Higher prices under Ontario’s renewed market are causing heartburn for mines and greenhouse growers, stakeholders told IESO on Nov. 26.

During the ISO’s quarterly market briefing, IESO officials said the market is performing well, with “intuitive price formation,” and that no new “high-priority defects” have been discovered since their last briefing in August. (See Ontario Nodal Market Nearing ‘Steady State’ After Nearly 4 Months.)

“We’ve now got about six months of operating in the renewed market behind us and … I think everybody’s learning and building their understanding of the new market dynamics that we’re seeing as we shift through each season,” said Candice Trickey, IESO’s director of market readiness and customer experience. “Overall, [based on] everything I hear from you and that I see internally, we are all making, collectively, really good progress in working in this new system.”

However, several stakeholders said they are facing challenges from higher prices since the new market launched May 1.

Alain Cote of Vale Canada — whose five mines and other operations use about 200 MW per hour — said Ontario Zonal Prices in November have risen from about $50/MWh to about $80/MWh in November.

“I’m just having a hard time … forecasting that,” he said. “It’s a big swing.”

Consultant Stephanie Freund, who advises commercial greenhouse companies in southwest Ontario, said her clients have seen increasing price spikes since October, when they turn on their grow lights to nurture winter crops.

“They are really struggling … trying to keep up with the day-ahead [market] in order to manage their lighting schedules … to avoid the spikes,” Freund said. “They’ve never seen such high electricity prices as now. … They won’t be able to afford running” the lights. She asked if IESO had tools to help them manage the volatility.

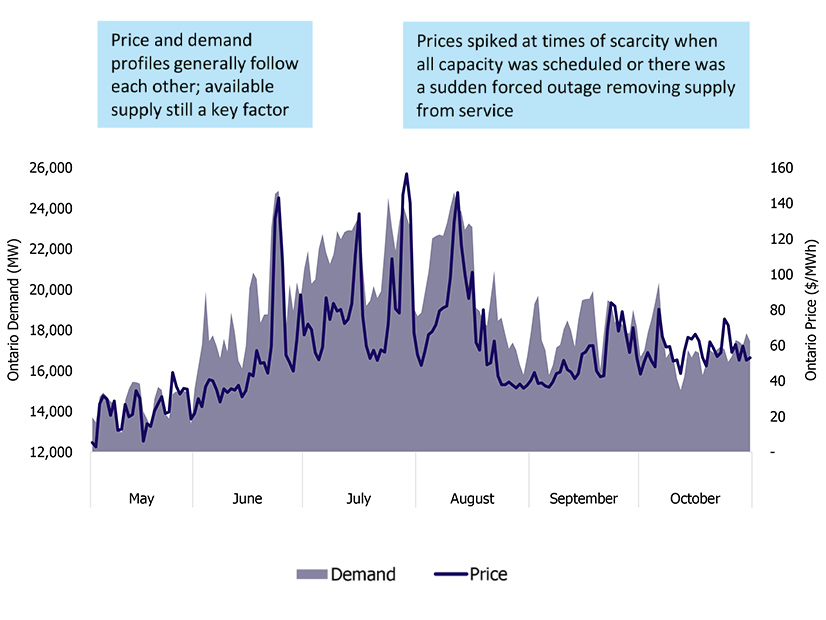

Darren Matsugu, IESO’s director of markets, said Ontario is seeing higher prices because it is the peak of the fall maintenance outage season. “We are definitely in the period where we have the most resources on outage to make sure that we have that availability before the winter,” he said. He suggested Freund talk to the ISO’s customer relations team about ways to manage the high prices.

Cal Brooks, of FirstLight Power, said that — even accounting for inputs like gas prices and system load — prices appear to be higher than under the Hourly Ontario Energy Price (HOEP), which the ISO used before the Market Renewal Program introduced nodal pricing and a financially binding day-ahead market.

