A new report on the Inflation Reduction Act — issued as the IRA faces a potentially existential threat — finds that it could boost U.S. GDP by $1.9 trillion over the next decade.

The study, commissioned by the American Clean Power Association and conducted by consulting firm ICF, said the economic benefits will extend across the energy sector and beyond, to transportation, buildings and manufacturing.

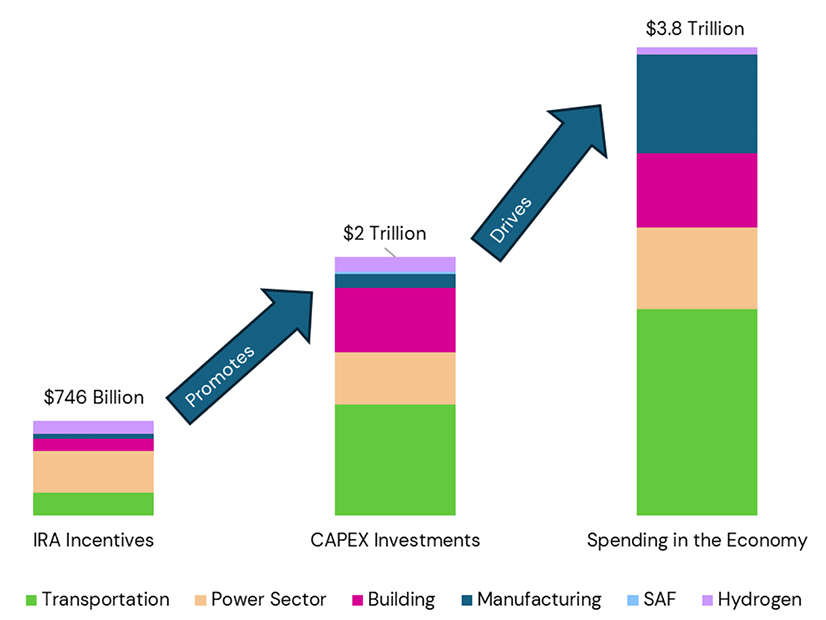

“Economy-wide Impacts of the Inflation Reduction Act Energy Provisions” estimates that the IRA’s roughly $740 billion in tax credits will:

-

- motivate approximately $2 trillion in capital investment;

- spur $3.8 trillion in spending attributable to the IRA;

- support 13.7 million job years from 2025 to 2035;

- contribute to the clean energy workforce expanding from 3 million in 2022 to 6.5 million in 2032;

- increase Americans’ disposable income by nearly $77 billion per year;

- eliminate emission of 4.1 billion metric tons of carbon dioxide equivalent; and

- yield more than $1 trillion in emissions benefits.

- That is a 4X return on taxpayer investment, the report concludes, with additional consumer savings from lower operating costs for higher-efficiency buildings and vehicles.

In the 28 months since the IRA was signed into law, “The clean energy tax credits have significantly increased domestic energy production, revitalizing communities across the country and lowering consumer energy bills,” American Clean Power Association CEO Jason Grumet said Dec. 19 in a news release announcing the study.

“By supporting our nation’s diverse array of energy resources, the IRA is strengthening our national security and enhancing economic competitiveness.”

That message directly aligns with some of the key stated priorities of President-elect Donald Trump, who has repeatedly attacked climate-protection initiatives including the IRA, a signature achievement of President Biden.

The IRA passed without a single Republican vote, and Republicans soon will be in a position to derail the remainder of the 10-year plan. But the economic benefits so far have accrued disproportionately to Republican congressional districts, and there is widespread speculation that any attempt at large-scale cancellation or clawback by Republican leadership will encounter resistance from the rank and file.

This gives some IRA proponents hope that any changes will be made with a scalpel rather than a chainsaw.

Introducing the study, ICF wrote that it sought to estimate incremental economy-wide impacts from the IRA — effects beyond those attributable to state policies and clean energy activity that would have occurred without the IRA.

It reviewed all IRA incentives in key areas: power, transportation, buildings, sustainable aviation fuel, hydrogen and manufacturing. Then it projected the incremental impacts of the IRA on each sector.

The accounting of the models includes not just positive impacts but negative factors such as the cost of funding the IRA, cost of private sector funding and cost of displaced economic activity such as fuels.

Supporting data include cost-benefit analyses, job creation due to investments made since 2022 and economy-wide employment impacts.

The U.S. Chamber of Commerce, Edison Electric Institute, National Electrical Manufacturers Association, National Hydropower Association and Nuclear Energy Institute joined with American Clean Power in endorsing the findings of the report.