The first offshore wind lease auction in the Gulf of Mexico drew minimal interest and extremely low bids.

Soon after it opened Tuesday morning, the U.S. Bureau of Ocean Energy Management announced it was over.

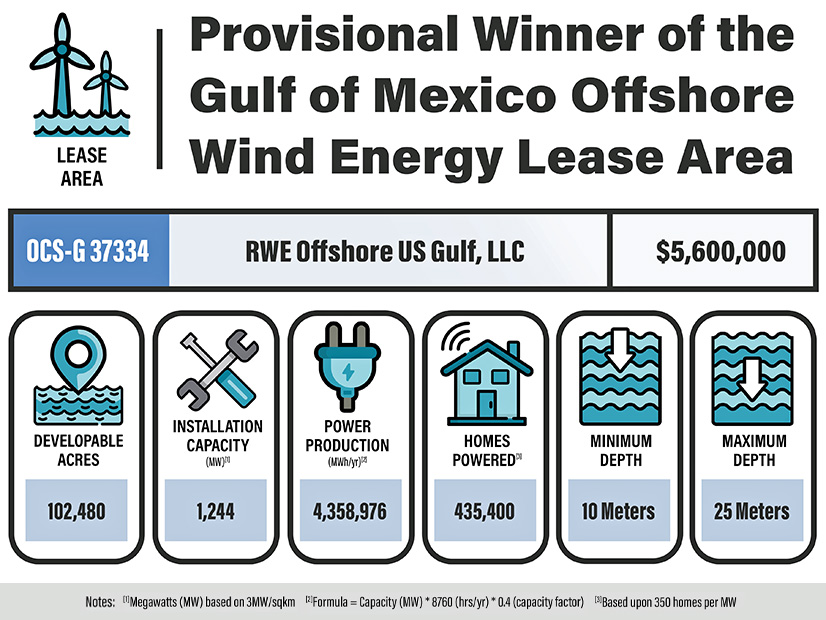

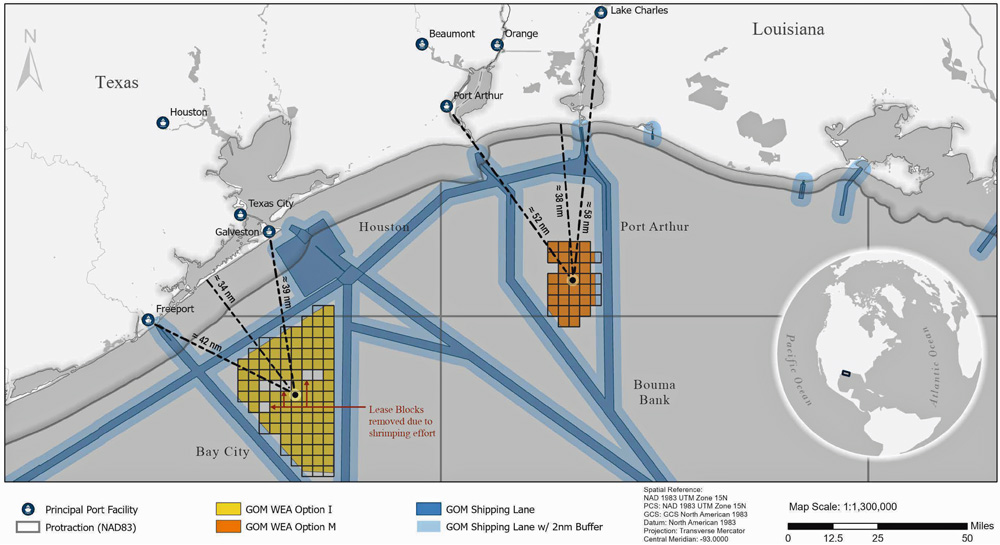

Two $5.1 million bids were submitted in the first round for one of the three lease areas up for grabs. RWE Offshore US Gulf submitted the sole bid in the second round: $5.6 million for rights to the 102,480-acre OCS-G 37334, south of Lake Charles, La.

Two 100,000-acre lease areas off Galveston, Texas, drew zero bids.

