Crushed by COVID and facing increasing efficiency standards and competition from electric vehicles, worldwide gasoline demand has likely peaked, the International Energy Agency reported Wednesday.

“World oil markets are rebalancing after the COVID-19 crisis spurred an unprecedented collapse in demand in 2020, but they may never return to ‘normal,’” IEA said in its latest medium-term report “Oil 2021.”

“Rapid changes in behavior from the pandemic and a stronger drive by governments towards a low-carbon future have caused a dramatic downward shift in expectations for oil demand over the next six years.”

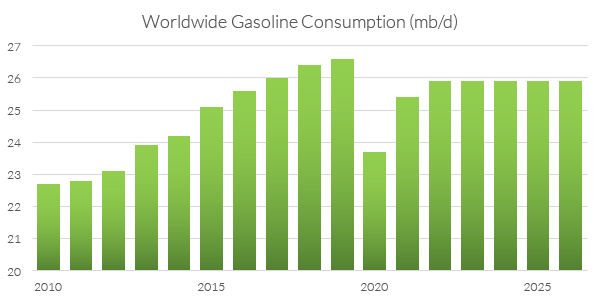

Although overall oil consumption, and that of aviation fuels, are expected to rebound beyond pre-COVID levels, gasoline consumption likely peaked in 2019 at 26.6 million barrels per day (mbd). Demand fell by a record 2.9 mbd last year because of government stay-at-home policies.

“Gasoline demand is unlikely to return to 2019 levels, as efficiency gains and the shift to electric vehicles eclipse robust mobility growth in the developing world,” IEA said.

Although gasoline growth will continue in Indonesia, India and China “as middle-class consumers seek greater mobility,” IEA said, developing countries’ demand will be insufficient to offset declines within the 37 Organization for Economic Co-operation and Development (OECD) countries, which have been tightening fuel efficiency standards.

IEA predicted that overall gasoline use will fall by 690 kbd from 2019 through 2026, when it will level off at 25.9 mbd.

EV Growth, Fuel Economy

In 2019, the European Union approved a target of an average of 95 g of CO2/km for new passenger cars beginning in 2020. EVs’ market share rose from 3% of European sales in 2019 to 11% in 2020, while the share of hybrids rose to 12% from 5.7%.

In January, President Biden ordered a review of the Trump administration’s Safer Affordable Fuel-Efficient (SAFE) rule, which reduced fuel economy improvements to only 1.5% annually for model years 2021-2026. Biden is expected to return to at least the 5% annual improvement under the Obama administration’s Corporate Average Fuel Economy (CAFE) standards.

IEA’s base case projects electric vehicles will reach 60 million globally by 2026 but says stronger government incentives and improved charging infrastructure could boost that by 50% to 90 million.

Also reducing gasoline demand will be changes to commuting patterns, which are expected to outlive the pandemic. IEA said that while only 8% of the global workforce teleworked before the pandemic, “recent studies suggest that up to 20% of jobs can be done from home on an ongoing basis.”

Behavioral Changes

Total oil demand fell by 8.7 mbd last year, to 91 mbd, and is not expected to return to pre-pandemic levels before 2023.

“Aviation fuels, the hardest hit by the crisis, are expected to slowly return to 2019 levels by 2024, but the spread of online meetings could permanently alter business travel trends,” IEA said.

In addition to reduced commuting and air travel, oil demand will be depressed by governments “focusing on the potential for a sustainable recovery as a way to accelerate momentum towards a low-carbon future,” IEA said. “The outlook for oil demand has shifted lower as a result of these trends, raising the prospect of a peak sooner than previously expected if governments follow through with strong policies to hasten the shift to clean energy.”

Oil producers responded to the drop in demand by reducing planned spending on upstream investments and expansions by one-third in 2020. “The outlook for the tight oil industry has been tempered by an apparent shift in the business model towards spending discipline, free cash flow generation, deleveraging and cash returns for investors,” the report said.

Future demand growth will come from rising populations and incomes in emerging and developing economies, IEA said, with 90% of the increase from the Asia Pacific region.

The petrochemical industry will be central to growth, with ethane, liquefied petroleum gas and naphtha responsible for 70% of the projected increase to 2026.

Overshooting Net Zero by 2050

Still, IEA said current government policies are insufficient to reach midcentury goals for net-zero emissions.

The agency’s base case, which assumes existing industry plans and government policies, forecasts global oil demand rising by 3.5 mbd between 2019 and 2025.

“Further fuel efficiency improvements, increased teleworking and reduced business travel, much stronger electric vehicle penetration, and new policies to curb oil use in the power sector … could reduce oil use by as much as 5.6 mbd by 2026, which would mean that oil demand never gets back to pre-crisis levels.”

The agency said immediate cuts in global oil demand would be required to meet 2050 net-zero targets, predicting current policies and plans will have only a “marginal” impact on demand over the next six years.

Although 127 countries representing 75% of global CO2 energy-related emissions have set goals for net-zero carbon emissions between 2050 and 2060, only 12 countries have proposed or enacted legislation to meet the targets, IEA said.

The EU will use higher carbon prices and policies supporting renewable development and energy efficiency to meet its targeted 55% reduction in greenhouse gas emissions by 2030 over 1990 levels. “Legislative details, to be revealed in June 2021, will likely focus on power and buildings in the next 10 years as strong legislation of vehicle CO2 emissions already exists through 2030,” IEA said. “Transport and industry decarbonization will accelerate post-2030.”

China, which continues to increase its use of coal, last year pledged to reach carbon neutrality before 2060 and peak CO2 emissions before 2030.