FERC staff expressed confidence Thursday that the North American bulk power system has sufficient reserves to make it through the winter comfortably.

But they also said utilities must be prepared for further impacts from the COVID-19 pandemic and constraints on the availability of natural gas and fuel oil.

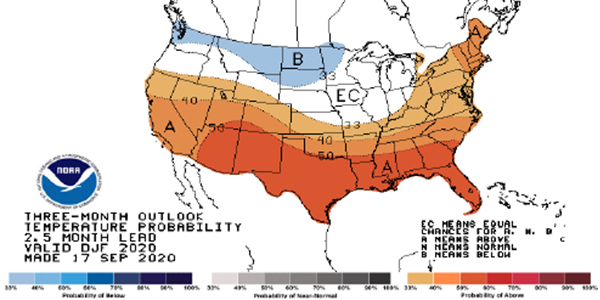

Winter 2020/2021 temperature forecasts | National Oceanic and Atmospheric Administration

Presenting FERC’s 2020/2021 Winter Energy Market and Reliability Assessment, Louise Nutter of the Office of Electric Reliability told the commission that the impact of the pandemic in winter is hard to judge in advance. While many of the worst disruptions — natural gas and crude oil prices, and electric load reductions because of stay-at-home orders — have eased since spring, further impacts depend “on whether COVID-19 cases rise across the United States and whether states increase mitigation measures.”

Staff highlighted several areas in which the pandemic appears to have brought lasting, or at least ongoing, change. The first is the shape of the daily demand curve, with weekday loads peaking “later in the morning and earlier in the afternoon compared to before the pandemic” — a phenomenon already noted by NERC regional entities earlier this year. (See Sagging Demand Cushions NPCC’s Summer Outlook.)

Utilities are also continuing to take the coronavirus into consideration in the form of new procedures to keep their personnel safe from infection through, for example, guidelines requiring social distance during operations and expanding stocks of personal protective equipment. These have been in place for many entities since before summer; however, with no firm idea of when the crisis will end, utilities are having to adjust what most assumed to be temporary measures to last indefinitely. (See NERC Planning Lessons Learned on COVID-19 Response.)

Finally, these pandemic-related scheduling issues also caused many entities to forgo maintenance planned for spring until autumn. (See COVID-19, Hurricanes Among Biggest Summer Threats.) Most of this work has been completed during “a compressed fall maintenance season,” but utilities have expressed concern about the possibility of the remaining maintenance interfering with winterization activities, along with unforeseen complications from the delay.

Reference Margins Looking Good

Outside of potential coronavirus issues, FERC said all regions appeared set to meet their reference margin. SERC-E, representing North and South Carolina, had the lowest reserve margin; however, its expected reserves of 22% still comfortably exceed NERC’s reference margin of 15%.

NERC’s winter 2020/2021 anticipated reserve margins | NERC

Weather is the primary driver of confidence, with the National Oceanic and Atmospheric Administration predicting normal temperatures or higher for most of the U.S. aside from the upper Northwest and Upper Midwest, which were assessed a 33% probability of below-normal temperatures. The mild conditions are expected to drive down demand for natural gas for heating in most areas, freeing up stockpiles and pipelines to be used for power generation.

On the generation side, the report predicts current trends of “increasing gas and renewable capacity with decreasing net capacity of coal and nuclear plants” to continue, with solar, wind and natural gas-fired plants comprising nearly all the capacity to be added by February 2021. Even with these additions, the share of electric generation coming from gas nationwide in the winter is projected to decrease from 38% last winter to 34% this year; NYISO and PJM are the only regions expected to grow their shares of gas-fired generation.

Gas Bottlenecks Possible for New England

New England represents the area of greatest concern for FERC, holding “the greatest risk of fuel shortages and related market stress” because of the widespread use of natural gas for both heating and power generation, which can produce bottlenecks on cold days even in the milder conditions predicted for this winter. Peak load for ISO-NE is forecast to hit 23,373 MW in the 2020/21 winter season, higher than last year’s peak of 22,319 MW but still within the regional capacity of about 31,000 MW.

Strains on natural gas supply lines could be exacerbated this year because of decreased demand for oil, which has reduced the availability of natural gas derived from oil production. Gas is also expected to be even more prominent in the resource mix than usual this winter because of the recent retirement of two nuclear plants — the 680-MW Pilgrim facility in Massachusetts in May 2019 and New York’s 1,000-MW Indian Point Unit 2 in April 2020.

California, the only other region highlighted in FERC’s report, may see oversupply conditions when generation from hydro, wind and solar facilities exceeds load, a regular occurrence in late winter. In February, for example, CAISO curtailed 157 GWh of energy, 8% of which came from solar generation; by contrast, in July the ISO curtailed only 31 GWh.

Asked by Commissioner Richard Glick whether CAISO is taking steps to reduce curtailments so that renewable generation capacity is used as much as possible, a staffer from FERC’s Office of Energy Policy and Innovation said the ISO is looking at “a number of possible solutions, [including] increasing the flexibility of existing resources through enhancing demand response initiatives, reducing minimum operating levels for generators and greater regional coordination through the Western Energy Imbalance Market.”

More Findings

Additional significant conclusions from the report include:

- Natural gas consumption by the electric power sector is expected to average 24 Bcfd, down 20% from winter 2019/2020. This represents a departure from the 5% average growth annually since winter 2015/2016 and is attributed to lower anticipated electricity production both from the mild weather and continuing coronavirus-related load decreases.

- U.S. exports of LNG should average 9.4 Bcfd, up 22% from winter 2019/20 levels thanks to increased U.S. liquefaction capacity and rising international demand. Gross U.S. LNG imports are expected to average 367 MMcfd, a 13% year-on-year increase.

- Natural gas storage inventories are expected to begin the winter withdrawal season at 3.95 Tcf, “the third highest inventory level in the past 10 years,” and end the season at 1.34 Tcf, representing the third-lowest level in the last decade.