“Do you see that as … something good in that maybe real supply and demand signals are now being reflected in a way they weren’t under the old market?” Brooks asked.

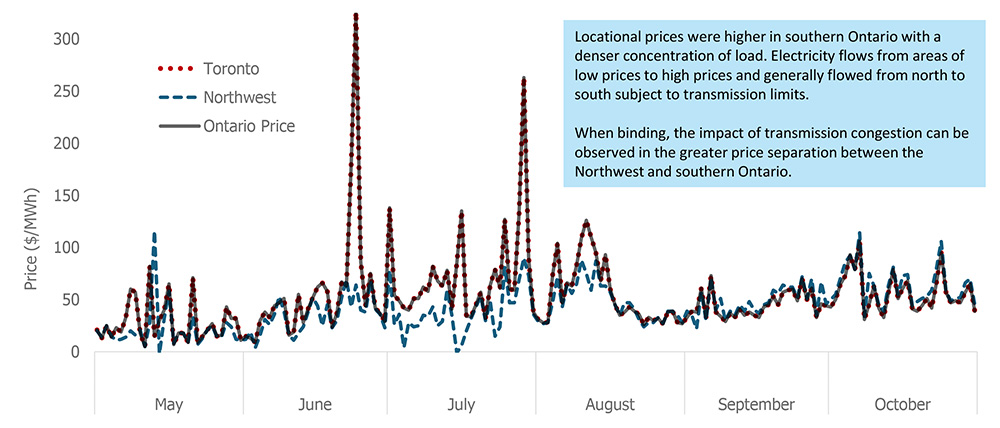

Matsugu noted that the HOEP uniform clearing prices did not include congestion and losses, which now are reflected in LMPs.

“The structural changes that we put in place are to better align the price signals we’re sending with the underlying system conditions,” he said. “Those system conditions are continuing to change. We are getting into tighter and tighter conditions than we have before, and so certainly we would expect that … the underlying prices [would] be higher.”

The ISO says the new market will produce net cost savings for consumers by reducing out-of-market payments and improving the efficiency of scheduling resources.

“I think we are seeing the benefits, particularly when we talk about our intraday unit commitment and our day-ahead commitment,” Matsugu said.

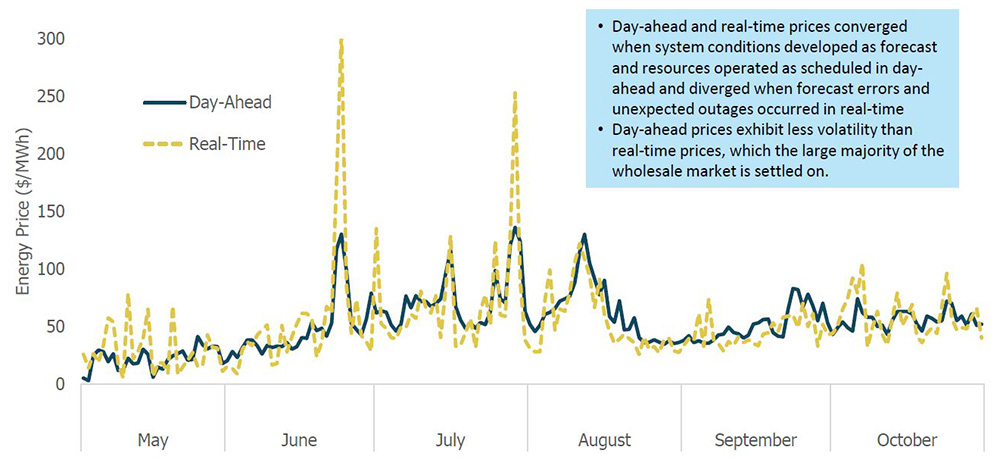

IESO officials said market prices have reflected system conditions, with real-time and day-ahead prices converging when actual conditions match forecasts and varying with deviations in real time.

