By Tom Kleckner

American Electric Power on Thursday said the mildest weather conditions since 1992 led its third-quarter sales to fall 12.8% from a year ago, down to $4.1 billion.

The Columbus, Ohio-based company reported a quarterly profit of $544.7 million, a vast improvement over last year’s loss of $765.8 million for the same period. A one-time $2.3 billion impairment charge in 2016 related to the value of competitive coal plants, wind farms and coal-related properties accounted for much of that loss. (See AEP Turns Away from Generation to Transmission, PPAs.)

But the company’s adjusted earnings per share of $1.10 missed the Zacks consensus estimate of $1.19. It was also down from $1.30/share — which excluded the impairment — a year ago. Its year-to-date earnings are $2.82/share, down from $3.25/share in 2016.

During an earnings call, CEO Nick Akins, a drummer in his spare time, drew inspiration from the progressive rock group Dream Theater’s song “Another Day” in reaffirming 2018’s guidance range of $3.75 to $3.95/share, built around a 5 to 7% growth rate. He recited the song’s lyrics to analysts: “Live another day, climb a little higher, find another reason to stay.”

“Because of our efforts to overcome the weather and other obstacles, we’ll finish out the year 2017, we’ll live for 2018, and continue on our path,” Akins said. “The fundamentals of our business plan remain secure, and we’re confident going into 2018.”

AEP narrowed its guidance range for 2017 to $3.55 to $3.68/share. Akins said the company will make up lost ground by “driving efficiency, eliminating expenses where practical and with negligible movement of expenses to 2018.” The company also expects to benefit from continued economic growth in its footprint.

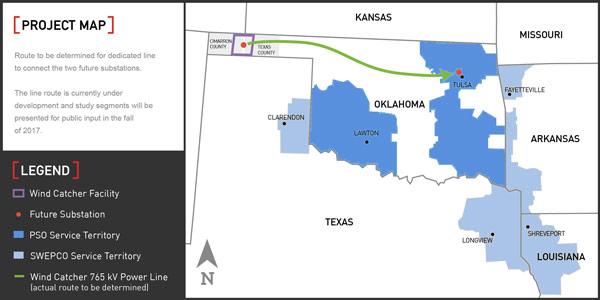

Akins said AEP now has procedural schedules in the four state jurisdictions — Arkansas, Louisiana, Oklahoma and Texas — with regulatory oversight of the company’s proposed $4.5 billion Wind Catcher Energy Connection Project, a 2-GW wind farm in the Oklahoma Panhandle. Hearings will be held January in Oklahoma and Texas, February in Louisiana and March in Arkansas. The company has requested approvals by April 30.

“At this point, I should figuratively drop the microphone,” Akins said, “but we’ll let the facts — $4.5 billion invested, $7.6 billion in customer savings, substantial infrastructure development and great use of wind resources — speak for themselves.”

AEP also has $603 million in pending rate cases before five state regulatory commissions.