Rules and guidance for the federal Section 48E(h) Clean Electricity Low-Income Communities Bonus Credit have been finalized and will be published shortly.

The Department of the Treasury and Internal Revenue Service released the details Jan. 8 and said applications will be accepted starting Jan. 16.

The 48E(h) program will provide a 10 or 20% adder on top of the 30% investment tax credit to 1.8 GW of clean electricity generation annually from 2025 through at least 2032.

It is an expansion of the 48(e) program created by the Inflation Reduction Act.

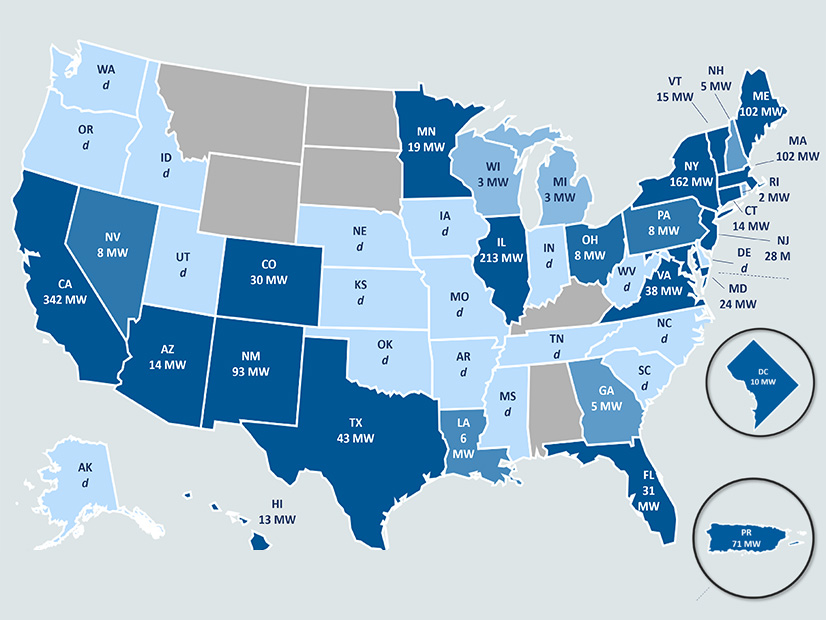

During its first year, 48(e) received more than 54,000 applications from 48 states, four territories and the District of Columbia. The approved applications are expected to generate investments of $3.5 billion in low-income communities and $270 million in annual offset energy costs.

In the second year, more than 57,000 applications were submitted. Approved applications are expected to generate investments of roughly $4 billion and offset nearly $350 million a year in energy costs.

The final 48E(h) rules contain some changes from 48(e):

-

- The range of eligible zero-emissions technologies is expanded beyond solar and wind to include hydropower, marine, geothermal and nuclear.

-

- The list of qualified housing programs has been expanded and the financial value that projects must provide to low-income households has been clarified.

-

- To steer benefits to small businesses, there is a pathway for emerging clean-energy companies to receive priority treatment of their applications.

-

- The annual 1.8-GW maximum capacity allocation is divided among four categories — 200 MW for facilities on Indian lands, 200 MW for low-income residential building projects, 800 MW for low-income economic benefit projects and 600 MW for facilities in low-income communities.

-

- This last category is subdivided — 400 MW for behind-the-meter residential facilities and 200 MW for front-of-the-meter or nonresidential behind-the-meter facilities.

In a news release, Deputy Secretary of the Treasury Wally Adeyamo described the revisions as a pathway to greater equity: “Expanding the Clean Electricity Low-Income Communities Bonus Credit will help lower energy costs in communities that have been overlooked and left out for too long and empower developers to work alongside communities to provide tailored solutions to meet their energy and economic needs.”

A Department of Treasury analysis of the first year of 48(e) found its results to be in line with the supply-side economics framework on which it was designed.

“Investment in underserved people and places can lead to disproportionately higher rates of return for the nation’s economy,” Treasury said Sept. 4, “and federal investments — like the ones provided by this program — will simultaneously promote economic growth and help address inequality.”

Some highlights from the first-year analysis:

-

- More than 54,000 applications were submitted for more than 7.2 GW of capacity; allocations went to 49,246 proposals totaling 1.475 GW and the 325 MW of eligible capacity that was not allocated was rolled over to the second program year.

-

- All of the allocations were for solar projects — few applications were submitted for wind power generation, and none were approved.

-

- More projects were awarded to applications in areas of high energy burden as defined by the Climate and Economic Justice Screening Tool than were awarded to applications in Persistent Poverty Counties.

-

- Awards were made predominantly in states with established solar markets and supportive regulations; other awards went to states with emerging solar markets, and those states are expected to make up a growing portion of the program over time.

-

- Many of the facilities that exceed 1 MW capacity will be subject to the prevailing wage and apprenticeship requirements of the Inflation Reduction Act.