ERCOT‘s Monthly Outlook for Resource Adequacy (MORA) report for March predicts the highest risk of an energy emergency alert (EEA) in the month will occur around 7 p.m. Central time, an ERCOT representative said in a webinar hosted by the Texas Reliability Entity on Jan. 21.

However, the overall likelihood of an emergency in the month is likely to remain low.

Pete Warnken, ERCOT’s resource adequacy manager, shared the report during the regional entity’s monthly Talk with Texas RE webinar, as part of a presentation on the grid operator’s reliability assessments for the winter months. NERC Manager of Reliability Assessment Mark Olson also took part in the call to discuss the ERO’s Winter Reliability Assessment and Long-Term Reliability Assessment, with a focus on their implications for the Texas energy grid.

ERCOT develops each MORA two months ahead of the month covered, based on data provided by ERCOT, its market participants and the grid operator’s consultants. MORA releases are targeted for the first Friday of the month; the March outlook was published Jan. 9.

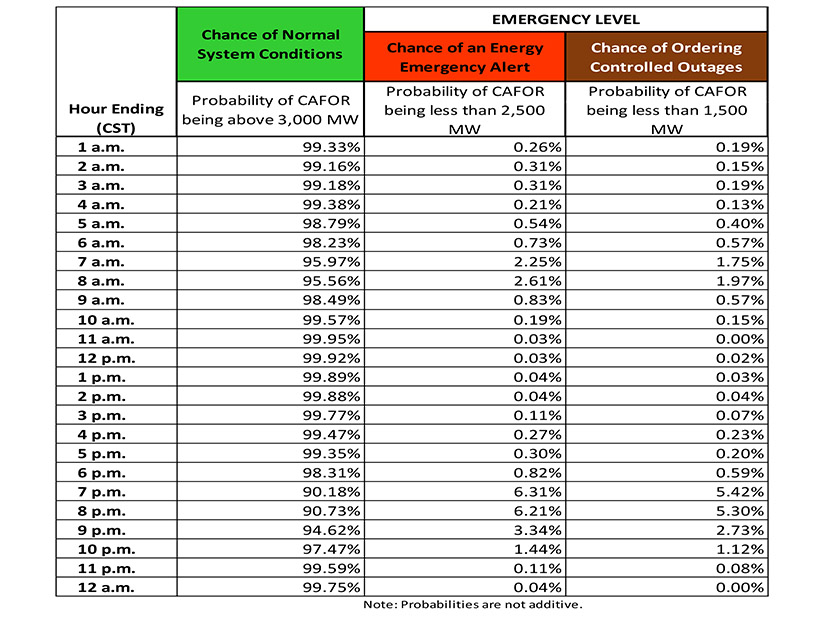

The MORA evaluates resource adequacy in two ways: first, by determining the risk ERCOT may need to issue an EEA or begin to order controlled outages for the monthly peak load day; and second, by evaluating the extent to which resource capacity can provide sufficient operating reserves for the hour with the highest risk of a reserve shortage. ERCOT does not specify a date for the peak load day.

According to the March MORA, the chance of an EEA — defined as the probability of capacity available for operating reserves (CAFOR) being less than 2,500 MW — on March’s peak load day will be 6.31% at 7 p.m. Central time, the highest likelihood of the day. The chance of ordering controlled outages, which matches the probability of CAFOR being less than 1,500 MW, also will be highest at that time, around 5.42%.

Warnken observed that while this level does not rise to what ERCOT would consider an elevated risk — which would mean a 10% or greater probability of issuing an EEA — it is higher than what the operator has seen in previous years for the same time period. This also was true of the February MORA, which he shared for comparison’s sake.

“You’ll notice that for … almost every hour, you do see a probability greater than zero,” Warnken said. “This is something that we weren’t seeing last year for a monthly report. And what explains this is, there’s been a lot of new loads being added to the system … things like data centers [and] AI computing facilities that run basically around the clock. And because they’re high loads for every hour, that risk [of having insufficient reserves] increases for the hours beyond what you typically see.”

Warnken also discussed ERCOT’s upcoming Capacity, Demand and Reserves (CDR) report, which the ISO normally publishes twice a year. Because of “significant methodology changes” introduced since the last CDR in May 2024, ERCOT delayed the planned December release to the middle of February to ensure the report’s quality. (See Texas PUC Shelves PCM Design Over Lack of Benefits.)

The biggest change to the report’s methodology is the use of effective load carrying capability (ELCC), defined as the expected reliability benefits of inverter-based resources during the hours with the highest risk of loss-of-load events, rather than using the historic availability of wind and solar facilities during peak load hours as in previous reports. Warnken said this approach will provide greater granularity into the effect of individual wind and solar facilities on the system, as well as battery energy storage systems.

Additional updates include revising the criteria for including planned resources in the CDR. Previous iterations of the report previously required material such as a signed interconnection agreement, adequate water supplies, and air permits; on top of these, the CDR now will require notification to ERCOT that a project developer has provided financial security for facility construction to the transmission provider, and that the transmission provider has received a notice to proceed with interconnection construction.

“One of the issues that we’ve had is that we’ve overestimated the amount of planned capacity forecasted,” Warnken said, noting that construction often is canceled or delayed on generation projects. “What we wanted to do is, add a couple of additional criteria to make sure that [we’re] less likely [to go] off the mark because of all these postponed projects.”