For years, Alpine Ocean Seismic Survey plied its trade, providing marine geophysics services to offshore wind projects in Europe and to gas and oil projects in the Gulf of Mexico. The company’s home state of New Jersey, however, was “kind of dead,” for wind work, said President Robert Mecarini.

Times have changed. Now, as an experienced player, the 70-year-old Norwood-based company has worked on the development of wind projects off the Jersey coast and is preparing to bid on work for the construction phase as the projects advance.

“We’re the only native New Jersey company that is doing this kind of work at the moment,” Mecarini said. “A lot of companies like using us just because we’re local content.”

The rising demand for Alpine Ocean’s services reflects a growing anticipation in the New Jersey business community that the state’s massive commitment to offshore wind energy will soon yield opportunities for local businesses, and that now is the time for companies to position themselves to compete in the expanding market.

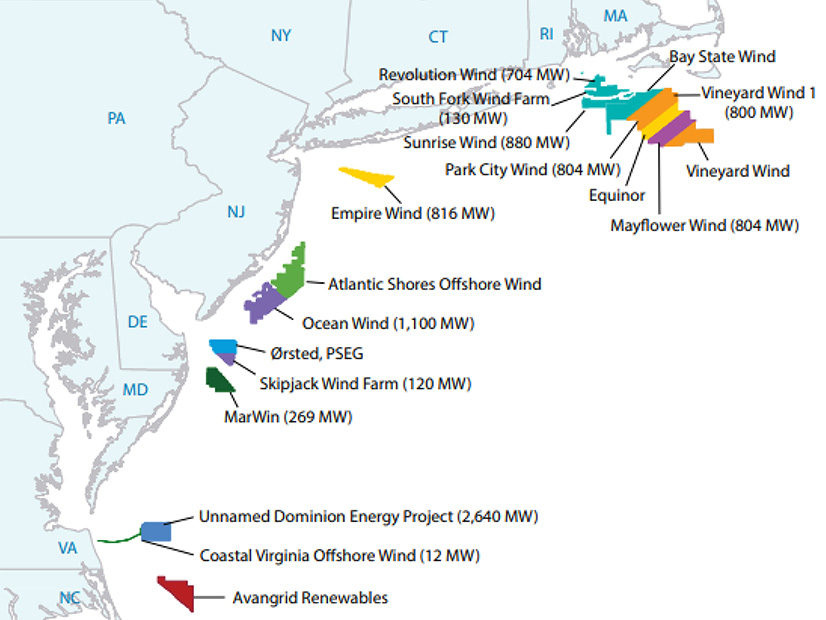

Gov. Phil Murphy has set an ambitious target of having 7,500 MW of wind energy off the New Jersey coast by 2035, as part of the state’s drive to 100% clean energy by 2050. The New Jersey Board of Public Utilities (BPU) has so far awarded about half of those megawatts, spread over three offshore wind projects.

The BPU’s first solicitation in 2019 was won by Ørsted’s 1,100-MW Ocean Wind 1, followed this June by the 1,148-MW Ocean Wind 2, another Ørsted project, and the 1,510-MW Atlantic Shores project, a joint venture between EDF Renewables North America and Shell New Energies US. (See: NJ Awards Two Offshore Wind Projects.)

With three more solicitations planned in the next six years, businesses are watching the sector’s evolution closely. State agencies are working hard to support local companies by funding and organizing wind sector training, holding informational forums and encouraging the major developers to look to in-state businesses — especially minority- and women-owned companies — to provide contracted services.

An Offshore Wind Supply Chain Registry set up by the New Jersey Economic Development Authority (EDA) includes hundreds of companies that can provide a range of essential hardware, from cables and conductors, to transformers, valves and other accessories. The challenge, however, is that many of them have little experience in the wind sector.

Creating A New Industry

“There’s no doubt that there’s a tremendous interest” among businesses, said Gerald T. Keenan, president of the New Jersey Alliance For Action, a bipartisan business advocacy group focused on improving the state’s infrastructure. “And it’s continuing to grow.”

The alliance organized a wind networking and informational event in August and has another one set for Sept. 17. The first one attracted around 200 people — including contractors, engineers, and labor and educational leaders — to a presentation on the two wind projects the BPU awarded in June, Keenan said.

“This is the creation of a new industry,” he said. “And I can’t recall an opportunity like this in my 24 years here.”

New Jersey officials envision the state creating a wind industry that will serve as a manufacturing and operational hub for the Atlantic coast offshore wind sector. Yet the success of that ambition may depend on New Jersey’s ability to compete with nearby states with similar goals.

The Port of Virginia announced a week ago that it has agreed to lease 72 acres of its Portsmouth Marine Terminal to Dominion Energy (NYSE: D) to serve as a staging and preassembly area to support development for the 2.6-GW Coastal Virginia Offshore Wind project. And US Wind Inc., which is developing a wind project off the coast of Maryland, recently announced plans to develop 90 acres of waterfront in Baltimore County into an “offshore wind deployment hub,” including a factory for monopiles, the foundations for offshore turbines. (See: Dominion Secures 10-Year Va. Port Lease for OSW Staging.)

