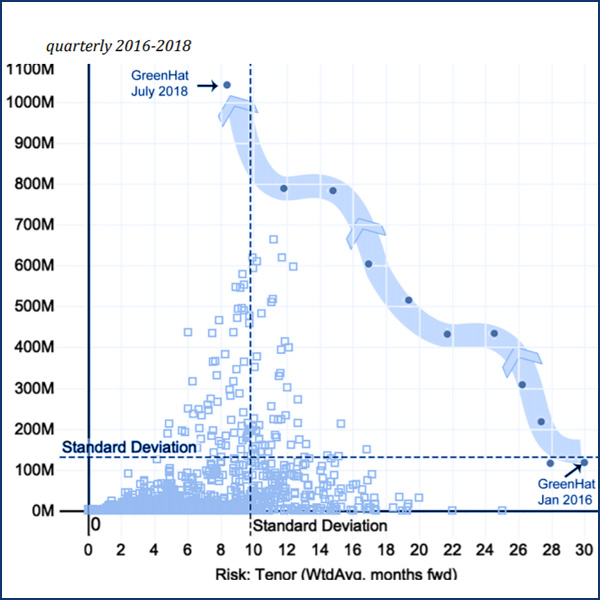

GreenHat Energy

PJM’s conference to discuss its $12.5 million settlement with two FTR firms produced neither protest nor complaint from any of the many stakeholders.

PJM will pay two trading firms $12.5 million to end a dispute over the 890 million MWh GreenHat Energy default under a settlement agreement filed with FERC.

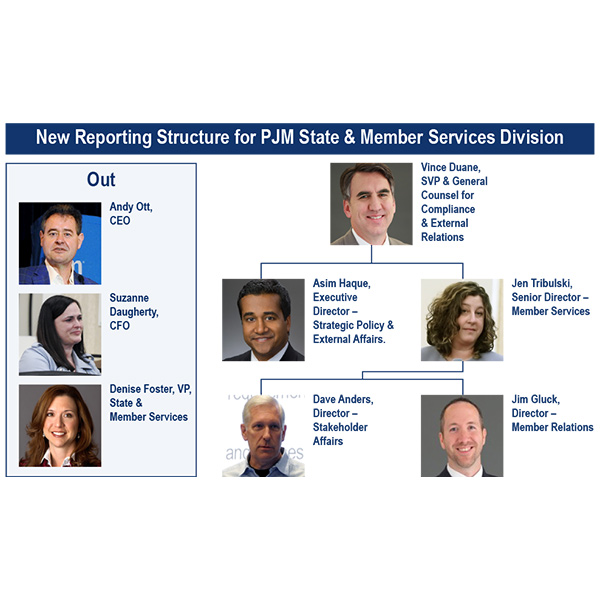

Regulators and other PJM stakeholders expressed dismay over the news that Denise Foster, head of the State and Member Services Division, was resigning.

PJM told their MIC that they anticipate submitting to FERC a settlement with its members on Oct. 9 over GreenHat Energy’s massive default.

Interim PJM CEO Susan J. Riley announced a shakeup of the RTO’s State and Member Services Division, the latest change in the wake of the GreenHat default.

MISO is proposing to increase collateral requirements in its FTR markets and give itself discretion to ban a participant from joining or re-entering.

The PJM Markets and Reliability Committee discussed the work of the Financial Risk Mitigation Senior Task Force and approved several manual changes.

Shell Energy and Old Dominion Electric Cooperative failed to make their case that they belong at the GreenHat Energy settlement table, FERC ruled.

Interim PJM CEO Susan J. Riley urged the Markets and Reliability Committee to move forward on “badly needed” credit policy reforms.

PJM announced the selection of its first chief risk officer — the official who will oversee the RTO’s credit policies in the wake of the GreenHat default.

Want more? Advanced Search