The Department of Energy wants to cut the cost of lithium-ion batteries by more than half, recharge electric vehicles with a 300-mile range in 15 minutes and boost recycling to provide 40% of the materials needed to manufacture new batteries — all within the next decade. The price of lithium-ion battery packs would be cut from $133/kWh to $60/kWh in DOE’s vision.

Reaching such ambitious goals will require the rapid build-out of a robust and secure lithium battery supply chain in the U.S., which is the impetus behind Li-Bridge, a new public-private alliance the DOE rolled out at a webinar on Friday. Led by the Argonne National Laboratory in Illinois, Li-Bridge is “focused on filling the gaps in the lithium battery supply chain and marks the first collaboration of its kind in the U.S.,” Argonne Director Paul Kearns said.

“Collaborating across many different institutions and sectors will help us quickly identify problems and craft effective solutions,” he said.

Argonne and several other DOE national labs will be the prime movers on the public side of the partnership, while three industry “convener organizations,” representing hundreds of companies and academic and research institutions involved in the battery supply chain, will help mobilize private participation, Kearns said.

The three groups are industry trade association NAATBatt International (originally, the National Alliance for Advanced Transportation Batteries), the New York Battery Energy Storage Technology Consortium (NY-BEST), a state-focused initiative, and New Energy Nexus, an international nonprofit promoting clean energy entrepreneurship.

The task before these public and private stakeholders is daunting but critical. Batteries lie at the convergence of grid decarbonization and transportation electrification, which could open opportunities for “combined supply chains,” said William Acker, executive director of NY-BEST.

“We need a lot of energy storage, both in the form of shorter-duration batteries and longer-duration dispatchable assets,” he said.

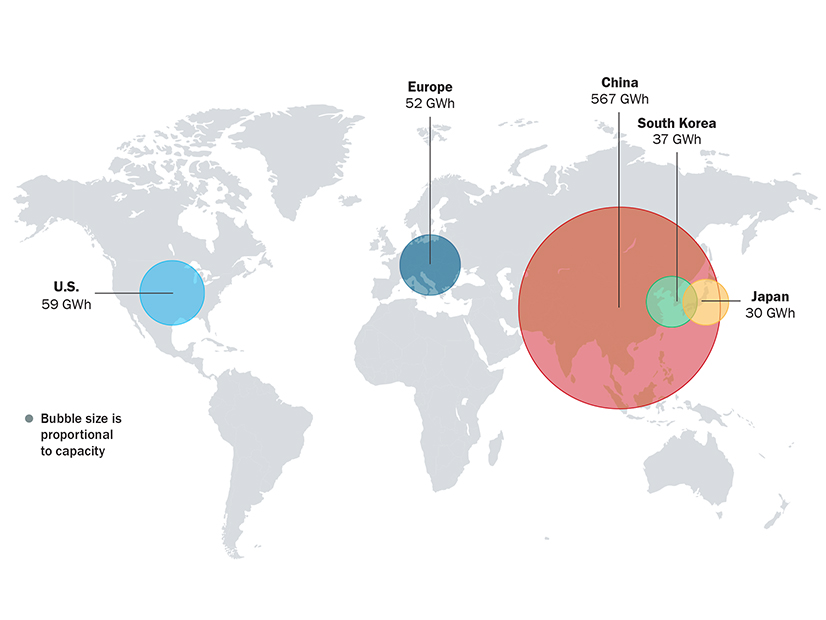

The U.S. currently accounts for only 8% of the global manufacturing capacity of lithium-ion cells, according to David Turk, the DOE’s deputy secretary, and is dependent on foreign sources — mostly China and other Asian countries — for the processing of key minerals, like lithium, cobalt and nickel, and the manufacture of cells.

The U.S. has a strong “innovation economy,” Acker said, but “our ability to translate that to manufacturing has always been a challenge,” pointing to NY-BEST members who “have invented technologies and have had to take them overseas to commercialize, to manufacture.

“Component manufacturing is incredibly important — making electrodes, making electrolytes, making the various pieces so that we have the entire supply chain domestically produced here in the United States,” he said.

A 2020 study from NY-BEST reflects the potential market for energy storage across the U.S. It found storage could cost-effectively replace 2,300 MW of fossil-fuel “peaker” plants on Long Island by 2030, based on projections from Lazard’s 2019 Levelized Cost of Storage report. Those peakers currently run at about a 15% capacity year-round, so taking them offline could save consumers an estimated $393 million, the report said.

Another study, co-authored by the New York State Energy Research and Development Authority, projected that New York would need more than 15 GW of storage statewide to achieve a zero-emissions grid by 2040.

Renata Arsenault, a technical expert in battery recycling at Ford (NYSE:F) and president-elect of NAATBatt, envisions a network of Gigafactories producing batteries across the country. “The new energy ecosystem will not look like our old one,” she said. “Innovation and technology will be needed to ensure that the critically needed extraction and refining, battery production and recycling are designed with sustainability front and center.”

Both Arsenault and Julie Blunden, a New Energy Nexus board member, said the current disruptions in the semiconductor supply chain in the auto industry further underline the urgency of standing up a homegrown alternative for lithium batteries.

“When we talk about a secure, robust, equitable domestic supply chain for batteries, what that means is de-risked,” Blunden said. “How do we take the current generation of batteries and the entire supply chain back to the methods of lithium recovering and refining, and convert that to a lower-cost, faster and better supply chain that is de-risked” for stakeholders, including manufacturers and homeowners putting batteries on their houses for resilience, she asked.

The EV-stationary Storage Connection

Li-Bridge is the latest effort in the DOE’s drive to build a U.S. battery supply chain that began during the administration of former President Donald Trump with initiatives such as the Energy Storage Grand Challenge and the formation of the Federal Consortium for Advanced Batteries (FCAB), a cross-agency group.

DOE’s National Blueprint for Lithium Batteries, released in June, sets out key goals for the build-out of a comprehensive supply chain, from securing access to raw and refined materials to recycling. Other priorities include workforce development, along with science, technology, engineering and math (STEM) education to support ongoing innovation. (See DOE Wants US Lithium Battery Supply Chain in Place by 2030.)

The National Blueprint will help “guide our collaboration both within FCAB and Li-Bridge,” said David Howell, acting director of DOE’s Vehicle Technologies Office, who also chairs FCAB. “Li-Bridge will provide that ongoing industry-government interaction to support our activities to stand up the battery supply chain … and it will also be an important forum [for] dialogue across the battery supply chain.”

Backing up the Li-Bridge rollout, DOE on Wednesday announced $209 million in funding for 26 research projects at the national labs, primarily looking at transportation electrification and advances in battery chemistry and materials. The list of grantees includes the Battery500 Consortium, led by the Pacific Northwest National Laboratory, which is working to double the energy density — the amount of energy produced per unit of weight — of lithium-ion batteries.

The current industry standard is around 250 to 265 watt-hours per kilogram. The consortium, which includes GM, along with other national labs and eight universities, is aiming for 500 Wh/kg — a target also being pursued by industry leaders such as Tesla and Panasonic with higher-density 4680 batteries.

The focus on automotive applications is strategic because “that demand is [at] a scale that is so much larger than … stationary storage,” Blunden said. “It’s going to be the transportation sector that has to create that demand. … Stationary storage will benefit from the fact that transportation electrification is accelerating how fast cheaper batteries are going to be at market.”