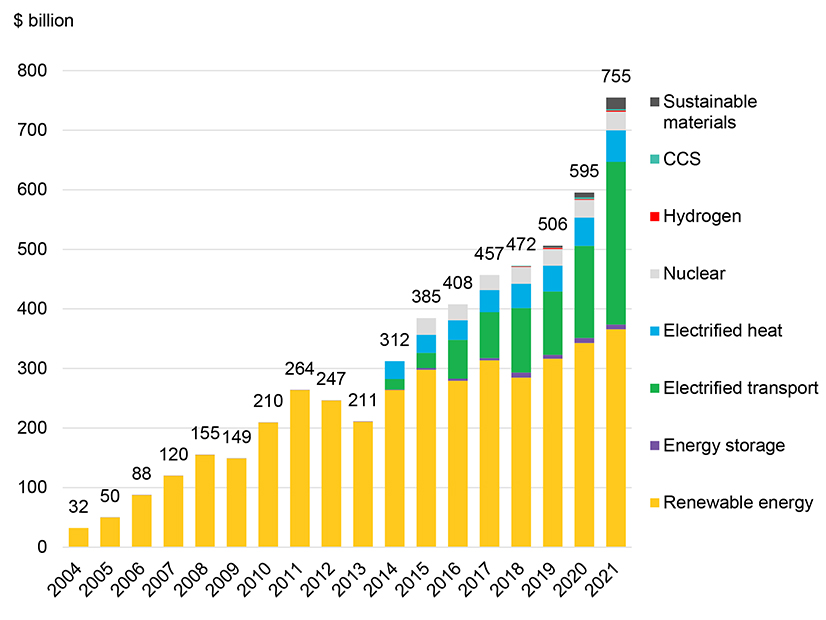

Driven by “rising climate ambition and policy action from countries around the world,” investment in low- and no-carbon energy deployment worldwide reached a new high of $755 billion in 2021, said BloombergNEF’s Energy Transition Investment Trends 2022 report issued Thursday.

But to reach global net-zero goals by 2050, clean energy investment will have to triple to an average of almost $2.1 trillion per year between 2022 and 2025, the report says.

“There is another doubling of investments needed thereafter, to an average $4,189 billion per annum over the years 2026-2030,” the report’s executive summary says. “About one to two fifths of the spend is required for next-generation low-carbon technologies, such as hydrogen, [carbon capture and storage] and nuclear.”

The 2021 figure represents a 27% increase over 2020’s high mark of $595 billion, the report says, noting that the figure covers projects with firm financial commitments. The two technologies propelling that growth now and over the coming decade are renewable energy and transportation electrification.

Renewable investments ($366 billion) led electric vehicles and charging infrastructure ($273 billion) in 2021, but with investment in EVs and chargers up 77% over 2020, BNEF predicts the transport sector will overtake renewables this year.

Writing on Bloomberg Green, Nathaniel Bullard, BNEF’s chief content officer, said that investments in electric transportation and energy storage are growing, respectively, at 10 and 8 times the rate of renewables.

At the low end of the scale, global investment in hydrogen, energy storage, sustainable materials and carbon capture and storage (CCS) together totaled $24 billion in 2021, the report says. But, looking ahead, BNEF sees multiple pathways to net-zero, in which potential investment in CCS could rise to $622 billion, while the potential investment for hydrogen could hit $532 billion.

Albert Cheung, head of analysis at BloombergNEF, sees the 2021 figures as a measure of the resilience of the clean energy sector. In a statement on the BNEF website, Cheung said that amid a global supply chain crunch that has raised costs for solar, wind and energy storage, the past year provided “an encouraging sign that investors, governments and businesses are more committed than ever to the low-carbon transition.

“[They] see it as part of the solution for the current turmoil in energy markets,” Cheung said.

No Competition

Overall, the report reflects expectations that rapid deployment of renewables and electric vehicles will be the core technologies needed for near-term greenhouse gas reductions, but getting to net zero in the longer term will require the growth of low- and no-carbon technologies, including nuclear, hydrogen and CCS.

The report anticipates ongoing growth in clean energy markets worldwide; it also shows the U.S. still lagging behind China in overall investments. China’s clean energy investments in 2021 totaled $266 billion versus $114 billion for the U.S.

Similarly, the Americas as a whole were behind both the Asia Pacific and the Europe, Middle East and Africa regions in total investments.

Those figures raised eyebrows on Twitter, where Tim Latimer, CEO of geothermal developer Fervo Energy, was dismayed by China’s overwhelming dominance. “Investment in these technologies will define the future — and it’s not even competitive right now,” he said.

But the U.S. still led other European and Asian countries, with its closest competitor, Germany, taking the No. 3 spot with $47 billion.

Renewables and clean transportation also led investment in what BNEF calls the “climate-tech sector” — the startups and early-stage companies driving innovation in the clean energy transition. Climate-tech investment worldwide totaled $165 billion in 2021, the report says, with 82% of the total going to renewables and transportation.

Drilling down further, BNEF reports that rising climate-tech investments in transportation were, in part, the result of the steep increase in companies going public through reverse mergers with special purpose acquisition companies (SPACs). SPACs are “blank check” or shell companies formed to raise capital to acquire or merge with another company and are being used as an alternative to taking companies public through a traditional IPO.

Transportation startups accounted for two-thirds of climate-tech SPACs in 2021, with total investments of $23 billion.

The U.S. Market

Recent U.S. announcements in the electric transport sector indicate strong growth for the sector going forward. On Tuesday, General Motors made headlines with its announcement of a $6.6 billion investment in the company’s transition to electric vehicles. GM is building a new battery factory and converting an existing plant to produce two electric pickup truck models, the Chevrolet Silverado and the GMC Sierra.

Both facilities are in Michigan and will maintain 1,000 jobs, while creating 4,000 new jobs, GM said in a press release. The $6.6 billion appears to be the first installment of the $35 billion the company committed to electric and automated vehicles in June.

GM’s announcement was followed on Wednesday with Tesla’s earnings call for the fourth quarter of 2021, during which the company reported earnings of $17.6 billion, driven by record deliveries of 300,000 EVs in the last three months of the year. The company also reported increases in its solar and energy storage deployments.