In Connecticut, Eversource Energy and Ørsted agreed in February to help redevelop the State Pier in the City of New London into a modern facility capable of supporting offshore wind turbine staging and assembly. The partners are developing three wind projects, totaling 1,700 MW, off the coast of Connecticut and New York. (See: New London, OSW Devs Agree to Deal on Staging Area.)

New York, with wind projects totaling 4.4 GW already procured, is developing a tower-manufacturing plant in the Port of Albany and a turbine-staging facility and operations and maintenance hub at South Brooklyn Marine Terminal. Other support activities for the offshore wind sector are planned to take place at the ports of Coeymans and Montauk Harbor, and at Port Jefferson in Long Island. (See NY Awards 2.5-GW Offshore Deal to Equinor.)

But Mecarini is confident New Jersey’s efforts to build a wind sector will resonate beyond the state’s borders. In the last 12 years, Alpine Ocean has grown from 8 employees to about 60, largely driven by wind opportunities around the world. Future growth could stem from New Jersey’s industry, and its neighbors too, he said.

New Jersey efforts to jump-start a new wind sector include the development of a port and hub, the South Jersey Wind Port, on the Delaware River, which potentially will include two manufacturing facilities to make nacelles, the giant housings that contain the power-generating components of wind turbines. And German manufacturer EEW Group is building a monopile factory in nearby Paulsboro, also on the Delaware River. (See: New Jersey Shoots for Key East Coast Wind Role.)

“What New Jersey is doing very proactively to get people ready to be part of the supply chain is important,” Mecarini said. “But it’s not only the New Jersey industry that it’s going to impact. It’s the offshore wind sector.

“These companies in New Jersey, that have the skill sets are not only going to use them in New Jersey. They are going to use them on projects in Massachusetts, projects in Maryland, projects in the Carolinas. Wherever there is going to be work, those companies that have a niche are going to be used,” he said.

The state is also creating a WIND Institute, an independent authority that will “coordinate and galvanize cross-organizational workforce, research, and innovation efforts,” according to the EDA website. A report by the state’s Wind Council that recommended the creation of the institute said the state should also place a short-term priority on training wind turbine technicians and creating a pipeline of “trade workers with the skills and qualifications required for offshore wind.”

To that end, the EDA on July 6 awarded a $3 million grant to Atlantic Cape Community College to establish a Global Wind Organization (GWO) safety training program and facility. Based in Denmark, GWO is an international nonprofit that develops safety training and standards for the industry.

Stoking Business Interest

Partnering with the Business Network for Offshore Wind and New York City Economic Development Corporation, the EDA in June and July organized three online webinars — on manufacturing, professional services and the construction trades — aiming to stoke business interest in the sector and guide interested companies.

“We see this as critical to helping us transform our economy and move into the next generation of clean jobs,” Julia Kortrey, offshore wind project officer for the EDA, told the manufacturing panel. “We not only want to reach 100%, clean energy by 2050. We want to make sure that economic development and jobs come with that.”

Kortrey said Ørsted has committed to award grants to minority- and women-owned businesses, and EEW is “eager to have both local and diverse suppliers to support the development and construction” of monopiles.

“As part of our value-oriented approach to offshore wind development, we have a strong emphasis on local content and supporting economic growth,” she said.

Among those keen to provide local content is American Aerospace Technologies, which is positioning itself to tap into what it hopes will be demand for drones taking off from the company’s facility at Woodbine Municipal Airport in South Jersey.

The Pennsylvania-based company in the past has used drones to provide control and monitoring services in the onshore wind and solar sectors, including doing airborne wind tower inspections, said CEO David Yoel. For solar, the company’s drones can provide surveillance with infra-red equipment that looks for “hot spots,” indicating potentially weak connections in solar equipment, Yoel said.

For offshore projects, drones could monitor and surveil turbine construction and operations, and track ship movements, he said. With an 18-foot wingspan, the company’s aircraft can fly for up to 20 hours, while burning only a gallon of gas every three hours, compared to 15 or 20 gallons an hour for a conventional aircraft, he said.

“One use would be to monitor for marine mammals in the in the area of operation and to be able to warn ships that there are marine mammals in the area, so that they get their speeds down to minimize the chances of any injuries,” Yoel said. “We can provide communication services to construction teams that are going to be offshore … essentially a cell tower in the sky that they can use to communicate with people when they’re 40 miles offshore.”

To do that, however, the company needs approval from the Federal Aviation Authority (FAA) to use drones in commercial air space, Yoel said. The company in the past has worked under short-term waivers but needs a more permanent solution to do offshore work, he said.

“Our goal is 12 to 15 months” to secure FAA approval, he said. “We’re focused on breaking the bottleneck to get to the point where we can offer these services to the industry.”