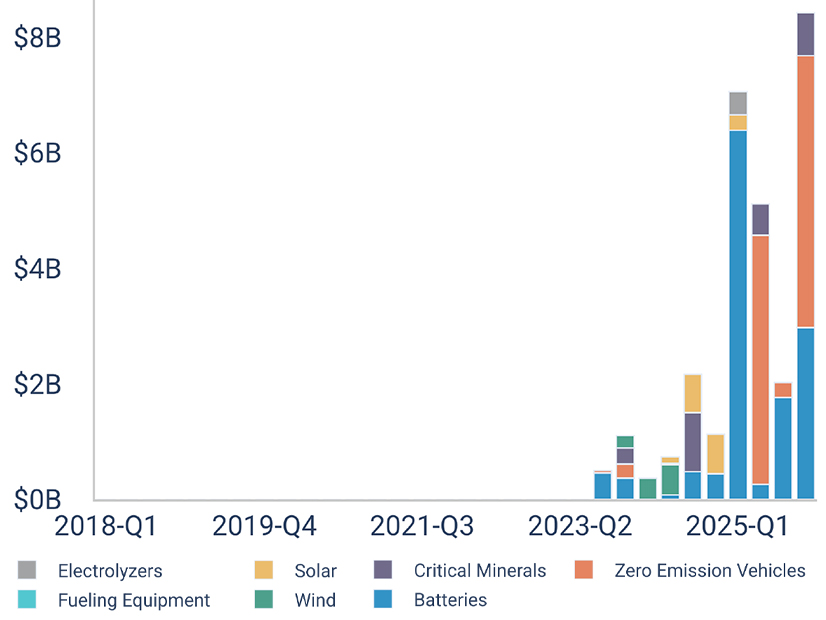

In late 2025, U.S. cleantech manufacturing investment cancellations reached their highest level of any quarter in the eight years a database has been tracking such announcements.

Also in the fourth quarter of 2025, new investment announcements dipped to their lowest level in five years.

The Clean Investment Monitor (CIM), maintained by Rhodium Group and MIT’s Center for Energy and Environmental Policy Research, tallied $3.4 billion in quarterly investment announcements and $8.4 billion in cancellation announcements.

For all of 2025, amid President Donald Trump’s opposition to many clean energy technologies, the CIM tallied $24.1 billion in manufacturing investment announcements and $22.6 billion in cancellations. By comparison, 2024 saw announcements worth $32.5 billion and cancellations worth $4.4 billion.

The ratio was even more lopsided in 2023 — $65.5 billion announced and $1.6 billion canceled.

The decrease in actual investment activity — the dollars actually being spent — was not as marked. Many previously announced investments were still being carried out in the fourth quarter. The CIM placed total actual investments at roughly $9.3 billion — down 29% from a peak of about $13.1 billion in the third quarter of 2024.

The majority of the $3.4 billion in new manufacturing announcements for the quarter was related to batteries — $2.5 billion, including Ford Motor Co.’s $2 billion decision to convert an EV battery factory in Kentucky to battery energy storage system production.

There were just five announced cancellations in the CIM for the fourth quarter, but they all were huge, and all were connected in some way to EVs. Ford’s planned electric pickup truck and commercial van factories in Tennessee and Ohio were valued at a combined $4.71 billion; Gotion’s EV battery factory in Michigan at $2.44 billion; Westwin Elements’ nickel refinery in Oklahoma at $748 million; and ICL Group’s battery materials factory in Missouri at $546 million.

The combined $8.44 billion in cancellations was the most of any quarter in the CIM database since its start in 2018.

U.S. cleantech manufacturing investment announcements tallied by the CIM peaked in 2022 as the landmark Inflation Reduction Act worked its way through Congress and was signed into law by President Joe Biden: $91.4 billion for the year, capped by $32.2 billion in the fourth quarter alone.

By contrast, the CIM tallied just $24.1 billion in 2025 announcements, capped with the $3.4 billion in the fourth quarter — the least of any quarter since the final months of Trump’s first term.

The CIM also tracks cleantech investments in the U.S. energy industry and retail sectors, neither of which has tapered off the way the manufacturing sector has.

Combined investments in all sectors hit a record-high $75.4 billion in the third quarter, mostly from consumers rushing to buy EVs before federal tax credits expired.