion in unjustifiable charges at stake. (See Powerex Paper Sparks Dispute over EDAM ‘Design Flaw’.)

CAISO then began months of work to address the concern, culminating in June, when it approved a new method for allocating certain congestion revenues in EDAM during parallel flow times, a design FERC later accepted. (See CAISO Approves New EDAM Congestion Revenue Allocation Design.)

The newly approved method, however, could create unintended market incentives, said Guillermo Alderete, CAISO director of market performance and advanced analytics, at an Oct. 29 joint meeting of CAISO’s Board of Governors and the Western Energy Markets Governing Body. CAISO’s Market Surveillance Committee (MSC) in a June memo also said it is concerned about the new method’s potential to create self-scheduling incentives.

To address those concerns, CAISO and its Department of Market Monitor (DMM) developed three stages of analysis, starting with a study of congestion revenue and parallel flow data in the Western Energy Imbalance Market between January 2024 and August 2025.

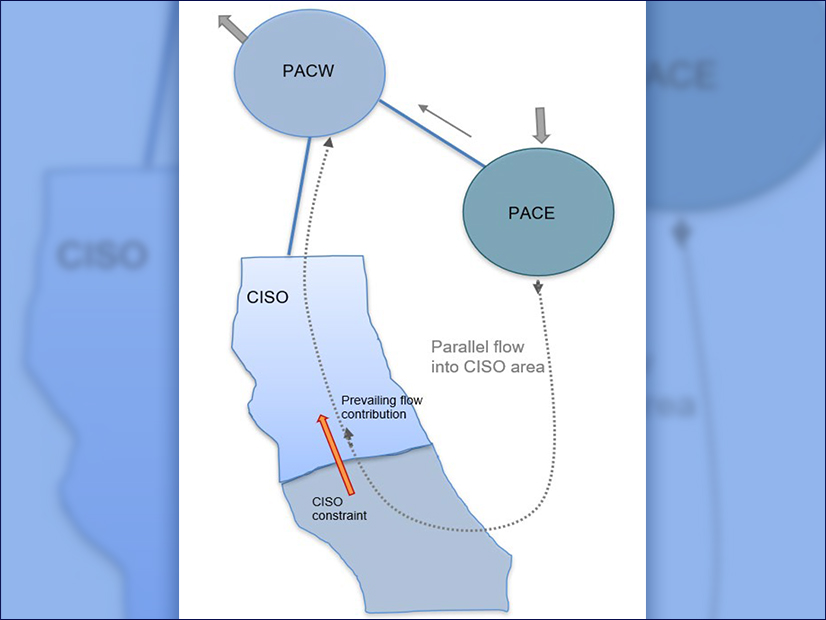

In this first stage, CAISO found transactions between PacifiCorp areas can “materially impact” parallel flow on some major transmission constraints in CAISO’s region, Alderete said.

CAISO specifically found that about 145 congested constraints — about 96% of the total constraints— were in the ISO. Of these constraints, about 21% were affected by parallel flows generated by transactions between the PacifiCorp East and West areas, Alderete said.

Constraints on Path 26 — which consists of three 500-kV lines between Pacific Gas and Electric’s and Southern California Edison’s territories — can see up to 40% flow impacts from transactions between the PacifiCorp East and West regions, he said.

However, the direction of transaction flow determines whether congestion revenue rents increase or decrease. If a transaction in PacifiCorp’s region flows in the same direction as transaction constraints on CAISO’s system, then congestion revenue rents will increase, Alderete said. On the other hand, if a transaction in PacifiCorp’s region flows in the opposite direction as transaction constraints on CAISO’s system, then rents will decrease, he said.

“Based on what you’ve seen so far, are you seeing anything that would indicate that we have a red flag that we should be looking at or reassessing anything?” WEM Governing Body member Robert Kondziolka asked at the meeting.

“No, at this time we don’t see any reason to take any dramatic action to change our proposal,” said Anna McKenna, CAISO vice president of market design and analysis. “But the analysis thus far does indicate and confirm some of the differences in parallel flows, and this is not a surprise.”

In general, congestion across all areas is concentrated during solar hours and increases during evening peak hours in the summer, Alderete said. Transactions in CAISO’s region have “de minimis” parallel flow impacts on constraints in PacifiCorp’s areas, Alderete said.

The second stage of analysis will use EDAM market simulations to analyze whether problematic incentives appear in the EDAM under the new congestion revenue calculation method.

The third stage will occur after the EDAM begins in 2026 and will include analysis of actual congestion revenue allocations under parallel flows in the EDAM.