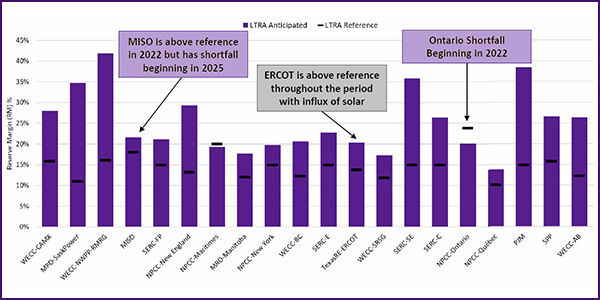

Planned reserves will fall below reference margins in MISO and Ontario within the next five years, NERC told the Midwest Reliability Organization in a preview of its Long-Term Reliability Assessment (LTRA) on Tuesday.

Mark Olson, NERC’s manager of reliability assessments, said Ontario, part of the Northeast Power Coordinating Council, will fall below its reference level in 2022, with MISO projected to drop below the threshold in 2025.

“Although MISO is over the reference margin level in 2022, their anticipated reserve margins are falling throughout the [first five-year] period, and they drop below the reference margin level in 2025,” Olson said. But he noted that the RTO has more than 100 GW of planned resources in its interconnection queue and ranks with PJM and ERCOT as having the most solar and wind planned. “Resource and transmission planners can develop these prospective resources to meet their current projected shortfall,” he added.

Olson also noted that MISO is among the areas for which a reduction in expected operating reserves is causing an increase in projected loss-of-load hours in non-peak months.

The LTRA, which considers reliability over a 10-year horizon, will be released next week, after the expected approval Thursday of NERC’s Board of Trustees, Olson said. It will include study process or methodology changes since last year’s assessment. (See NERC Sees Opportunities, Challenges in Grid Evolution.)

MRO heard briefings from all four of its assessment areas: MISO, SPP, Manitoba Hydro and SaskPower.

MISO

MISO’s Stuart Hansen, who also spoke at the MRO briefing, said the RTO is actually projected to fall slightly below its 18% reserve margin in 2024. “But there’s no huge need for concern,” he said. “We will see additional retirements in the coming decade, but we do have plenty of new units that we’re studying in our interconnection queue, which is at record-high numbers right now. So, that will in all likelihood help maintain” the margin.

The RTO’s planning reserve margin increased to 18% from 16.8% in the 2019 LTRA because of changes in load shape, generation verification test capacity, and retirements and new resources, Hanson said.

He said MISO and its stakeholders are addressing any concerns through the resource availability and need (RAN) initiative. He also noted that wind and solar represent 84% of the 104.1 GW in the interconnection queue. The high proportion of intermittent resources “kind of highlights the need for this RAN effort, to make sure that we’re capturing all of our resource adequacy risks accurately and that we’re relaying that information to our members so that they can better plan the system,” he said.

SPP

Chris Haley, senior planning specialist for SPP, said the RTO has seen no major changes since 2019’s assessment, but he noted it continues to add wind, setting a new wind peak of 19,176 MW on Nov. 23. The RTO now has 25.5 GW of wind in total.

Haley also noted SPP’s coordination plan with ERCOT, which addresses operational issues for the DC ties between the Texas and Eastern interconnections. SPP has the ability to recall the capacity of any switchable generation resources that have been committed to satisfy the resource adequacy requirements contained in SPP’s Tariff. “We did have an instance in [summer] 2020 where we did recall some of that capacity,” he said.

The RTO’s 2019 loss-of-load-expectation study results indicates the region may need to increase its current 12% planning reserve margin by 2024 to maintain its one-day-in-10-years metric.

Saskatchewan, Manitoba

Suman Thapa, a senior engineer for SaskPower, highlighted major transmission projects under construction in the province. He said a 230-kV tie line with Manitoba expected in service by mid-2021 “will facilitate our new long-term … contracts with Manitoba.” The company is also testing a new 230-kV phase-shifting transformer on its line to North Dakota, expected in service by March 2021.

In June, Manitoba Hydro placed a 500-kV line from Dorsey (near Winnipeg) to the Iron Range near Duluth, Minn., into service. “That’s a significant interconnection,” the utility’s Kelly Hunter said. “It improved our Manitoba-MISO transfer capability … from an export-import perspective, and we think it adds resilience to both systems.”

The company also is completing work on the Keeyask hydroelectric generating station, a 630-MW addition.

Hunter said the new plant and the additional import capability from the Manitoba-Minnesota transmission line may prompt the retirement of the Selkirk natural gas plant (33 MW summer/118 MW winter).

Unlike its neighbors to the south, the Manitoba system is evolving slowly, Hunter said, and will likely remain dependent on hydropower. Solar PV has become unattractive for the winter-peaking region as incentives have expired and it has added no wind since 2011, he said.

“The economics [for wind] really are not that favorable right now because we already tend to be an exporter,” he said. “Any additional wind we built would probably end up being sold outside the province. And if we sell it into MISO, we’d be competing with wind energy that’s subsidized by the [U.S. production tax credit.] So, it just doesn’t make economic sense for us.”

NERC asked questions for this year’s LTRA regarding regions’ use of inverter-based resources. Almost two-thirds of Manitoba’s resources are inverter-based, including 138 MW of wind, 35 MW solar PV and 4,184 MW of hydro, including Keeyask.

That creates a challenge in ensuring an adequate short-circuit ratio at the HVDC inverter bus, which the company has addressed with 13 synchronous condensers, Hunter said.