NPCC's Summer Reliability Assessment found that the region generally has enough resources to meet demand this summer, though weather patterns could strain grid operators.

The Northeast Power Coordinating Council, the regional entity covering New York, New England and four Canadian provinces, said in its 2025 Summer Reliability Assessment that only the Maritimes provinces of New Brunswick and Nova Scotia show a significant likelihood of needing to implement operating procedures during the summer months under expected peak conditions.

However, the RE acknowledged that New York and New England also face the risk of loss of load expectation under more severe conditions, illustrating “a growing concern regarding resource adequacy under extreme conditions.” NPCC said utilities have “strategies and procedures … in place to manage potential operational challenges and emergencies as they arise.”

NPCC approved its SRA on May 9 but released it June 4, following the release of NERC’s summer assessment on May 14. (See NERC Warns Summer Shortfalls Possible in Multiple Regions.) The assessment covers the week beginning May 4 through the week beginning Sept. 21.

Coincident peak demand for the entire region was estimated in the report at 104,606 MW, occurring during the week beginning Aug. 3 with a forecast net margin of 9,279 MW, or 8.9%, in the RE’s 50/50 forecast (representing a 50% chance that the actual peak load will be higher or lower than the prediction). The net margin forecast in 2024 was 12,382 MW.

Overall, NPCC’s projected generation capacity has decreased by about 1,300 MW from last summer to 157,000 MW, with the biggest capacity reduction due to the planned retirement of the Pickering G1 and G4 nuclear units in Ontario.

The revised net margin, excluding bottled resources (calculated by subtracting the available transfer capacity between Quebec and the Martimes and the rest of NPCC from the total net margin for the two subregions), stood at 8,397 MW. NPCC’s lowest margin for the summer is projected as 4,675 MW, or 4.5%, during the week beginning July 13. By comparison, NPCC’s all-time coincident peak demand was 112,552 MW on Feb. 3, 2023, and its all-time peak for summer was 112,384 MW on Aug. 1, 2006.

In the 90/10 forecast, representing a 10% chance that peak load will exceed expectations, peak load was significantly higher, at 111,061 MW, resulting in a net margin of 2,825 MW and a revised net margin of 1,943 MW.

Finally, the RE’s above 90/10 forecast — “a low-probability, high-impact composite scenario [relying] heavily on individual area risk assumptions” — had demand even higher at 114,943 MW, with more than 5,000 MW of additional unplanned outages and derates, resulting in a revised net margin of negative 7,381 MW. A negative revised net margin “indicates a combination of imports and operating procedures will be necessary to mitigate potential resource shortages,” NPCC said.

The “single most important variable” affecting demand this summer is weather conditions, the report said, noting that despite the identification of the overall peak week, “summer peak demand could occur during any week of the summer period because of these weather variables.”

This fact could add to the reliability challenge if, for example, a widespread weather event causes multiple regions’ peaks to arrive at the same time. NPCC observed that peak demands in New England and New York already “have a high degree of correlation” historically, and Quebec’s summer peaks in recent years have begun to contribute to the coincident peak as well.

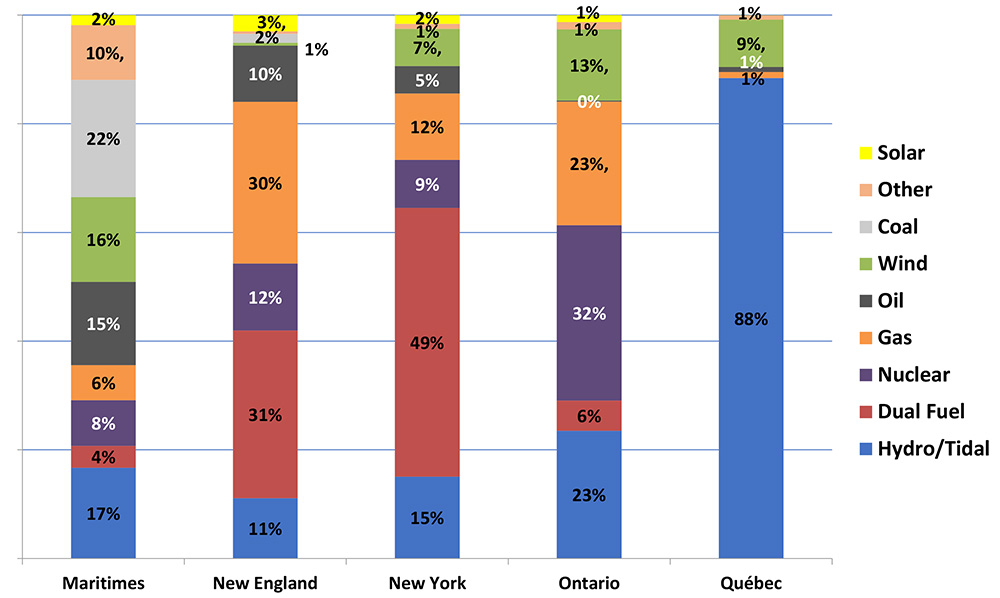

Generation resource mixes continue to vary widely across the RE’s footprint. In Quebec, hydro and tidal power are expected to make up 88% of all generation, with wind second at 9%, while in New England, hydro and tidal stand at just 11% and dual-fuel plants take the largest share at 31%, with gas close behind at 30%. In New York, dual-fuel dominates at 49%, and in Ontario, nuclear has the largest share, with 32%. Finally, in the Maritimes, no single generation source accounts for more than 25% of the mix; the largest share of generation is held by coal, at 22%.

NPCC noted its support for registered entities facing adverse system operating or weather conditions, outlining its ability to coordinate emergency communications including conference calls between affected entities. The RE also monitors weather conditions and supports information sharing and other coordination efforts between the natural gas and electric industries.

The “assessment indicates our region has spare capacity for this summer, which can be used to help mitigate reliability risks that may result from unexpected unavailability of key facilities, fuel supply interruptions, generation maintenance or higher-than-anticipated demand,” NPCC CEO Charles Dickerson said in a statement.