The North American power grid’s resource adequacy outlook is “worsening,” and multiple assessment areas are at high risk of energy shortfalls over the next 10 years, NERC wrote in its 2025 Long-Term Reliability Assessment released Jan. 29.

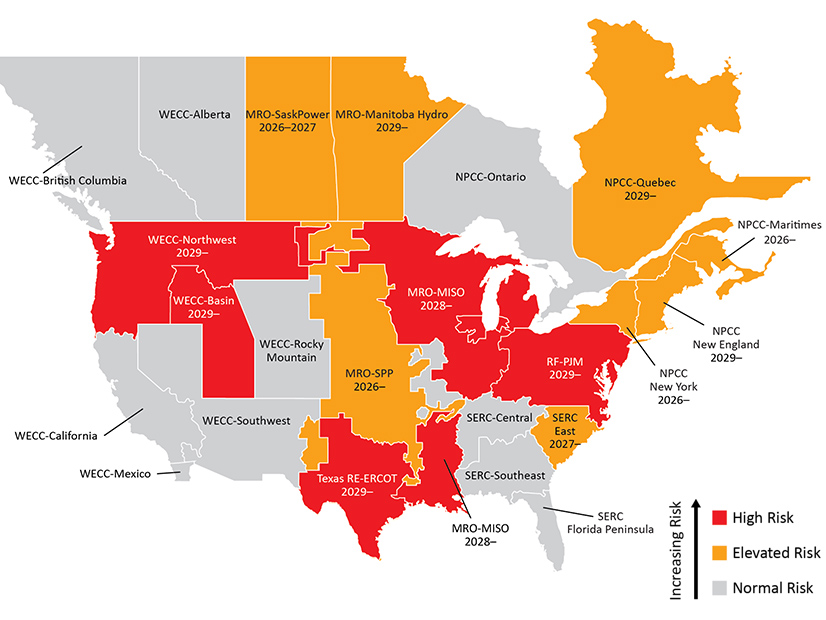

NERC determined that five of the ERO’s 23 assessment areas — MISO, PJM, Texas RE-ERCOT, WECC-Basin and WECC-Northwest — could develop into high risk between 2026 and 2030, meaning planned resources as of July 2025 would lead to energy shortfalls in excess of resource adequacy targets or baseline criteria for unserved energy or loss of load.

A further eight areas — MRO-Manitoba, MRO-SaskPower, MRO-SPP, NPCC-Maritimes, NPCC-New England, NPCC-New York, NPCC-Quebec and SERC-East — were assessed as elevated risk. These areas met resource adequacy targets but were likely to experience energy shortfalls in extreme weather conditions. The remaining 10 assessment areas were labeled normal risk, indicating sufficient resources under a broad range of conditions.

In a webinar accompanying the release of the LTRA, John Moura, NERC’s director of reliability assessments and performance analysis, called the message of the assessment “pretty straightforward: Reliability risk is increasing … not because we lack awareness, but [because] the system is changing faster than the infrastructure needed to support it.”

This is a common theme among the elevated and high-risk areas, most of which were described in the LTRA with some variation of “demand growth projections are outpacing planned resource additions,” as NERC wrote about NPCC-Quebec. Summer and winter peak demand across the continent are projected to grow more quickly over the next 10 years than in any decade since 1995-2004, reaching a constant annual growth rate of 3% and 2.5%, respectively.

To submit a commentary on this topic, email forum@rtoinsider.com.

Demand growth in many areas is being driven by multiple factors, including large loads such as data centers and industrial centers in nearly every area, along with the electrification of transportation in the U.S. East Coast and Canada, and the growth of heat pumps in areas such as New England and PJM. Population growth is contributing to demand in NPCC-Quebec and ERCOT.

Another frequently mentioned concern is the nature of new resources, with variable energy resources like solar and wind generation projected to rise from 10.2% of on-peak capacity in 2025 to as much as 20% in 2035, depending on the completion of planned projects. This creates vulnerability in winter, because winter peak demand usually occurs during early morning, when availability of weather-dependent resources is low.

As a result, most areas likely will need to turn to natural gas generation to fill the gap. Utilities are projected to add at least 12 GW of new gas generation through 2035, and possibly as much as 41 GW; 11 to 39 GW of this capacity is expected to be completed within the next five years. This buildout also will require investment in gas infrastructure to ensure the availability of fuel, NERC observed.

The report “shows that there’s still time to act, and the results shouldn’t be taken as an indictment of those [assessment] areas. In fact, the level of industry and policy engagement, and, of course, analytical rigor behind the work is higher than ever,” Moura said. “The challenge is not a lack of effort; it’s really the pace and scale of the system transformation occurring at the same time as demand growth accelerates.”

Reactions to the LTRA among industry stakeholders were varied. Michelle Bloodworth, CEO of coal lobbying group America’s Power, highlighted the report’s projections of coal plant retirements in high-risk regions and warned that “the grid will lose an energy-secure, affordable and reliable source of baseload power” as a result.

Caitlin Marquis, a managing director at renewable energy trade group Advanced Energy United, urged state governments and grid operators “to remove the red tape blocking deployment of the most cost-effective and fastest-to-build resources, including solar, energy storage and demand-side resources.”

“Rather than double down on resources that already dominate the supply stack, adding more affordable, reliable advanced energy technologies like storage paired with renewable energy and demand-side solutions will increase resource diversity and support affordability by minimizing fuel-based price spikes,” Marquis wrote.

Todd Snitchler, CEO of the Electric Power Supply Association, said in a statement that the challenges mentioned in the LTRA “are national in scope and are not limited to any single market or operational structure.” He said the best approach for reliability is “competitive electricity markets that send clear, durable development signals — not by policy interventions that create misalignment between supply and demand.”