By Hudson Sangree

Updated Nov. 16.

Pacific Gas and Electric’s stock price rose dramatically Friday after state California Public Utilities Commission President Michael Picker made a series of surprising public statements about the company’s future as it faces potentially billions of dollars in wildfire liability for the current Camp Fire, the deadliest in state history, and a series of devastating blazes in 2017.

On Thursday, Picker took part in a call with Wall Street analysts in which he said allowing PG&E to go bankrupt wouldn’t be good policy, Bloomberg News and other media outlets reported. He reiterated those comments in at least two newspaper interviews, and discussed the possibility of legislative action to relieve PG&E’s financial burden.

But Picker also said he was concerned about the utility’s lack of accountability. He told the Wall Street Journal that breaking up the company might be an option for regulators to consider. In a news release, the PUC president said he intended to expand an ongoing investigation into PG&E’s “safety culture” that the commission opened after the San Bruno gas line explosion in 2010.

“In the existing PG&E Safety Culture investigation proceeding,” Picker said in the statement, “I will open a new phase examining the corporate governance, structure, and operation of PG&E, including in light of the recent wildfires, to determine the best path forward for Northern Californians to receive safe electrical and gas service in the future.”

PG&E’s stock rose back to around $24 per share Friday after it plunged this week as the toll of death and destruction from the Camp Fire, the worst in modern California history, increased. The company fell under suspicion for starting the wildfire after one of the utility’s transmission lines was reported downed at the time and location of the fire’s ignition.

The news sent PG&E Corp.’s stock tumbling from roughly $48 per share on Nov. 8, when the fire started, to less than $18 per share on Thursday – a 62.5% drop in one week.

Similarly, Southern California Edison’s stock fell sharply as the Woolsey Fire raged in Los Angeles and Ventura counties, killing two and destroying more than 500 structures so far. Edison told state regulators it experienced an outage at a substation near where the fire started, the Los Angeles Times reported.

On Nov. 8, PG&E filed a report with the California Public Utilities Commission, saying it had experienced an outage on a 115-kV line near where the Camp Fire started and shortly before it was first reported. The company later wrote in a news release that the “information provided in this report is preliminary, and PG&E will fully cooperate with any investigations. There has been no determination on the causes of the Camp Fire.”

Early Thursday morning, firefighters responded to reports of a vegetation fire under transmission lines near Poe Dam, part of PG&E’s Feather River Canyon Power Project in rural Butte County. The California Department of Forestry and Fire Protection (Cal Fire) has identified the area as the approximate location where the fire started. A property owner in the area has told media outlets that she received an email from PG&E saying the company planned to do work on her land because its power lines were causing sparks.

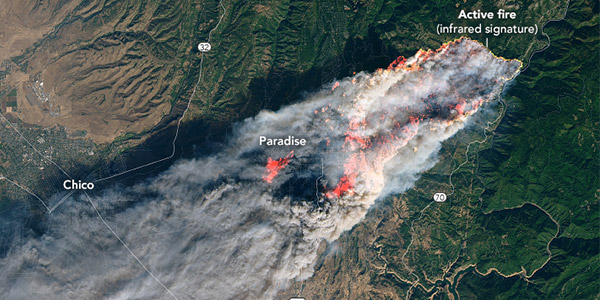

Fanned by 35-mph winds, the fire quickly grew and destroyed most of the town of Paradise (population 27,000). As of Friday, it had killed 63 civilians, destroyed approximately 9,844 homes and hundreds of other structures and burned 142,000 acres, Cal Fire reported.

Previously the deadliest fire in state history was the Griffith Park Fire in Los Angeles in 1933, which killed 29 people, according to Cal Fire. The most damaging in terms of homes and other structures destroyed previously was the Tubbs Fire in Napa and Sonoma counties in October 2017, the cause of which is still under investigation.

The largest wildfire in modern state history, the Mendocino Complex of fires, occurred this summer, burning 459,000 acres in the rugged mountains north of San Francisco from July to September 2018.

The Camp Fire has revived talk of PG&E’s possible bankruptcy, which became the subject of concern following a series of devastating wildfires in 2017. State fire investigators have said PG&E was responsible for 17 of the 21 blazes. The 2017 fires could subject the company to billions of dollars in liability under California’s unique system of holding utilities strictly liable for damage caused by power lines and equipment, regardless of negligence.

Earlier this year Gov. Jerry Brown proposed doing away with that system, known as inverse condemnation, arguing it threatened electric reliability and the state’s efforts to completely exclude carbon emissions from its power grid by the middle of the century.

Lawmakers tasked with formulating a major wildfire bill, SB 901, ultimately left inverse condemnation intact while creating a method by which utilities could issue long-term bonds to pay for some fire damage. (See California Wildfire Bill Goes to Governor.) Critics called the bill a bailout for the utilities, but Brown signed the legislation in September.

PG&E executives recently said in an earnings call that the new law was insufficient, and they intend to seek an end to inverse condemnation through the courts and legislature. (See PG&E Outlines Fire Strategy in Earnings Call.)

Company CEO Geisha Williams also discussed the company’s new practice of proactively shutting down sections of its grid during conditions that made wildfires especially dangerous. The company warned last week that it might have to shut down power to areas, including Butte County, but then decided conditions there did not warrant it.

In its recent third-quarter earnings call, SCE said its equipment was likely a partial cause of the hugely destructive and deadly Thomas Fire last year. That fire was the largest in state history until this year’s Mendocino Complex far surpassed it. (See Edison Takes Partial Blame for Wildfire in Earnings Call.)

SCE’s stock price fell from more than $25 a share before the Woolsey fire began, also on Nov. 8, to around $21 per share in trading Thursday.