Jennifer Jayapalan, of Workbench Energy, said her company has seen big changes in how some resources are being used. “We’ve seen a lot more demand response activations, not just in peak conditions, but also into the fall and as recently as the last week or two,” she said. “And we’re seeing a lot more operating reserve [OR] activations across this period as compared to really all years prior to MRP. And neither of these two actions are really publicly reported anywhere by IESO, and both are quite expensive.”

Matsugu said scheduled generation outages contributed to the DR and OR activations and that the ISO will consider whether it can provide more transparency on such actions. “We don’t have, necessarily, all the same resources available that we had during our peak of the summer, but we do that outage planning to correlate with the expected levels of demand.”

Defect Caused Demand Fluctuations

Trickey said the ISO investigated whether a defect that was causing demand fluctuations had an impact on hourly DR activations and concluded it did not create any inappropriate activations.

The defect caused the Ontario demand values published in IESO’s Realtime Totals Report to change by hundreds of megawatts for only a few five-minute intervals.

Because of the unpredictable nature of variables such as supply disruptions, sudden increases in heating or cooling demand, and neighboring system conditions, there often are changes in demand from one interval to the next. But “swings of several hundred megawatts for only a few intervals have historically been quite rare,” the ISO said in a presentation.

IESO said it identified a calculation that overstated demand when hourly DR resources are on standby. The ISO has implemented a manual workaround to counter the defect pending a permanent fix.

Without the workaround, the defect could result in incorrect prices for impacted intervals and incorrect peak demand hours for the Industrial Conservation Initiative if they occur on a potential peak day. ICI participants pay their share of Global Adjustment charges based on their peak demand factor, which is calculated based on their contribution to the top five peak hours over a year.

IESO identified 38 intervals with incorrect prices and corrected them with administrative prices. It confirmed that the top 10 peaks posted on the Peak Tracker webpage were not affected.

Settlements, Defects

IESO officials said they have improved settlement processing times, and that statements and invoices issued in October and November were delivered ahead of the ISO’s 5 p.m. goal.

Trickey said the new market is producing much more data “and that was taking longer to process than ideal. So we’ve been working on improvements.”

Of the settlement disagreements that have been resolved, the ISO said about 30% have been attributed to defects that have been corrected, with the remaining 70% of disputed statements confirmed as correct.

IESO continues to work through a backlog of disagreements, some of which are related to pending defect fixes. The ISO is notifying participants if there are delays in correcting settlements because of the pending fixes.

IESO officials said they had discovered several minor defects since August, including scenarios in which non-quick-start resources operating in combined cycle mode are receiving after-the-fact settlement mitigation calculated using the single cycle mode reference level.

The ISO also disclosed economic operating point (EOP) errors that may result in adjustments to real-time make-whole payments (MWPs) in resettlement statements posted on Nov. 17 and Dec. 12. EOPs reflect the output a resource could have achieved based on its physical capabilities and LMP, under actual market conditions.

The impact of the resettlements will be small, “because they’re all fairly specific scenarios impacting just certain types of resources,” Trickey said.

The defects are separate from the MWP issues for which the ISO is proposing rule changes. (See IESO Tweaking Make-whole Payments for Operating Reserves.)

Advisory Forum

Trickey said IESO will continue its quarterly briefings on the Renewed Market’s performance for the first year of operation.

In response to requests from market participants, the ISO is creating a new group, the Renewed Market Advisory Forum, to discuss ways to improve the market.

Trickey said the group will focus on incremental improvements, not “long-term, evolutionary” changes.

“We’ve implemented this new market. Is everything working the way we thought it would, or as effectively as we hoped?” Trickey explained. “And if we’re seeing some gaps — whether it’s information that people need, or some parts of the system that aren’t working as well as we hoped — this is where we would like to have those kind of conversations with participants that are really engaged in the market.”

Candidates interested in participating should submit expressions of interest by Dec. 19 to engagement@ieso.ca.