Although grid resilience has become an increasing concern for regulators, their efforts have been reactive, resulting in pilot projects but no consistent policies or metrics for measuring success, speakers told the National Association of Regulatory Utility Commissioners’ Winter Policy Summit on Thursday.

“We haven’t found any commission in the country that has a comprehensive framework and long-term plan for what resilience means and what [level of resilience] are we trying to get to,” said Ted Ko, vice president of policy and regulatory affairs for Stem, which operates what it says is the world’s largest energy storage network.

To address that, Ko co-authored a policy roadmap on resilience, with a focus on using solar-plus-storage technology for backup power following natural disasters and outages.

Ko was joined by Bill Chiu, managing director of grid modernization and resiliency at Southern California Edison (SCE) and Damir Novosel, president of Quanta Technology, who outlined an October 2020 report they co-authored with other members of the IEEE Power and Energy Society titled “Resilience Framework, Methods, and Metrics for the Electricity Sector.” The session was moderated by New Hampshire Public Utilities Commissioner Kate Bailey.

“We’re seeing more and more of these so-called traditionally low-frequency events becoming more frequent and in greater intensity, and some of it’s obviously driven by climate conditions,” Chiu said. “So, moving forward … the resilience definition should be able to deal with protection against any kind of events that would have a significant impact to the grid.”

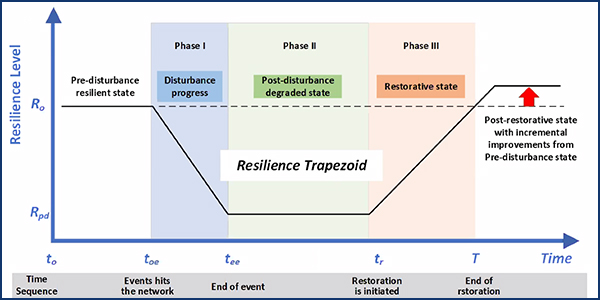

The IEEE report says regulators should take an “all hazards” approach that considers threats from hurricanes, wildfires and other natural disasters; cyber and physical attacks; aging equipment; and human error. That, Chiu said, takes “advantage of the commonality of the recovery process — regardless of the type of event that we have. … Regardless of whether you’re talking about severe weather events or other types of system trauma, there is going to be these five stages we need to consider: prevention, protection, mitigation, response and recovery. The whole idea here is to actively collaborate with key stakeholders to continuously mature what I call the resilience muscle … so that we get better at each one of these phases.”

The IEEE report identifies varying definitions of resilience and its relationship with reliability, along with metrics for evaluating and benchmarking it.

“Measures that help to improve reliability also increase the resilience. But there are times when there will be some opposing tradeoffs,” Chiu said. For example, the practice of reclosing power lines after faults could harm resilience by allowing lines to ignite foreign debris during wildfire season.

Novosel talked about technologies and methods for improving resilience, including improved power system modeling; sensors; use of outage reporting smart meters and monitoring for geomagnetic induced current; and drones for situational awareness and assessing conditions. “Our smart meters have not been fully utilized in the industry yet,” he said.

Smart inverters for controlling distributed energy resources, combined with energy storage, energy efficiency and demand response can allow customers to island via microgrids during disturbances. “The more renewables and storage we have, the more expansive the microgrid can be,” Novosel said.

He also noted, “Some of the investments in distribution can help the transmission system and the other way around.”

The report also offers recommendations on how to use the metrics and includes case studies from, among others, SCE, Con Edison, San Diego Gas & Electric, Commonwealth Edison and Austin Energy. Transmission and distribution system hardening practices and wildfire risk mitigation are covered in a section on lessons learned from California.

Florida utilities responded to hurricanes in 2004 and 2006 by undergrounding some lines and hardening others by replacing wooden transmission and distribution poles with concrete and steel structures able to withstand 145-mph winds, investments that have greatly reduced outages. Novosel said Entergy is now considering how to replace a line near the Gulf of Mexico that was destroyed by high winds during Hurricane Laura last August.

“There’s a question now: Should we rebuild the line, or should we put in a microgrid? And how to find the balance to minimize the risk … at the same time moving toward decarbonization?”

“There will be the issue of the level of investments that would need to be made. Should it be reached in three years, in five years?” he continued. “That’s where … probabilistic planning comes in very handy because we still have uncertainties that we need to include in the process.”

Making Resilience a Market

The Stem report takes note of efforts by regulators in New Jersey, New York, Maryland, Connecticut, Massachusetts, and Rhode Island to determine the costs and benefits of solar-plus-storage microgrids and backup power. The studies were followed by investments in backup power pilots for critical facilities such as hospitals, water treatment facilities and public shelters.

While the pilots have effectively proven the value of such investments, Stem said, “comprehensive policy support is now needed to scale implementation. Even among states most at risk of outages, the current policy landscape is a piecemeal collection of pilot projects, small grant programs, and catastrophe response — not a systematic and proactive approach to ensuring widespread energy resilience for all.”

It cites the California Public Utilities Commission, which is providing incentives for commercial and residential customers adding clean backup power under its Self-Generation Incentive Program. (See California PUC Devoting $1.2B to Self-generation.)

The program hasn’t worked exactly as intended, however. In October, the CPUC reported that much of the $612 million intended to provide battery backup to homes in high fire-threat areas has been taken by customers who use electricity to pump well water instead of helping the low-income and medically vulnerable residents it was meant for. (See PSPS Relief Funds Not Spent as Intended, CPUC Says.)

The report calls for developing a framework that defines resilience components, classifies customers according to resilience needs and recommends policy and market mechanisms to address possible scenarios.

It says states should strive to gradually eliminate subsidies and develop market mechanisms that allow stakeholders to analyze the costs and benefits of potential resilience projects and invest in those that are most cost-effective. Ultimately, microgrids and other projects for resilience should be included in integrated resource plans and distributed resource planning, it says.