NextEra Energy is collaborating with GE Vernova on development of natural gas-fired power generation and is taking further steps toward restarting an idled nuclear plant.

NextEra CEO John Ketchum announced the moves Jan. 24 with release of the company’s fourth-quarter and full-year financial results. Both are in response to the anticipated growth in U.S. power demand.

The Duane Arnold Energy Center in Iowa was shut down after it suffered damage in an August 2020 derecho. After 45 years in operation, it was put in line for decommissioning rather than repairs.

Nuclear fission has rapidly gained interest for its near-constant output of zero-emissions power, and NextEra has shown rapidly growing interest in restarting Duane Arnold.

During the second-quarter earnings call in July 2024, Ketchum said the prospect of a restart under the right conditions had been given some thought. During the third-quarter call in October 2024, he said the company was “very interested” in a restart.

During the fourth-quarter call, he said the company recently asked the Nuclear Regulatory Commission for a licensing change, an important first step on the regulatory path to restore Duane Arnold’s operating license and restart operations as early as the end of 2028.

But a restart would meet only a fraction of the gigawatts of new generation the nation needs, and new-build nuclear is unlikely to fill that deficit in the next decade, he said.

“That means we need renewables and storage to meet demand that is here today and, as we move towards the next decade, we can supplement renewables and storage with natural gas-fired generation,” Ketchum said.

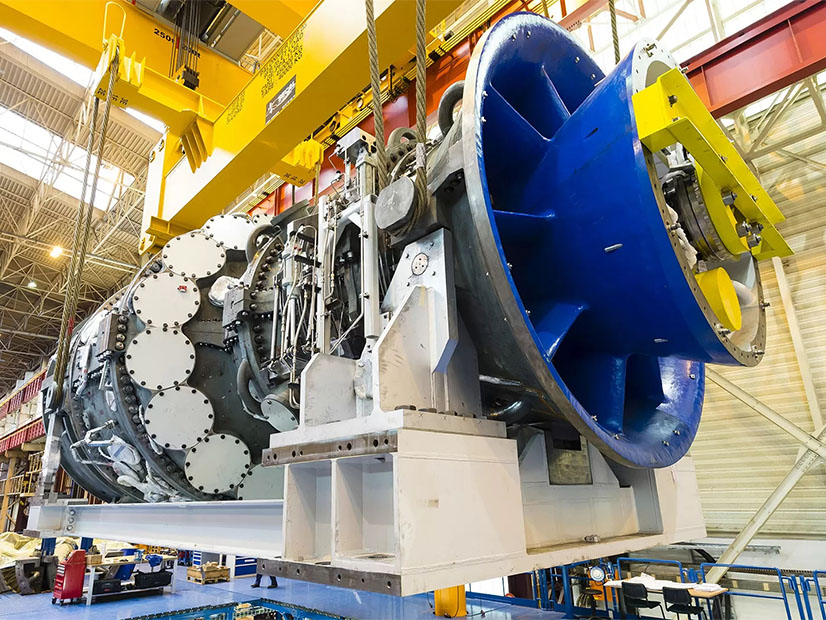

The framework agreement he announced with GE Vernova would create a partnership between a leading developer of power generation and a leading manufacturer of power generation equipment who already have a decadeslong relationship.

“This agreement has the potential to support multiple gigawatts for data centers, the reshoring of manufacturing and the electrification of industry, as well as serve investor-owned utilities, municipalities, cooperatives and commercial and industrial customers,” Ketchum said.

And it offers the potential to boost renewables development by pairing them with natural gas generation, he said.

“Over the next four years, the companies plan to collaborate to identify key locations on the energy grid that would benefit from new generation,” Ketchum said.

During the call, an analyst asked for the specifics of the partnership.

Ketchum said NextEra and GE Vernova would target large load customers with an integrated solution of gas-fired generation, renewables and storage that would be co-owned equally by the partners and contracted on a long term to the customer.

“We could contemplate in the right situation with the right customer potentially a build-own-transfer on gas-fired generation as well, if it was part of a larger transaction that included renewables and other growth opportunities,” he added.

Another analyst asked about the costs involved in a Duane Arnold restart.

Ketchum did not want to tip his hand prior to any cost negotiations, but said the storm damage is not severe or complicated — the cooling tower needs to be replaced, and NextEra has experience building cooling towers at its gas-fired plants.

One of the first questions was about the “elephant in the room” — the Trump administration’s antipathy to renewables.

Subsidiary NextEra Energy Resources is a leading developer of solar and wind power generation and energy storage. What impact does Ketchum expect from Trump’s executive orders targeting renewable energy and the IRA funding that has spurred growth in the renewable energy sector?

Ketchum did not offer an exact answer. Instead, he offered reasons why that impact would not be great, and why he thought Trump would temper his initial stance.

First off, he said, NextEra has only one onshore wind project on federal land and zero offshore wind, so it avoids the worst of the president’s wrath.

Second, the country needs a lot more electricity quickly, and NextEra can deliver it quickly with wind, solar and storage.

Finally, NextEra is one of the largest infrastructure developers in the nation; it plans to invest $120 billion over the next four years.

“And again, 80% of those dollars is going into Republican states. That’s a lot of manufacturing, a lot of job creation, a lot of property taxes, a lot of economic benefits. So those are the messages that we’re trying to make sure we get we get across in Washington around the IRA discussion,” Ketchum said.

“I remain very optimistic that we’re going to be able to work through any issues that that may come up along the way.”

Preliminary full-year financials show NextEra Energy had 2024 net income of $6.94 billion on operating revenues of $24.75 billion, or $3.37 per share.

That compares with $7.31 billion, $28.11 billion and $3.60 for all of 2023.

NextEra Energy stock closed 5.2% higher in heavy trading Jan. 24, making it the highest-performing component in the S&P 500 on a day when the index closed 0.3% lower.