After a long decline in the U.S., coal-fired generation is enjoying strong policy support in the second Trump administration.

Don’t call it a comeback.

After a long decline in the U.S., coal-fired generation is enjoying strong policy support in the second Trump administration.

It has seen an uptick in output amid rising power demand and higher natural gas prices. And planned retirements of aging facilities are being delayed in some cases to preserve generation capacity.

But no large coal-burning plant has been built in the U.S. in more than a decade, and most objective observers do not expect any future construction — natural gas plants are more economical and less likely to face policy friction during a future Democratic presidency.

The U.S. Energy Information Administration in its December 2025 Short-Term Energy Outlook reported that coal provided 16% of U.S. electricity in 2024. It predicted coal would total 17% in 2025, then drop back to 16% in 2026 as the total number of gigawatt hours generated through all technologies increased by 1.7%.

Brattle Group Principal Samuel Newell told RTO Insider that the business case for new coal generation does not work.

“If you’re going to burn fossil, natural gas-fired combined cycle generation is just — you’re not going to beat the economics with new coal, even before accounting for the really high exposure to future regulatory risk,” he said.

Existing plants are a different matter.

“Certainly, there’s a lot of discussion about existing coal and how long it makes sense for existing plants to stay online,” said Newell, who leads more than 50 electricity-focused consultants at Brattle. “And there have been many plans, projections for fairly rapid retirement of the coal fleet, but with that likely slowing down a bit with the high load growth we have now. Not new coal.”

EIA records show U.S. coal-fired generation declined in each of the four years of President Donald Trump’s first term, despite Trump declaring his predecessor’s war on coal to be over. In his second term, Trump has called for construction of new coal plants, including as co-located power for large loads, but so far, he has had a bigger impact by supporting existing coal facilities.

Trump laid the groundwork for this in April 2025 with an executive order “Reinvigorating America’s Beautiful Clean Coal Industry,” and Energy Secretary Chris Wright has reaffirmed the vision repeatedly since then.

In late May, eight days short of the planned retirement of Consumers Energy’s 1,560-MW J.H. Campbell coal plant in Michigan, Wright issued an emergency directive under the seldom-used Section 202(c) of the Federal Power Act to keep it operating, saying it was needed to avoid capacity shortfalls in the Midwest. He subsequently renewed that order twice.

In September, Wright said the Department of Energy is working with utilities around the country to avert other retirements, although he conceded that planned retirements of coal plants that are smaller, older or inefficient are likely to go forward. (See Wright: DOE Working to Stop More Coal Plants from Retiring.)

On Dec. 16, Wright issued a 202(c) order blocking the imminent retirement of TransAlta Centralia’s 730-MW coal-fired generator in Washington, again citing resource adequacy.

Some plant operators are pushing back retirements without DOE telling them to do so. Count on Coal cheered the trend in an August post, saying more than 40 retirements had been averted in the past three years.

However, coal-fired generation comes with considerations beyond dollars and watts, such as its impact on the climate of the planet and the health of people who live near such facilities.

Alexander Heil, a senior economist with The Conference Board whose work centers on renewables and the energy transition, cited this impact in arguing against coal.

“There’s no such thing as clean coal … that’s a total misnomer,” he told RTO Insider. “I mean, there are 9 million people worldwide, I believe, that die every year from air pollution, particulate matter and such. That’s not priced … there’s tons of social costs, all kinds of externalities with coal.”

He added: “I don’t really think people are seriously going to be considering coal as an alternative here in the U.S.”

Environmental advocates have blasted the J.H. Campbell and Centralia orders, saying they are costly, dirty and unnecessary, as well as a liability, given their age and condition.

“Actions by the Trump administration to force jalopy coal plants to continue burning coal are an unprecedented power grab that cost communities in their wallets and their health,” Earthjustice said.

But coal still has its fans.

America’s Power, a trade organization advocating for coal-fired generation, says coal is “critical to maintaining affordable electricity prices, and a reliable and resilient electricity grid.” The organization notes the U.S. has the largest coal reserves in the world — enough for 440 years at current production and consumption levels.

America’s Power recently commissioned a study that concluded the cost of replacing U.S. coal with various configurations of renewables and other generation would run $3 billion to $54 billion a year, plus unquantified loss of reliability attributes.

“Fortunately for consumers, utilities in 19 states have reversed decisions to retire coal plants, but more than 50,000 MW of coal generation are still scheduled to retire over the next five years,” CEO Michelle Bloodworth said as she announced the report Dec. 10. “This amount of coal generation could power at least 50 hyperscale data centers, which are in desperate need of power. The new study shows that it would be a big economic mistake to allow these coal retirements to continue.”

But the other side offers cost estimates that go in the opposite direction.

The Environmental Defense Fund said a study it and other advocates commissioned showed the federal stop-retirement orders could cost ratepayers $3 billion to $6 billion a year. (See New Report: Consumers Could Pay $3B More Annually if DOE Stay-open Orders Persist.)

EIA statistics quantify coal’s decline:

-

- U.S. coal production has come nearly full circle in the past 75 years, rising from 481 million short tons in 1949 to 1.17 billion in 2008 and dropping to 513 million in 2024.

- From 2015 through 2024, U.S. coal-fired generation dropped from 1,352 TWh to 652 TWh per year, with every year but one lower than the year before.

- Natural gas generation increased 40% from 2015 through 2024 and surpassed coal as the leading U.S. generation technology in 2016. (Solar generation by comparison jumped 678% over the same period but still provided only 47% as much electricity as coal in 2024.)

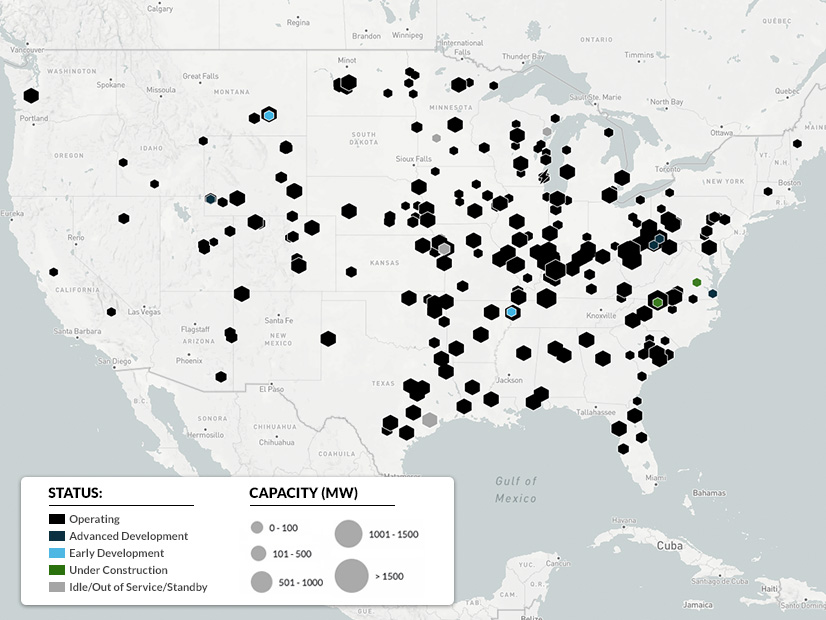

- The number of U.S. coal-fired plants dropped from 491 in 2014 to 219 in 2024.

- From 2015 through 2024, the time-adjusted capacity of the U.S. coal fleet dropped from 286 GW to 176 GW, and its capacity factor fell from 54.3% to 42.6%.