ATLANTA — Utilities in the Southeast are cleaning up their generation fleets, but large consumers say the monopolies remain an obstacle to their decarbonization goals.

Kenneth Shriver, Southern Co.’s (NYSE:SO) chief economist insisted at the RE+ Southeast conference last week that his company is on the side of renewable developers and companies that have adopted net-zero goals. Southern’s generation mix was 70% coal 15 years ago, but it has reduced that to less than 20%, Shriver said.

“We are generating 50% less … carbon emissions today than we were in 2007,” he said. “We committed to that [goal by] 2030. We’re eight years ahead. And we’re on a path to net zero by 2050. That’s what our customers are wanting, and that’s what they are asking us for.”

“We all have the same goal, to get to net zero,” Shriver said. “We had some differences in our timeframes of when we want to do that. And the question mark now is, we’re trying to really work with customers to figure out, ‘Hey, you want to go earlier? How do we work with you and leverage that to the benefit of all customers?’”

Shriver said the company’s desire to ensure renewables benefit all customers “makes us focus on a lot more on more utility scale solutions, and solutions that can fit all customers, not just one particular group. As we work with individual customers, especially for the large C&I [commercial and industrial] customers, we have better economies of scale [and] we have generally found that we can deliver renewable solutions to customers, meet their needs, and then also have benefits to the overall grid.”

Shriver said Southern’s shift to renewables — it claims to be the fourth-largest operator of solar in the U.S. — shows that mandates are unnecessary when the economics are right. In the integrated resource processes for Southern’s utilities, utility-scale solar penciled out as the most economic source of new generation, he said.

Capped Programs

But some renewable advocates and C&I customers say Southern and other utilities backing the Southeast Energy Exchange Market (SEEM) and opposing an RTO are slowing the transition to a carbon-free grid.

Jamey Goldin, Google’s (NASDAQ:GOOG) energy regulatory counsel for global energy markets and policy, said the Southeast will be the most difficult region in the U.S. for Google to deliver on its climate goals because of the region’s monopoly utility structure. He dismissed SEEM as “a nothing burger.” (See Southern Co. Takes Heat over SEEM, Opposition to RTO.)

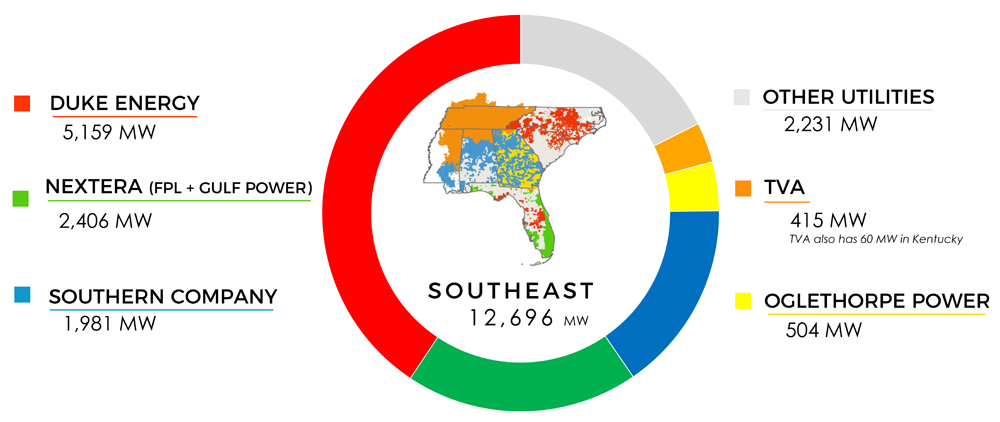

Steve Levitas, senior vice president for regulatory and government affairs for Pine Gate Renewables, said renewable programs in the vertically integrated monopolies of the Southeast are insufficient for C&I customers’ “infinite appetite for clean energy.”

“These programs are almost always limited in size with pretty severe caps, like a gigawatt at the outside of North Carolina,” Levitas said. “So, then the question arises, how do you allocate limited capacity of these programs? … Say you come into a state like Georgia with all kinds of corporate headquarters and data centers and the like and you put up a 600-MW program. It’s not going to go very far.”

North Carolina has allocated on a first-come, first-served basis, while other states use lotteries.

“The way that makes no sense to me … is a pro rata allocation,” he said. “That would mean that if you had 600 MW of capacity available, and you have 3 GW of load that is seeking to participate … everybody gets 20% green energy,” he said. “I don’t know if anybody you worked with would find that very satisfying.”

Pining for a Southeast Market

“Extending an organized wholesale market into the Southeast would go a long way towards solving these problems, so we can structure transactions the way we do in other parts of the country,” Levitas added. “That’s a political hot button and is probably not on the horizon anytime soon. But it would create more opportunities for customers who are trying to accomplish these goals. And I won’t even talk about going to retail choice, but that fully solves the problem.”

Dmitri Moundous, senior manager of storage business development for Cypress Creek Renewables, acknowledged a full wholesale market, or an energy imbalance market, is “obviously wishful thinking.” But he said SEEM is “really not going far enough at all.”

SEEM’s savings from reduced curtailments of renewables is “measured in single millions,” Moundous said. “When you go to an energy imbalance market, there’s multiple studies that show that you can [obtain] savings into the hundreds of millions of dollars — so, an entire order of magnitude higher.”

“That is something that can really catalyze energy storage in the Southeast,” he said. “In markets like the Pacific Northwest, where you have corporates that have commitments to 100% clean energy goals [and] time-matched renewables, that sort of storage is valued a lot more.”