Vehicle-to-grid integration (VGI) is about more than connecting electric vehicles to the grid, say reports from the U.S. Department of Energy and the Alliance for Automotive Innovation, both released July 16.

Rather, it represents a convergence of the automotive and electric industries in ways that could provide benefits for the grid, utilities, EV drivers, all utility customers and, in the big picture, society in general.

At its most basic, VGI is the use of electric vehicle batteries, connected to EV chargers, as grid resources, either through managing when and at what pace they charge or tapping EV batteries for grid support or backup at times of peak demand or in emergencies.

The two reports are complementary, with DOE’s “The Future of Vehicle Grid Integration” laying out a vision for VGI development by 2030, while the AAI report provides lists of recommendations focused on rate design and the kinds of technology that will be needed for consumer, utility and regulatory buy-in.

DOE sees huge potential for VGI, with “millions of electric vehicles, charging at home and work, at charging depots and along the [highways] … integrated with the electricity system in a way that supports affordable and reliable charging for drivers and enables a reliable, resilient, affordable and decarbonized electric grid for all utility customers.”

VGI can “seamlessly [align] the grid’s physical infrastructure and operational structure, regulatory frameworks and market design with customer charging behaviors to create a symbiotic relationship that benefits everyone regardless of EV ownership,” the report says.

AAI’s definitions of success are more specific and targeted at building a solid business case for VGI. For EV drivers, VGI should deliver no-compromise mobility; convenient, reliable and affordable charging; and compensation for grid services, while utility customers will get a more efficient and modern grid that enhances system reliability and resilience and delivers economic and environmental benefits.

Recommendations for utilities include adoption of time-of-use rates for EV charging and allowing EVs to participate in demand response programs.

The overlap between the two reports is their recognition of the complexity of the work ahead to achieve their goals and the need for broad-based collaboration between utilities, automakers, regulators, EV charging firms and software developers, and local officials and community groups.

Both also call for the development of standards and codes, with AAI more focused on data accuracy and technical interoperability, and DOE calling for “cyber-informed engineering” for EVs, charging equipment and the grid to minimize physical and cyber threats.

What is also implicit in both reports is a shared sense that as more EVs hit the road across the U.S., VGI will be critical to managing their increased electricity demand, and best practices and information sharing will be needed to move beyond a recurring pattern of utility pilot programs to fuller system integration.

DOE’s Big Picture

The DOE report was developed by the department’s EVGrid Assist initiative, which is itself a cross-industry group. The report notes it is intended to set goals for an ideal VGI environment and that a second report with specific strategies will be forthcoming.

At the same time, it provides a framework for why VGI is important and specific pillars that could form a core for successful and equitable deployment of VGI.

The report argues that VGI increases the use of grid infrastructure, cutting system costs, while helping to hold the line on electricity rates and put more clean energy online. EV owners can take advantage of more cost-effective charging, which lowers their total cost of ownership.

VGI programs could also serve as a model for tapping other distributed energy resources for grid support and flexibility, the report says.

Pillars for successful VGI deployment will include recognizing the “universal value” VGI provides to all utility customers and promoting a “right-sized” grid in which managed charging programs could cut peak loads and provide system flexibility. “Better use of grid assets reduces the risk of overbuilding,” the report says.

For example, the report calls on utilities to provide “clear information about upgrade costs, capacity availability and load service request processes [to] help developers and site owners identify cost-effective charging locations where capacity is available.”

The report’s other pillars focus on developing standards and codes, ensuring system security and providing customers with “a wide range of products and services to accomplish their charging needs,” as well as compensation for the services they provide.

Both DOE and AAI recommend that VGI programs offer “value stacking,” allowing EV owners to get paid for different services their EVs might provide.

Telematics and Bidirectional Charging

Incentivizing VGI through various rate designs is a priority in the AAI report. Utilities and regulators could support the deployment of DC fast chargers by adopting commercial and industrial rates that “ensure the … viability of fleet electrification and DCFC stations in the early stages of operations and in lightly trafficked areas.”

