Markets+

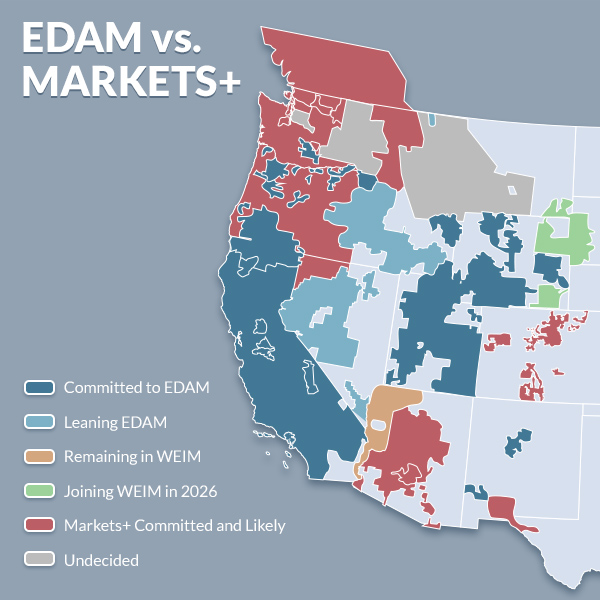

CAISO and SPP have made “significant progress” on adapting existing tools to tackle seams between the two entities’ respective day-ahead markets, according to a CAISO representative.

As the Bonneville Power Administration prepares to join Markets+, the agency hopes to complete the initial program governance setup and define its commercial model for market participation in early 2026.

The West-Wide Governance Pathways Initiative could lead the charge on developing an alternative to the Western Resource Adequacy Program that would integrate with CAISO’s Extended Day-Ahead Market, according to co-Chair Pam Sporborg.

A new FERC report adds to the growing body of work showing the complexity of confronting the seams issues likely to arise between the West’s two day-ahead markets when compared with challenges at the borders between RTOs and ISOs in the Eastern U.S.

SPP says the development of its Markets+ day-ahead market in the West is proceeding on time and under budget, with the hard part yet to come.

The Western Resource Adequacy Program Day-Ahead Market Task Force held its first meeting after the program’s binding decision deadline, with members exploring how the new participant footprint will impact transmission connectivity and other issues.

A group of nonprofits suing BPA said its decision to join SPP’s Markets+ instead of CAISO’s EDAM “violated clear mandates from Congress.”

PacifiCorp joins other utilities leaving the Western Power Pool’s Western Resource Adequacy Program just before the deadline to commit to the program’s first binding phase.

Calpine, Eugene Water & Electric Board, PGE and PNM joined NV Energy in leaving the Western Resource Adequacy Program, while Idaho Power signaled its continued commitment.

State regulators approved an accounting order for Public Service Company of New Mexico’s participation in CAISO’s Extended Day-Ahead Market, in a case that rekindled the debate over which day-ahead market PNM should choose.

Want more? Advanced Search