EDAM

As the Bonneville Power Administration prepares to join Markets+, the agency hopes to complete the initial program governance setup and define its commercial model for market participation in early 2026.

The West-Wide Governance Pathways Initiative could lead the charge on developing an alternative to the Western Resource Adequacy Program that would integrate with CAISO’s Extended Day-Ahead Market, according to co-Chair Pam Sporborg.

FERC granted CAISO's request to remove the sunset date on the Western Energy Imbalance Market Assistance Energy Transfer feature, which has been used by more than 10 of the market’s balancing area authorities in recent years.

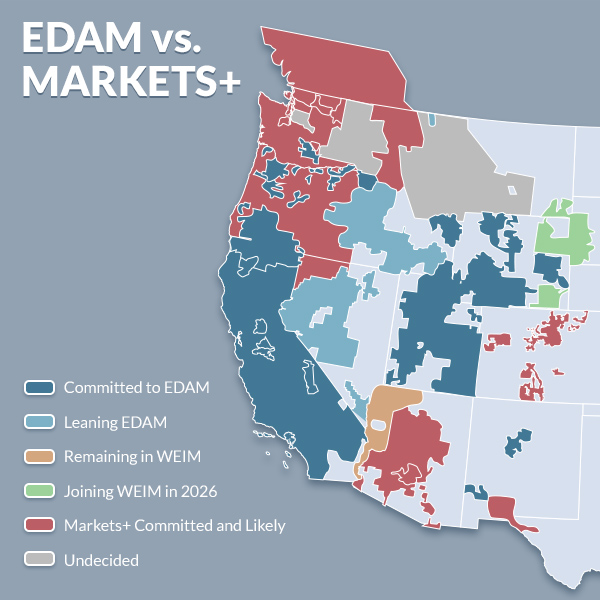

A new FERC report adds to the growing body of work showing the complexity of confronting the seams issues likely to arise between the West’s two day-ahead markets when compared with challenges at the borders between RTOs and ISOs in the Eastern U.S.

PacifiCorp is hiring additional employees to prepare for CAISO’s Extended Day-Ahead Market next year, with staff expecting the launch will bring a few “scratches and bruises.”

CAISO's Department of Market Monitoring has asked the ISO to re-evaluate its intertie scheduling proposal for the Extended Day-Ahead Market due to potential impacts on market participants.

A new Brattle Group study examined the impact on planning reserve margins of an alternative Western resource adequacy program that includes expected participants in CAISO’s Extended Day-Ahead Market.

At one of the most well attended workshops of the year, CAISO staff described new processes for scheduling intertie resources and resource adequacy imports in EDAM.

The Western Resource Adequacy Program Day-Ahead Market Task Force held its first meeting after the program’s binding decision deadline, with members exploring how the new participant footprint will impact transmission connectivity and other issues.

PacifiCorp joins other utilities leaving the Western Power Pool’s Western Resource Adequacy Program just before the deadline to commit to the program’s first binding phase.

Want more? Advanced Search