FERC this week approved a procedure for “critical” New England generators and transmission operators to obtain compensation for compliance with NERC rules but said it would not cover past expenses (ER20-739).

The ruling allows owners of assets judged critical to the derivation of interconnection reliability operating limits (IROL) to seek compensation for costs of complying with NERC’s critical infrastructure protection (CIP) reliability standards.

The commission approved ISO-NE’s proposed Tariff Schedule 17, allowing facility owners to seek cost recovery through Federal Power Act Section 205 filings effective March 6.

ISO-NE said there are 27 generation units at 15 plant locations and one merchant transmission facility that are IROL-critical facilities.

The RTO said the generators designated as IROL-critical “protect other control areas from unanticipated events that might occur inside New England and maximize internal transmission capability, which benefits all internal transmission customers. These IROL-critical facilities predated the IROL-critical designations and were thrust into compliance requirements not originally anticipated in the economics of the projects, and not recoverable through existing market mechanisms.”

The facilities’ compliance with CIP standards “allows the ISO to operate the system with higher limits without unacceptable risk. Conversely, compromised IROL-critical facilities’ controls, for example, can lead to inadvertent operation of the system using incorrect limits. Operating the system based on faulty limits can result in local or widespread system instabilities, potentially leading to uncontrolled separation, cascading outages and blackouts in the New England and neighboring control areas,” ISO-NE said.

In joint comments, NextEra Energy Resources, Vistra Energy, NRG Energy, FirstLight Power, Cogentrix Energy Power Management, Cross-Sound Cable Co. and Dynegy Marketing said they have spent “several million dollars to meet their higher reliability requirements thus far” on six facilities with a capacity of 3,598 MW designated as IROL-critical. They said they should be allowed to collect all historic costs, not only going-forward costs.

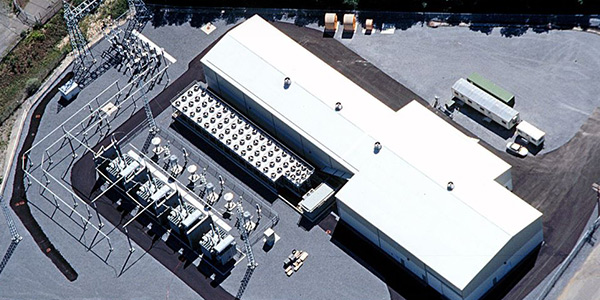

Cross-Sound Cable Co., which operates a 24-mile submarine cable under Long Island Sound to connect the New England and Long Island electric grids, is a merchant transmission facility that ISO-NE has designated as IROL-critical. The 330-MW HVDC line terminates on Long Island at the Shoreham converter station (pictured). | Cross-Sound Cable Co.

ISO-NE took no position on whether prior costs should be recoverable, saying the commission should decide based on individual asset owners’ Section 205 filings. The New England States Committee on Electricity (NESCOE) opposed recovery of prior costs, saying it would violate FERC’s rule prohibiting retroactive ratemaking.

The commission sided with NESCOE, saying it would consider only CIP costs incurred on or after the effective date of a Section 205 filing.

“Under FPA Section 205, rate changes may be prospective only, and, under the rule against retroactive ratemaking, the commission is prohibited ‘from imposing a rate increase for [power] already sold’ or ‘adjusting current rates to make up for a utility’s over- or undercollection in prior periods.’”

ISO-NE — the NERC reliability coordinator for New England — said facilities it identified as IROL-critical must comply with CIP reliability standards for the medium-impact category, subjecting them to significant compliance costs compared to low-impact facilities, which are not recoverable under its Tariff.

Schedule 17 includes a template for recording incremental compliance expenses, including categories for labor, equipment and hardware; software; physical improvements; and administrative and regulatory costs.

ISO-NE said it will charge the costs to transmission customers on a pro rata basis based on the customer’s monthly regional network load or average monthly through-or-out service reservation.

The filing won the support of 64% of the New England Power Pool, just below the two-thirds threshold required for the organization’s formal support.

Rather than making periodic Section 205 filings, the facility owners asked FERC to allow them to make informational formula rate filings with data on actual costs incurred.

The commission declined to set a formula rate for cost recovery but said facility owners may seek formula rate treatment in their Section 205 filings.