Eversource Energy on Friday reported how well it is managing the impact of COVID-19 on its financials, just as Connecticut regulators suspended a July 1 rate increase set to boost its bottom line.

The company posted second-quarter earnings of $252.2 million ($0.75/share), up from $31.5 million ($0.10/share) in the same period a year ago. The increase was due primarily to last year’s results including a $0.64/share impairment charge related to the Northern Pass transmission project, which failed to win regulatory approval in New Hampshire.

“The vast majority of our employees who either had tested positive for COVID-19 or were self-quarantined are now back to work,” CFO Philip Lembo said Friday in an earnings call.

Eversource is New England’s largest utility company, with subsidiaries supplying electricity, natural gas and water service to approximately 4 million customers in Connecticut, Massachusetts and New Hampshire.

In terms of usage, kWh sales in the second quarter were down about 1.4% overall compared with last year. But in New Hampshire, which is not decoupled, sales were up 1.8%, the company said.

A 26% June spike in residential usage in Connecticut compounded the effects of a July 1 rate increase, resulting in consumer complaints and legislator calls for action and prompting the state’s Public Utilities Regulatory Authority (PURA) Friday to suspend the rate increase to allow for reexamination.

The order specifically affected Connecticut Light and Power’s revenue decoupling mechanism charge, which had gone up from -0.011 cents/kWh to 0.182 cents/kWh; the transmission charge, up from 2.356 cents/kWh to 3.395 cents/kWh; the non-bypassable federally mandated congestion charge, up from 1.423 cents/kWh to 2.729 cents/kWh; and the electric system improvements tracker charge, up from 0.171 cents/kWh to 0.299cents/kWh.

“We’re not shutting off customers, and we’re working diligently to help customers in this pandemic situation,” Lembo said, referring to press reports of customer complaints. “The rate overall on a customer’s bill is only up about 3.5%, mostly driven by this record level of usage.”

He also cited the utility’s contract to provide payment “and subsidy, some might say, to Millstone Nuclear Plant” as a contributing factor.

The Connecticut Department of Energy and Environmental Protection in December 2018 negotiated a 10-year contract for about 50% of the plant’s output after deeming it to be at risk of retirement. (See Conn. Zero-Carbon Awards Include Nukes, OSW, Solar.)

Grid Mod

Lembo also highlighted the company’s plans to file three proposals that day in PURA’s grid modernization proceeding to help the state reduce its carbon footprint by at least 80% by 2050.

The company plans over the next five years to replace 800,000 meters with automated meter infrastructure; wire 2,500 homes for electric vehicle charging and build 3,000 additional charge stations in the state over a period of three years; and incentivize installation of 30 MW of residential energy storage and 20 MW of commercial storage.

In Massachusetts, the company continues to implement the grid modernization plan authorized by regulators more than two years ago, he said.

“We expect to complete the authorized projects, including infrastructure to connect 3,500 charge ports and utility storage projects on Cape Cod and Martha’s Vineyard, in 2021,” Lembo said. “In mid-2021, we’ll be filing a new three-year plan with implementation in the 2022 through 2024 time period.”

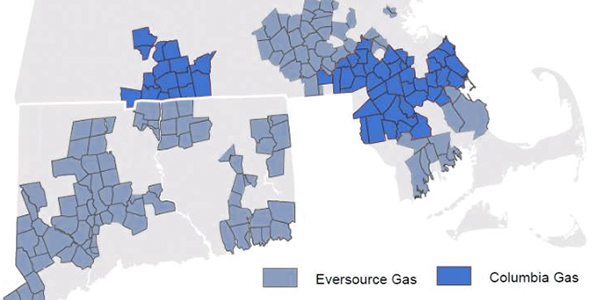

In other matters, the company expects to receive regulatory approval by Sept. 30 for its $1.1 billion acquisition of Columbia Gas’s 320,000 natural gas customers in Massachusetts.

Lembo also cited the June 9 release of the Bureau of Ocean Energy Management’s (BOEM) supplemental environmental impact statement for the Vineyard Wind project, which also affects development of about 22 GW of offshore wind generation off the Atlantic coast.

“This was an important step in BOEM’s evaluation process for the different applications that have been filed to date, including two of our joint proposals with Ørsted, one of those being [130-MW] South Fork, the other [704-MW] Revolution Wind,” he said. (See Developers Seek 1-Mile Spacing for Vineyard Wind.)

The company expects BOEM later this summer to release its schedule for review of South Fork, though it is “very unlikely” that South Fork will enter service before the end of 2022. It still expects Revolution Wind to be in service by the end of 2023, Lembo said.

The joint venture’s 880-MW Sunrise Wind project in New York is slated to go into service at the end of 2024, he said.

Call transcript courtesy of Seeking Alpha