The Smackover Formation in southwest Arkansas has one of the highest lithium brine concentrations in the U.S., which is why the Department of Energy is planning to invest $225 million in federal funds to help stand up an environmentally sustainable lithium extraction and purification project being developed by SWA Lithium.

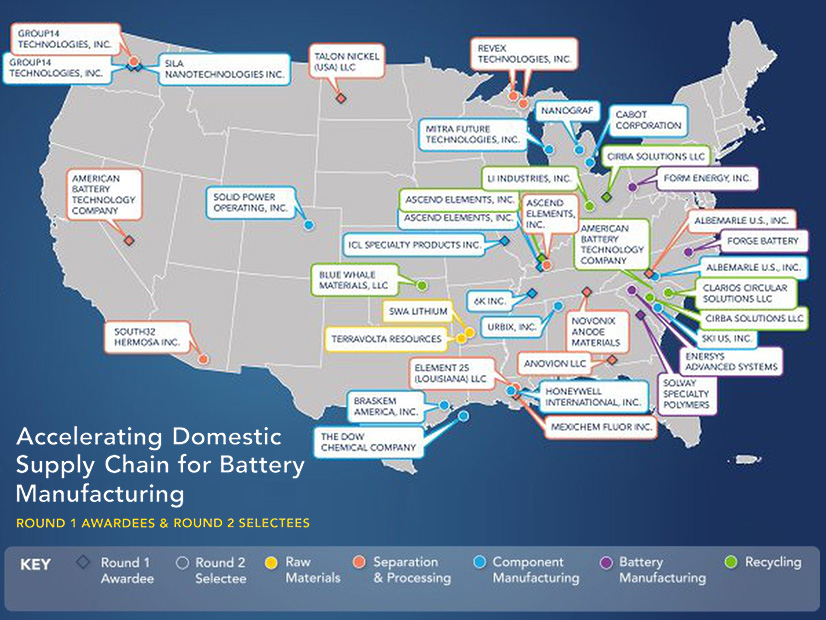

A partnership between Standard Lithium and Equinor, SWA is one of 25 battery supply chain projects DOE has selected to receive $3 billion in grants from the Infrastructure Investment and Jobs Act, according to a Sept. 20 announcement.

“The selected projects will retrofit, expand and build new domestic facilities for battery-grade processed critical minerals, batter components, battery manufacturing and recycling,” the announcement said, as well as create 8,000 construction and 4,000 permanent operating jobs.

Located in 14 states, the awardees represent the “most essential building blocks of the battery supply chain,” as well as a diverse range of companies, according to DOE. For example, Dow Chemical is set to receive $100 million to turn waste carbon dioxide into battery-grade electrolytes, while Silicon Valley startup Mitra Chem is up for a $100 million award to manufacture next-gen lithium iron phosphate battery components in Muskegon, Mich.

“This award selection represents a pivotal moment for the entire U.S. battery industry,” said Vivas Kumar, CEO of Mitra Chem. “By bringing advanced battery production to American soil, we’re securing our energy future and positioning the U.S. at the forefront of the global electric vehicle revolution.”

The company’s DOE grant is being topped up with a $25 million grant from Michigan, according to a Mitra Chem announcement.

Awardees must be able to match the IIJA funds dollar for dollar at least as part of the negotiations that will now begin to finalize contracts for the awards. The DOE announcement also noted that nearly 90% of the projects will be located in or adjacent to disadvantaged communities, and more than half have already signed or committed to signing project agreements with labor groups.

The SWA project, for example, has committed to ensuring that 40% of workers and 20% of apprentices on the project will be local hires.

“Taking action on climate change and rebuilding our domestic manufacturing capacity are mutually reinforcing goals,” said Ali Zaidi, White House national climate adviser.

The “game-changing” awards announced Sept. 20 will “support the technologies that we need in the market today, the components that we will need in the future and the innovative technologies we need to advance our vision for a circular domestic battery supply chain,” Zaidi said.

Breaking Chinese Dominance

With batteries a core technology for decarbonizing the grid and electrifying transportation, building out a domestic supply chain ― and breaking China’s dominance in critical mineral processing and battery manufacturing ― has been a political flashpoint and a high priority for the Biden administration.

The success of these projects could also have a critical impact on EV adoption rates in the U.S., as half of the Inflation Reduction Act’s tax credits for EVs require that their batteries meet specific domestic content requirements. (See Will Final Rules on EV Tax Credits Help or Hurt US Market Growth?)

Released in May, the Treasury Department’s final rules on the tax credits give automakers a two-year phase-in period for some of the domestic content provisions — for example, graphite — but also puts DOE’s awardees on relatively short lead times.

Mitra Chem, for example, expects its plant in Muskegon to be online and ready to double the U.S. output of lithium iron phosphate by 2027.

The current awards are the second round of grants for battery materials processing, manufacturing and recycling, following $2.8 billion in awards to 20 companies announced in October 2022.

At the time of the first awards, DOE had set ambitious targets for companies building out U.S. supply chains, such as developing enough battery-grade lithium to manufacture 2 million EVs annually. Scale is still a factor in the second round, but DOE is also focusing on some of the main challenges facing the EV industry: from ongoing consumer anxiety about EVs’ range and charging times to the environmental impacts of lithium mining. (See DOE Awards $2.8 Billion to ‘Supercharge’ Battery Production.)

With a $67 million grant, Albemarle US plans to retrofit a manufacturing facility in Charlotte, N.C., where it will produce advanced lithium anodes that will increase EV battery density and range, cut charging times and improving safety. Target output is 50 metric tons per annum.

Forge Battery intends to use its $100 million grant for a first-of-its-kind facility, also in North Carolina, to manufacture high-performance lithium-ion battery cells for “underserved, specialized domestic markets,” including heavy-duty trucks, off-road vehicles, and aerospace and national defense applications. Production will begin in 2026 and reach full capacity — 3 GWh per year — by 2029.

And the SWA project aims to be a model for sustainable lithium mining through its use of direct extraction technology, which draws lithium brine from aquifers, filters out the lithium and then reinjects it into the ground to create a closed-loop process. The first phase of the project could produce up to 22,500 MT of lithium carbonate per year, the company says.