Attendees of the International Energy Agency’s 2022 Ministerial Meeting gathered Thursday in Paris for a closing plenary to review ministers’ discussions in three roundtable sessions.

Government and business delegates tackled issues related to private finance for a net-zero transition, reducing emissions in hard-to-decarbonize industry sectors, and energy security challenges for critical materials and minerals.

Here’s a look at some insights that came from the roundtable discussions.

Finance

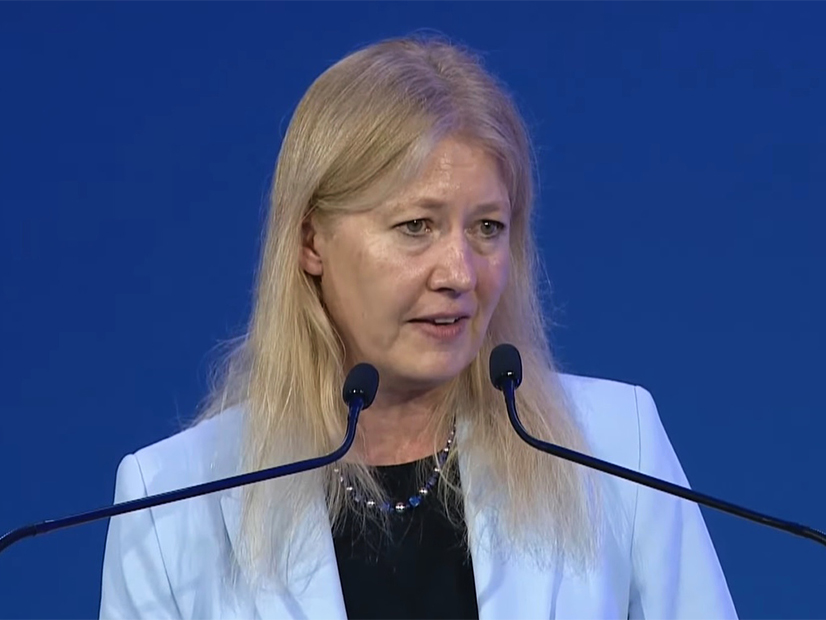

Ministers and business representatives had a “very engaging” session on how to accelerate private financing for clean energy advancement, said Stephanie Pfeifer, CEO of the Institutional Investors Group on Climate Change.

“There is a consensus that we really need to deal with the current crisis in the Ukraine, but it’s also critical that we keep sight of longer-term net-zero goals,” she said in a wrap-up of the roundtable.

The top concern during the session was that governments must have clear regulatory frameworks and policy signals to drive technological investments.

Attendees said priority should be given to:

-

-

- addressing permitting problems, such as licensing delays;

- setting price signals, such as a global carbon price;

- creating support mechanisms, such as tax credits, for contracts; and

- building early-stage support for newer technologies, such as green hydrogen, biomethane, and carbon capture and sequestration.

-

There also was a call for more collaboration between policymakers, companies and investors at early stages in developing markets.

“We should have a forum to have these discussions on a much more regular basis so that we don’t lose sight of the net-zero transition, the just transition and the energy security that we all know we need,” Pfeifer said.

Sectors

A roundtable discussion on reducing sectoral emissions led to a debate on why certain sectors are hard to decarbonize, according to Shell CEO Ben van Beurden.

Ben van Beurden, CEO of Shell, in Paris Thursday. | International Energy Agency

Ben van Beurden, CEO of Shell, in Paris Thursday. | International Energy AgencyThe top sectors of concern included heavy industries, such as steel petrochemicals and cement, and long-distance transportation, such as aviation and shipping.

“We came to the conclusion that maybe the sectors aren’t as hard to decarbonize as a lot of people fear or expect them to be,” van Beurden said in a roundtable wrap-up. (See Shell CEO: Sector-based Mandates Critical for Global Energy Transition.)

There’s a perception, he said, that the technologies needed to reduce emissions for heavy industries and long-distance transportation do not exist yet. But technologies, such as hydrogen, green steel and CCS, do exist to help those sectors, and they’re “much further along than perhaps we collectively fear,” he said.

Roundtable members decided that the biggest challenge to reducing sectoral emissions is providing incentives to decarbonize, according to van Beurden.

The best incentives, according to the roundtable, include:

- mandates for adopting a certain amount of a technology;

- standards for any mandated technology;

- faster permitting; and

- a stable policy environment.

The hard-to-decarbonize sectors also need more international coordination, according to the roundtable participants.

“We need to deal with global competition because many of these heavy-duty industries are global industries,” van Beurden said. “And the moment you try it out successfully in one geography, another geography may very effectively undercut it by global competition.”

Materials

Participants of a roundtable discussion on energy supply chain challenges concluded that there’s an “unprecedented” need for critical minerals and materials in the energy transition, according to Christian Bruch, president and CEO of Siemens Energy.

Christian Bruch, president and CEO of Siemens Energy, in Paris Thursday. | International Energy Agency

Christian Bruch, president and CEO of Siemens Energy, in Paris Thursday. | International Energy AgencyThe demand side needs “an end-to-end strategy by country,” Bruch said in a roundtable wrap-up. But it’s not clear what is needed “country by country,” he said.

To resolve risk and uncertainty, he added, governments must work together to coordinate the supply chain to avoid duplicative activity.

On the supply side, participants said that the extraction industry must hit key environmental, social and governance marks to attract investment.

“We need to think about how to steer money into this segment and get public acceptance for the mining industry,” Bruch said.

Energy Security

At the close of the two-day meeting, IEA’s 31 member countries adopted a communiqué acknowledging a “new phase” for the agency under the guiding principle of “supporting countries in the global effort to attain net-zero greenhouse gas emissions in the energy sector by midcentury.”

Ministers committed to work together to mitigate disruptions to energy resource supply and consider ways to “modernize” IEA’s oil stockholding requirement for member countries. During the next ministerial, member countries will hear recommendations from the governing board for adjusting that requirement while maintaining a “robust and efficient emergency response mechanism suitable for the transition to a net-zero future,” the communiqué said.

In early March, member countries responded to changes in the global oil market from Russia’s invasion of Ukraine by agreeing to release 61.7 million barrels of oil from their emergency stocks. The release represented 3% of their total collective emergency reserves, according to IEA.

The agency outlined a plan in mid-March to reduce oil demand by 2.7 million barrels a day by July to help avoid a supply crunch from Russia’s actions. The plan focuses on short-term measures that would reduce oil used by cars, such as working from home, designating car-free days in big cities and lowering costs of public transportation.

In a joint statement at the end of the ministerial, IEA members condemned the invasion of Ukraine, saying that “energy should never be used as a means of political coercion or to threaten national security.”