By Hudson Sangree

PG&E’s beleaguered stock price sank even lower Monday and Tuesday, dropping by more than 30% over two days because of fears the company could go bankrupt or be broken up by the state after two years of catastrophic wildfires in California. (See PG&E’s Troubles Mount After Camp Fire.)

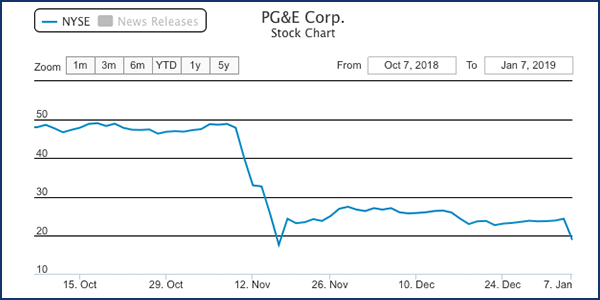

The company’s share price fell from $24.40 late Friday to a new low of $16.79 as trading started Tuesday morning. It recovered slightly during the day Tuesday and closed at $17.56.

PG&E’s stock began its latest tumble after Reuters, citing unnamed sources, reported Friday the company was exploring filing for bankruptcy.

S&P Global Ratings dropped the company’s credit rating from investment grade (BBB-) to “junk” (B) status Tuesday and said it might make further downgrades if PG&E does not take clear steps to preserve its creditworthiness, given state officials may be unwilling to help the company.

“Previously, we assumed that given California’s robust renewable portfolio standards and the increasing risks of climate change, legislators and regulators would proactively work with the utility to preserve credit quality to achieve these goals. However, based on recent developments, we no longer believe this to be true given the utility’s own missteps,” S&P said. “We expect that negative public sentiment and the increased political pressure will challenge the regulators’ willingness and ability to implement measures to protect credit quality over the near term.”

Before the wine country fires of 2017, PG&E’s stock price had reached a high of more than $70/share. Just prior to the Camp Fire in November, it had been holding relatively steady for months. On Nov. 7, the day before the Camp Fire destroyed the town of Paradise, Calif., and killed 86 residents, the utility’s stock price stood at about $49/share.

The plunges after the 2017 and 2018 fires resulted in PG&E losing roughly $16 billion in market value over 14 months.

State fire investigators blamed PG&E equipment for starting 17 of the 21 major wine country fires in 2017 but have not determined the cause of the most destructive of those fires, the Tubbs Fire, which wiped out the northern portion of the city of Santa Rosa, Calif.

In recent court filings, PG&E reiterated its argument that a private landowner, who employed an unqualified person to run distribution lines on her property, may have started the Tubbs Fire.

The cause of the Camp Fire hasn’t been determined either, but PG&E reported severe damage to a 115-KV distribution line and flames near the origin of the Camp Fire on the morning it started. (See PG&E Grapples with Line Safety After Camp Fire.)

Also on Tuesday, PG&E reported Patrick M. Hogan, head of electric operations, would be retiring Jan. 28 and Michael A. Lewis had been elected by the board of directors to succeed him as senior vice president.

“Mr. Lewis, 56, has served as Vice President, Electric Distribution Operations of the Utility since August 2018,” PG&E said in a filing with the U.S. Securities and Exchange Commission. “At his previous company [Duke Energy], Mr. Lewis helped the distribution and transmission organizations achieve industry-leading safety benchmarks,” the utility said.

PG&E recently announced a “board refreshment” process in which it would seek to recruit more directors with safety experience, following criticism from the California Public Utilities Commission and lawmakers that its safety culture was deeply flawed.