Chargers in remote areas may not, at first, get enough use to cover utility demand charges and make the chargers financially viable, the report says. Possible solutions could include “temporary demand charge holidays … offsetting the demand charge with declining short-term subsidies and replacing the demand charge with a kW-based subscription fee.”

For fleet electrification, another option is automated load management, a system that manages demand across more than one EV charger and can cut costs for the installation and operation of charging equipment, the report says.

On the residential side, AAI pushes for a “prompt transition” from pilot programs offering time-of-use rates or managed charging to mass market initiatives, which will be “crucial to achieving cost-effective VGI as EV adoption accelerates.” The report also urges utilities and automakers to work together on wider consumer education programs to ensure EV owners are aware of and can easily sign up for such programs.

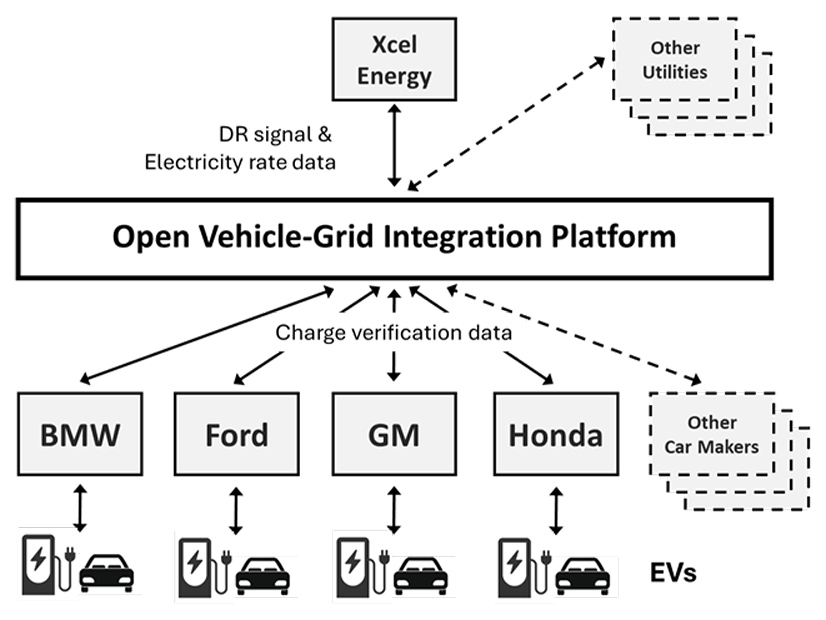

AAI also points to telematics ― the integration of telecommunications and computer data ― as a key tool for advancing the benefits of managed charging.

“Telematics-based managed charging programs integrate vehicle and utility data to optimize the timing of charging, thereby enhancing the value of an EV as a grid resource,” the report says.

“By factoring the state of charge into the optimization algorithm, telematics-based managed charging systems can determine how long it will take to replenish the battery and therefore how much latitude there is to modulate charging to shift load and provide grid services,” it says.

Deploying bidirectional charging at commercial scale is another way EVs can be integrated with the grid. By allowing EVs to charge from or discharge to the grid, bidirectional charging essentially turns EVs into mobile batteries that can provide “frequency regulation, spinning reserves and load shifting,” the report says. “Their ability to charge and discharge multiple times while plugged in significantly augments their value relative to standard EVs.”

However, not all EVs currently on the market have bidirectional charging, which the AAI report says is costly to build into the vehicles, and incentives may be needed to compensate fleet operators for the added expense.

The bottom line is that utilities, RTOs and regulators should enact policies and programs to compensate EV owners who send power to the grid, the report says. A Pacific Gas and Electric pilot program for EV commercial fleets provides incentives to offset equipment costs and uses day-ahead hourly pricing to encourage fleet operators to put power from their EV batteries back on the grid during times of peak demand.