The federal government is teeing up a second wind energy auction in the Gulf of Mexico.

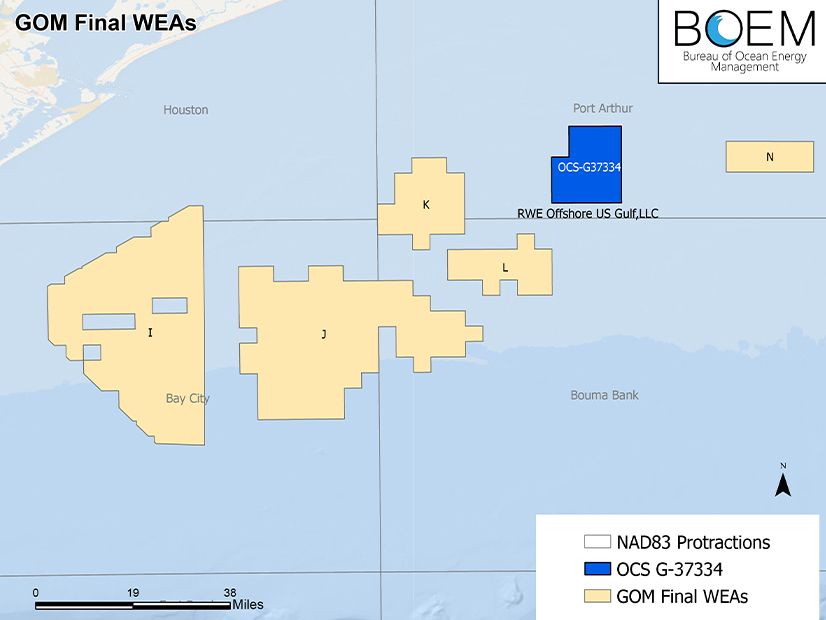

The U.S. Bureau of Ocean Energy Management on March 20 proposed a lease of four areas totaling 410,060 acres off the Texas and Louisiana coastlines.

The proposed sale notice will be published in the Federal Register on March 21, triggering a 60-day public comment period in which BOEM hopes to receive feedback on the size and location of the proposed lease areas, and on potential lease revisions to include hydrogen production with the electricity generated there.

Also, BOEM is considering lease stipulations requiring that historically underserved communities be considered and engaged early and often in the development process.

If BOEM decides to go through with this second auction, it would publish a final sale notice.

BOEM and some industry observers had expressed optimism for the first Gulf of Mexico wind auction, in August 2023, but it drew minimal interest. (See Gulf of Mexico Wind Energy Auction Falls Flat.)

Only one of the three lease areas offered drew bids, and the winning bid by RWE Offshore US Gulf was just $5.6 million — much less than winning bids submitted for lease areas off the Atlantic and Pacific coasts.

August 2023 was not a good time for the emerging U.S. offshore wind industry — early movers off the Northeast Coast were struggling mightily with supply chain, financial and infrastructure constraints.

But beyond that, the Gulf of Mexico presents challenges of its own: weaker winds, softer seabed geology and an annual hurricane threat.

After the first Gulf auction fizzled, research firm Clearview Energy Partners flagged other factors for its clients: Electricity is relatively inexpensive in the Gulf Coast region and there is not a strong push by state leaders to get electrons flowing from sea to land.

Production of green hydrogen might be a key motivator for offshore wind development in the region, Clearview wrote, but at the time, the IRS had not issued guidance on the Inflation Reduction Act’s clean hydrogen tax credit.

The IRS has since issued proposed guidance and may finalize it before a second auction. This could offer developers a clearer picture of the potential economics of offshore wind in the Gulf.

BOEM said it would use new, more efficient software for the second Gulf auction.

BOEM Director Elizabeth Klein said in a news release: “We look forward to receiving feedback from tribes, other government agencies, ocean users, local communities and others to minimize any impacts to natural and cultural resources, reduce potential conflicts with ocean uses, and maintain a healthy marine ecosystem.”