As Republicans in Congress debate whether to cut the Inflation Reduction Act’s clean energy tax credits, solar, wind and storage advocates are fighting back with reports arguing that renewables and the IRA tax credits are critical for achieving President Donald Trump’s goals of U.S. energy dominance, creating jobs and cutting consumer utility bills.

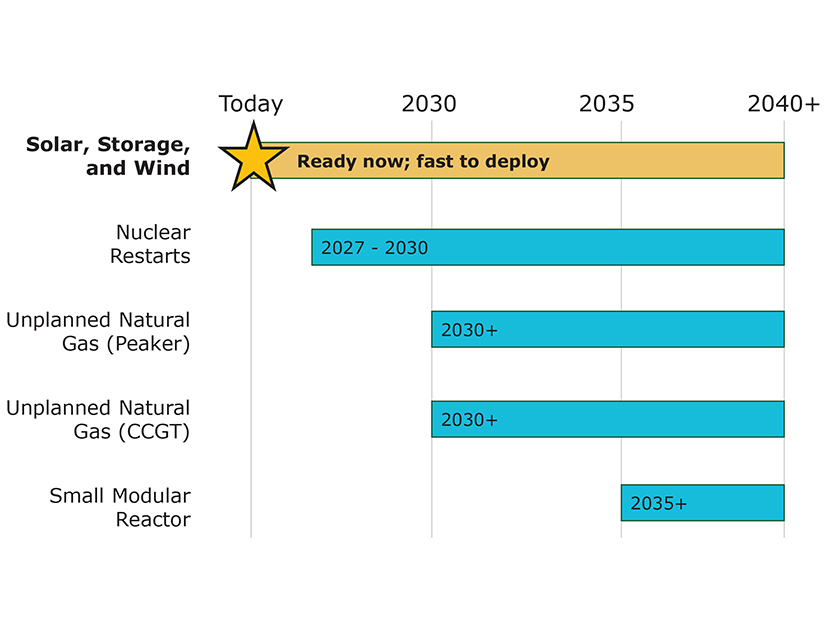

A new report from the American Council on Renewable Energy says solar and wind can be deployed cheaply and quickly to meet the country’s rapidly escalating demand growth, while providing support for natural gas and nuclear plants that could take five to 10 years to come online.

In a March 19 press release, ACORE President Ray Long echoed Trump’s rhetoric, calling for “an ‘all of the above’ energy strategy if we want to achieve energy dominance. We have an extraordinary opportunity to meet the demand growth challenge with affordable, reliable and secure energy, so we can’t afford to forfeit this chance by limiting our own advantage.”

Stretching the all-of-the-above argument even further, the ACORE report also frames renewables as a prop for increasing U.S. global dominance in natural gas exports and ensuring national security.

All-of-the-above has made the U.S. “the world’s largest producer of oil and natural gas,” the report says. “Clean energy provides domestic, readily deployable energy solutions to meet Americans’ needs while continuing to enable high-value exports of liquefied natural gas and other resources abroad, and further lessening dependence on unpredictable foreign actors and external shocks.”

A second report, from nonprofit Energy Innovation Policy and Technology, focuses on jobs ― particularly those that could be lost ― state by state, and the impact on consumer energy bills if the tax credits are repealed. The U.S. could lose 790,000 jobs by 2030, while electric bills for all American households could increase by $6 billion by 2030 and $9 billion by 2035, the report says. GDP could drop by as much as $160 billion.

Trump’s freeze on IRA funding already may have stalled as many as 60 clean energy projects, totaling $57 million in investments, the EI report says.

“Reduced clean energy investment will increase fuel and operating expenses across the country,” the report says. “Wind and solar have no fuel costs and lower operation and maintenance (O&M) costs than gas, coal, oil and nuclear power plants. Full repeal of existing federal policies would increase the share of electricity coming from these power plants, creating roughly $20 billion in additional fuel and O&M costs in both 2030 and 2035.”

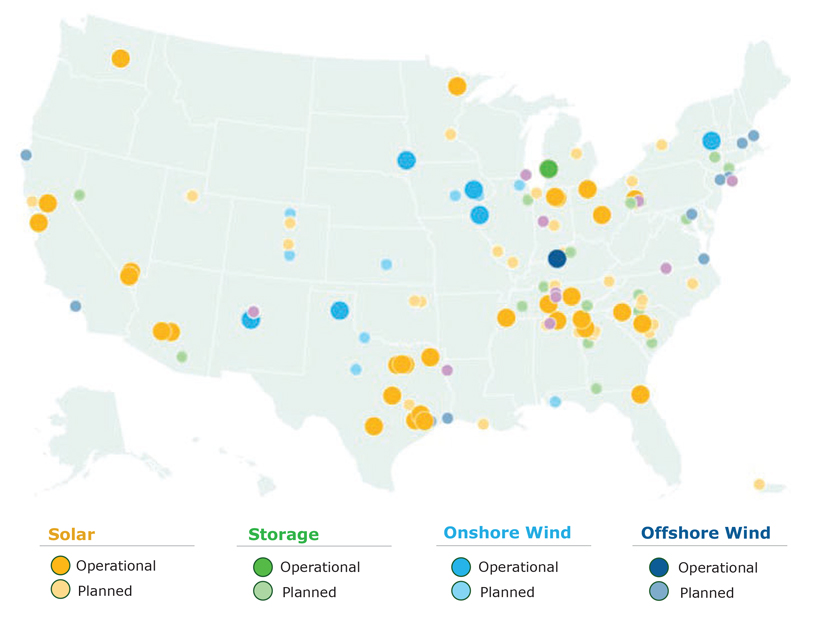

Both reports stress that Republican states and districts have received the lion’s share of IRA dollars, which in turn have attracted private investment and created jobs. Georgia led the nation, adding an estimated 43,000 new jobs since passage of the law, ACORE says.

