Energy efficiency and load flexibility would be effective and cost far less than the new generation assets many jurisdictions are planning to build to meet anticipated load growth, a new report asserts.

While both efficiency and flexibility have been cited repeatedly as solutions, they remain underused, the American Council for an Energy-Efficient Economy (ACEEE) said Feb. 4 as it released “Faster and Cheaper: Demand-Side Solutions for Rapid Load Growth.”

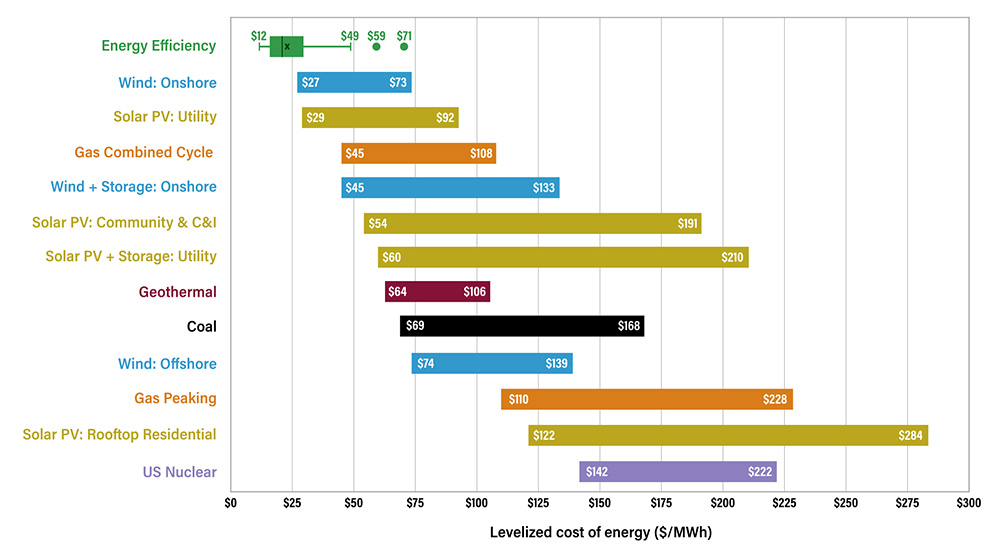

Analysis of large utility programs showed energy efficiency with a median cost of $20.70/MWh and load flexibility costing less than $40/kW-year, ACEEE said, while the levelized cost of electricity from renewable, fossil and nuclear alternatives is spread across a much higher range.

The authors note that the cost cited for energy efficiency does not factor in significant avoided costs for distribution infrastructure including substations, transformers and lines. They additionally tout demand-reduction measures as quicker and cleaner than building new generation, as well as better at protecting ratepayers.

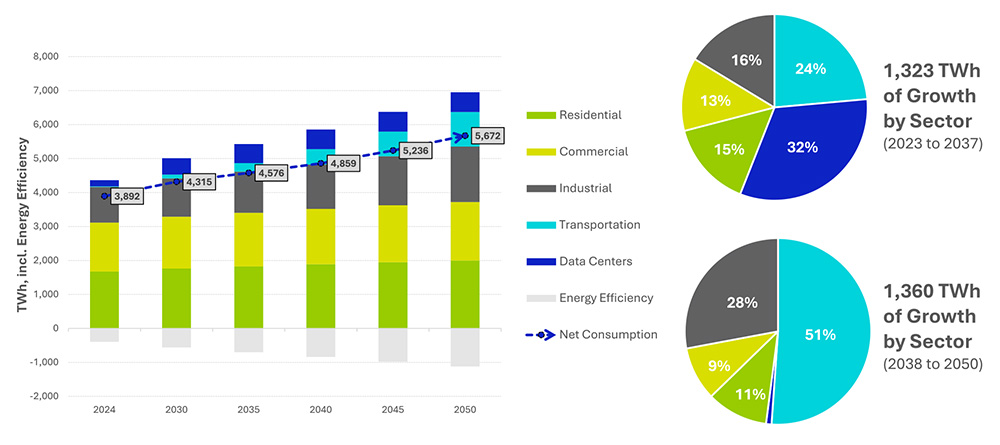

There is wide agreement that the U.S. has begun a period of sharp power demand growth, significantly from data center proliferation, but there is no consensus on how steep and high the growth curve will be. The ACEEE report notes that 10-year forecasts of demand growth range from 20 to 50% and peak demand growth from 19 to 35%.

