Utility scale solar

After a decade of intensive policy work and billions of dollars expended, the state’s grid was more reliant on carbon-based fuels in 2024 than in 2014.

New Jersey Gov. Mikie Sherrill signed two sweeping executive orders that sought to control the state’s aggressively rising electricity rates through ratepayer credits and generation expansion.

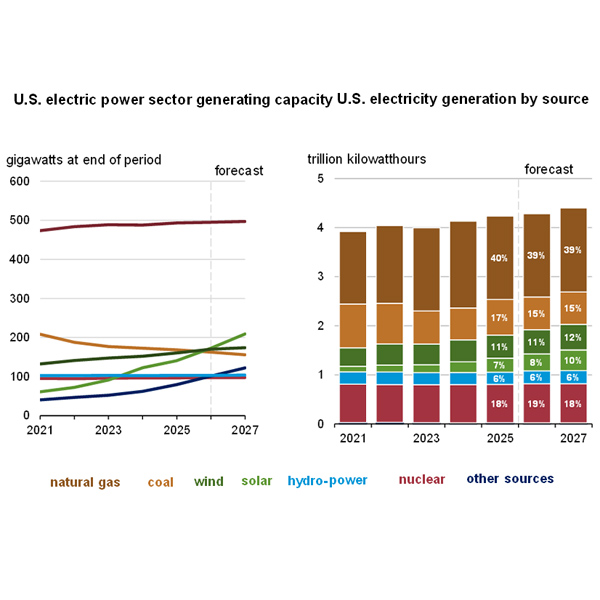

The U.S. Energy Information Administration forecasts the highest power demand growth in a quarter century in 2026 and 2027, due largely to the proliferation of data centers.

The renewable energy industry and its advocates have initiated two more lawsuits against the Trump administration over its continuing campaign against wind and solar energy development.

The degree of risk and uncertainty springing from indifferent or outright obstructive new federal policies in 2025 has trimmed planned solar deployment.

Representatives of Connecticut, Maine, Massachusetts and Vermont have selected a cumulative 173 MW of new solar generation through a coordinated procurement process.

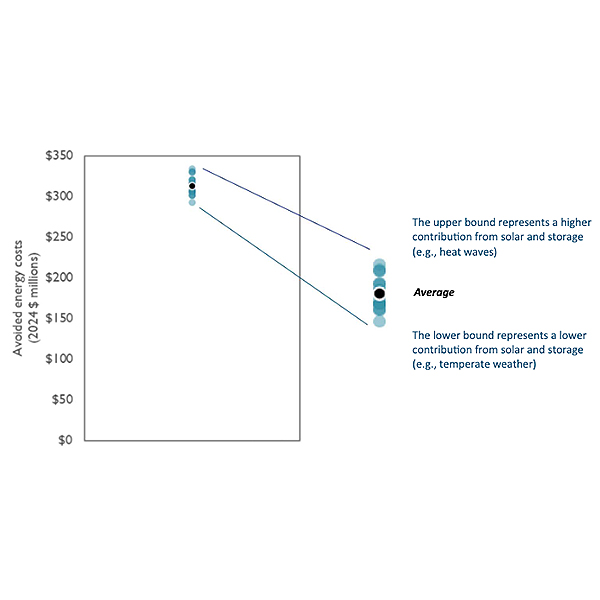

A new report estimates that solar and battery storage growth in New England between 2025 and 2030 could reduce wholesale energy costs across the region by about $684 million annually by 2030.

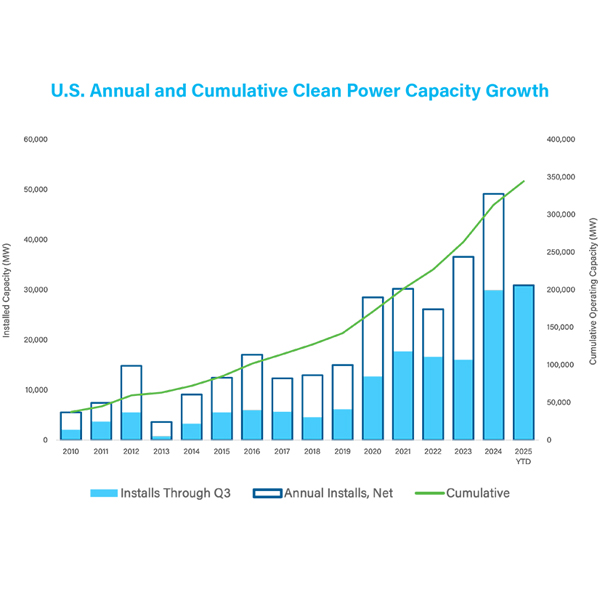

New solar, battery storage and onshore wind power generation totaled 11.7 GW in the third quarter of 2025, the American Clean Power Association reported.

Livewire columnist K Kaufmann argues that clean energy supporters should focus on a strategically planned, outcome-focused, and rapidly achievable transition toward renewables.

El Paso Electric again is seeking regulatory approval for its New Mexico renewable energy plan after resolving tariff-related cost uncertainty of a solar-plus-storage procurement proposed in the plan.

Want more? Advanced Search