The expansion of renewable energy resources and retirement of conventional generation over the next decade is expected to “fundamentally [change] how the [bulk power system] is planned and operated,” according to NERC’s 2020 Long-Term Reliability Assessment (LTRA), released Tuesday.

NERC produces the LTRA each year to assess North American resource adequacy in the next decade, and identify trends that could affect grid reliability and security both in individual regions and in the continent overall. Preparation of this year’s report began in 2019, John Moura, NERC’s director of reliability assessment and performance analysis, said at a media event on Thursday.

Most areas are expected to have sufficient resource capacity for annual peak demands between 2020 and 2025. A major exception is Ontario, which is projected to have a 2025 peak anticipated reserve margin of 2% against a reference margin level of 15.9%. MISO was also called out as “marginal,” with 2025 peak anticipated reserve margin of 17% against an 18% reference margin. All other areas were classified as “adequate,” though the Maritimes were noted to have a relatively small capacity surplus of 36 MW with the potential for shortfalls in 2022 and 2023.

Renewable Output Forecasting

But NERC cautioned that resource adequacy is only part of the story. With the resource mix more varied than ever before, the type of generation must be considered as well. And some areas with sufficient capacity on the surface were found to have more risk than meets the eye.

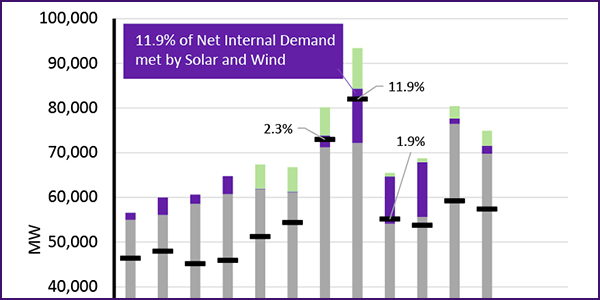

The report noted that the output of variable energy resources, such as wind, solar and run-of-river hydroelectric plants, are to blame, “can change according to the primary [driver] … resulting in plant output fluctuations on all time scales.” The report noted a number of assessment areas where solar and wind resources form more than 5% of peak demand for 2020 or are projected to do so by 2025.

ERCOT is the standout, with solar and wind generation expected to account for 11.9% of net internal demand five years from now. WECC’s CAMX region (California and Baja California Norte, Mexico) also currently draws on solar and wind resources to meet internal demand, though not to the same extent as ERCOT. PJM and MISO are also expecting significant growth in wind and solar assets planned for addition over the next 10 years, with PJM to have 98.3 GW by 2030, up from 10.9 GW today, and MISO set to grow from 22.3 GW to 106.6 GW.

These additions are part of strong growth in renewables expected across the BPS; wind and solar resources are expected to make up 57% of new capacity by 2024. This can lead to uncertainty in grid planning, as weather conditions are not always predictable — a problem compounded by many utilities’ use of outdated models for solar and wind generation, or none at all, as a joint report by NERC and WECC warned earlier this year. (See NERC, WECC Warn of Inverter Modeling Gaps.)

NERC recommended that the industry “verify that inverter-based resource models … agree with the as-built, plant-specific settings, controls and behaviors of the facility,” and that the ERO improve reliability standards “to account for inverter-based resource performance and characteristics.” In addition, the ERO should work with industry to review data needs for distributed energy resources such as battery storage and rooftop solar panels to improve performance of these resources.

Uncertain Impacts from Pandemic

NERC did not attempt to incorporate the impacts of the COVID-19 pandemic into the LTRA, citing uncertainty about the duration of the crisis. However, the organization noted “increased uncertainty” in demand projections that began to be felt amid stay-at-home and remote work policies adopted earlier this year in many areas. (See Sagging Demand Cushions NPCC’s Summer Outlook.) NERC also observed that changes in industrial load “can affect the availability of [demand response] programs that rely on curtailment of industrial customers during periods of high demand.”

While no “specific threats or degradation to the reliable operation of the BPS” were flagged in the report, NERC did warn that cybersecurity risk remains heightened because of the remote work postures continuing at many utilities. Entities will also continue to face challenges obtaining personal protective equipment for operators and field personnel for the foreseeable future, and they may have to continue reckoning with the consequences of deferring maintenance.