But if the law’s tax credits and other incentives are repealed, EI estimates the state could lose 15,200 jobs by 2030 and 28,600 by 2035, along with about $3.4 billion in GDP. Household energy bills could go up $2 billion statewide, with individual electricity bills rising $40 per year in 2030 and $180 per year by 2035, the report says.

Competing with China

Georgia took a big hit in February when Freyr Battery abandoned its plans to build a $2.6 billion battery factory in the state, deciding instead to refocus its business on a solar panel factory it had bought in Texas, according to an Associated Press report. The change in company priorities was driven by high interest rates and competition from cheap Chinese batteries, the company said.

Battery maker Kore Power also backed out of its plans to build a $1.2 billion factory in Arizona after Trump froze IRA funding, according to Canary Media. The company had received a conditional commitment for a $850 million loan from the Department of Energy’s Loan Programs Office in 2023 but had not finalized it before the change in administration.

Similar to Freyr, Kore decided to go with a cheaper option and plans to lease an existing factory site and retrofit it for batteries.

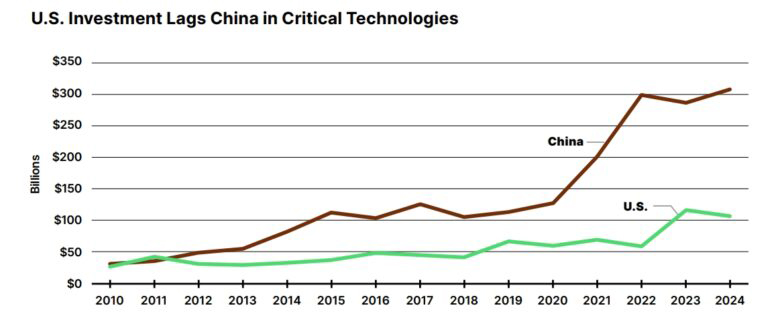

Chinese dominance in clean tech investing provides another argument for keeping the tax credits, the ACORE report says. In 2024, China invested more than $300 billion in solar, wind, geothermal and energy storage technology, versus just over $100 billion in the U.S.

“A full repeal of the IRA could create up to $80 billion in energy investment opportunities in other countries, compared to a base case scenario where the IRA is preserved,” the report says. “Under these projections, announced projects and 50% of projects under construction could be canceled, and manufacturers would likely seek to meet global demand through factories abroad.”

ACORE backs up those numbers with a survey of top energy executives at companies “that actively finance or develop clean energy projects.” In a scenario where IRA tax credits remain in place, about 30% of the top companies ― those investing $1 billion or more in clean energy ― said they would increase their investments by 5 to 10% or more.

Faced with potential uncertainty about the tax credits, more than 80% of the companies said they would decrease their investments either significantly or moderately.

“Sponsors are going to start having to think about how much capital they can put at risk for developing assets that take four or five years to develop, if we don’t have some level of certainty around how we’re going to manage the tax credits,” one unnamed institutional investor told ACORE.

Heavy Pressure

The IRA’s clean energy tax credits and incentives have been in the crosshairs of some Republican lawmakers almost from the moment former President Joe Biden signed the bill into law in August of 2022. But outright repeal is not universally supported, exactly because of the projects, jobs and additional economic benefits the law has brought to red states and districts.

In August 2024 and again in March, Rep. Andrew Garbarino (R-N.Y.) led a small group of Republican representatives writing to House leadership to take “a targeted and pragmatic approach” to IRA tax credits. The August letter was signed by 18 representatives, and the most recent one on March 9 had 21 signatures, including Garbarino’s.

The letter’s talking points echo the industry advocates, who have been actively lobbying Garbarino and others on Capitol Hill, The New York Times reports.

The 10-year time frame for tax credits, established in the IRA, has been vital for “capital allocation, planning and project commitments, all of which would be jeopardized by premature credit phaseouts or additional restrictive mechanisms such as limiting transferability,” the letter says. “As energy demand continues to skyrocket, any modifications that inhibit our ability to deploy new energy production risk sparking an energy crisis in our country, resulting in drastically higher power bills for American families.”

Garbarino is also trying to detach the tax credits from the IRA, noting that most of them existed prior to the law, which primarily extended them, according to the Times article.

With Republicans’ razor-thin majority in the House of Representatives, Garbarino and other tax credit supporters could hold a balance of power as leadership looks for ways to fund the trillions of dollars needed to extend the 2017 Tax Cuts and Jobs Act.

But many analysts have noted that if Congress produces a budget reconciliation bill that slashes the IRA tax cuts, even supporters like Garbarino would be under heavy pressure from their colleagues and Trump to vote the party line.