BOEM had prequalified 15 companies to participate in Tuesday’s auction, some of them already major players in the burgeoning U.S. offshore wind market.

The Biden administration put a positive spin on the situation later Tuesday.

Interior Secretary Deb Haaland did not mention the auction in a news release, focusing instead on the larger picture — President Biden’s push for clean energy and a clean energy economy.

BOEM Director Elizabeth Klein focused on the positive, saying: “Today’s lease sale represents an important milestone for the Gulf of Mexico region — and for our nation — to transition to a clean energy future. The Lake Charles Lease Area will have the potential to generate enough electricity to power about 435,400 homes and create hundreds of jobs.”

Challenges

The nation is very late to offshore wind development — U.S. waters host just 42 MW of the more than 60 GW of installed capacity operating worldwide.

But the Biden administration and some states are rushing to catch up, and hope to bring dozens more gigawatts online in the next several years as a climate protection measure.

In the past year, this effort has run into major complications with inflation, interest rates and supply chain constraints. Projects contracted but not yet underway off the Northeast coast say they need more money to proceed; bids for the next round of projects apparently are coming in quite high.

The Gulf of Mexico has another set of problems, BOEM noted in a 2020 report: weaker winds and a softer seabed than exist on other parts of the Outer Continental Shelf, plus the annual threat of hurricanes.

Despite all this, some had expected big things from Tuesday’s auction.

Others were not surprised by the results.

Washington, D.C., research firm Clearview Energy Partners said in a note to clients Tuesday that the macroeconomic trends hammering the offshore wind industry probably diminished interest among developers.

It also cited factors specific to the Gulf of Mexico:

-

- State solicitations have been a strong driver of offshore development in other parts of the country; there have been none in the Gulf states.

- Production of clean hydrogen with wind energy may be a key motivating factor for its development in the Gulf, but the IRS still has not issued guidance on the clean hydrogen tax credit in the Inflation Reduction Act.

- Electricity in the region is relatively cheap, and the return on offshore wind investment potentially is negative.

That said, there is movement on other fronts. Louisiana is pursuing wind power development in state waters and is in negotiation with multiple developers.

Construction close to shore eliminates some time-consuming federal oversight. And the waters off Louisiana’s coast already are dotted with oil rigs, so wind power development there may not see the fierce opposition that has erupted in places such as beachfront New Jersey resort communities.

Clearview said the two areas off Texas could yet attract interest.

“We note that project developers could file applications for noncompetitive leases in the two areas in the future. In this context, we wouldn’t rule out the prospect that some developers decided it’s ‘not now’ rather than ‘not ever.’”

Trade group Business Network for Offshore Wind had a similar take on Tuesday’s auction.

“Today’s auction results show the important role state public policy plays in offshore wind market development,” CEO Liz Burdock said via email.

“The network remains fully committed to offshore wind in the Gulf and to supporting our members forming the robust supply chain that is already instrumental to building out a new American energy industry. Gulf expertise in offshore construction is unparalleled, and their innovative solutions will continue to drive the U.S. and global offshore wind industry forward. We congratulate RWE and the state of Louisiana, which is positioning itself as a regional leader and building upon [its] strength as a major national supplier, and we look forward to helping solidify the state’s market.”

BNOW last week published a report exploring in greater depth the opportunities and challenges for wind energy development in the Gulf of Mexico.

History

Tuesday’s auction was lackluster compared with BOEM’s three most recent efforts.

RWE got the rights to its patch of water for $54.64 an acre.

Leases auctioned last year topped out at more than $10,000 an acre. Some winning bids were considerably less than $10,000, but all were much, much more than $54.

In February 2022, developers submitted $4.37 billion in winning bids for six lease areas totaling 488,000 acres off the New York-New Jersey coast — the most lucrative energy auction ever in federal waters, for oil, gas or wind.

The May 2022 wind auction off the Carolinas was a more restrained affair — two bids totaling $315 million for two leases totaling 110,000 acres.

In December 2022, the first Pacific wind energy auction drew $757 million in bids for five lease areas totaling 373,268 acres off California.