The most common response by utilities has been to plan new gas-fired generation, the authors say, and given utilities’ historic tendency to overestimate future demand, this creates the risk of stranded generation, transmission and distribution assets.

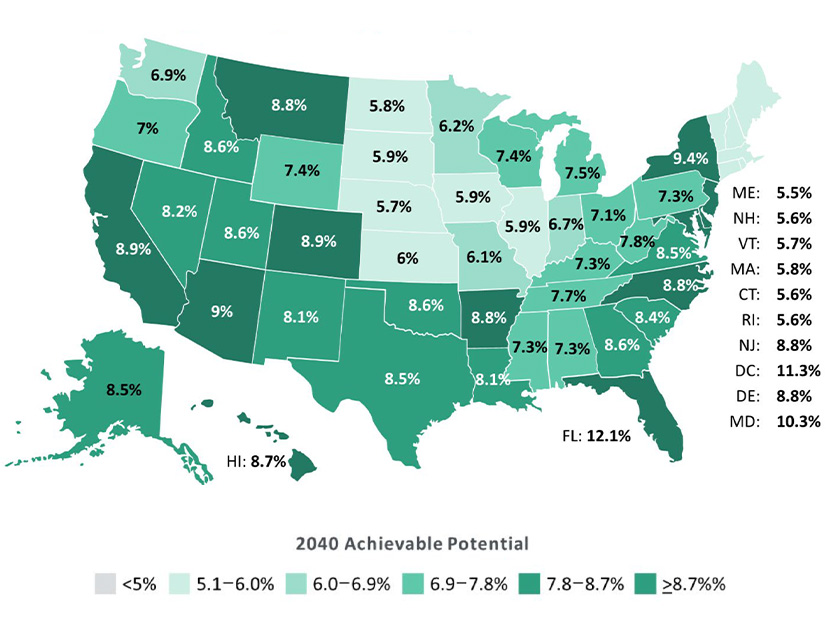

Demand-side management in the form of energy efficiency and load flexibility is the better response, ACEEE asserts. Aggregated nationally, energy efficiency could reduce electricity consumption by approximately 8% and demand by about 70 GW by 2040, the report asserts, adding that experts estimate 60 to 200 GW of load flexibility nationwide.

The data center buildout is a once-in-a-career opportunity for the decision-makers in the power sector, many of which get a regulated rate of return on every dollar of investment they make. The Edison Electric Institute reported in July 2025 that investor-owned utilities were planning $1.1 trillion of investments between 2025 and 2029, significantly more per year than the $1.3 trillion invested in the preceding decade.

Demand-side management is not a large piece of the solution yet. The ACEEE study notes that only 6% of U.S. energy consumers participated in a retail demand response in 2024. FERC in its 2024 assessment of DR and advanced metering said participation in the seven U.S. wholesale markets was 33.1 GW in 2023.

A Duke University study in early 2025 found that if data centers would curtail their peak electricity use by just 1%, they could free up 126 GW of grid capacity. (See US Grid Has Flexible ‘Headroom’ for Data Center Demand Growth.)

With its new report, ACEEE is trying to move the needle further, so that more efficient use of existing capacity is considered before expansion.

“Our power system needs to meet rapidly growing electric demand while ensuring reliability and affordability,” said Mike Specian, ACEEE utility research manager and lead author of the report. “The first-line approach should be tapping into our massive reserve of energy efficiency and load flexibility, not spending billions on new power plants.

“Demand-side measures are faster and cheaper to deploy today than new generation. They can be targeted to specific locations to defer or avoid the need to build new infrastructure, saving families and businesses money in the process.”