CAISO’s Department of Market Monitoring (DMM) said March 27 that lower natural gas prices helped drive down energy prices in the Western Energy Imbalance Market (WEIM) in the fourth quarter of 2024.

Energy prices across the WEIM averaged about $39/MWh in the 15-minute market — down approximately 31% compared to the fourth quarter of 2023 — despite load being about 2% higher on average, according to Ryan Kurlinski, the DMM’s senior manager of monitoring and reporting.

Similarly, the DMM’s quarterly report found prices in the five-minute market “were also down 31% and day-ahead market prices were down 22% compared to Q4 2023.”

The lower energy prices were largely due to lower gas prices, according to the DMM.

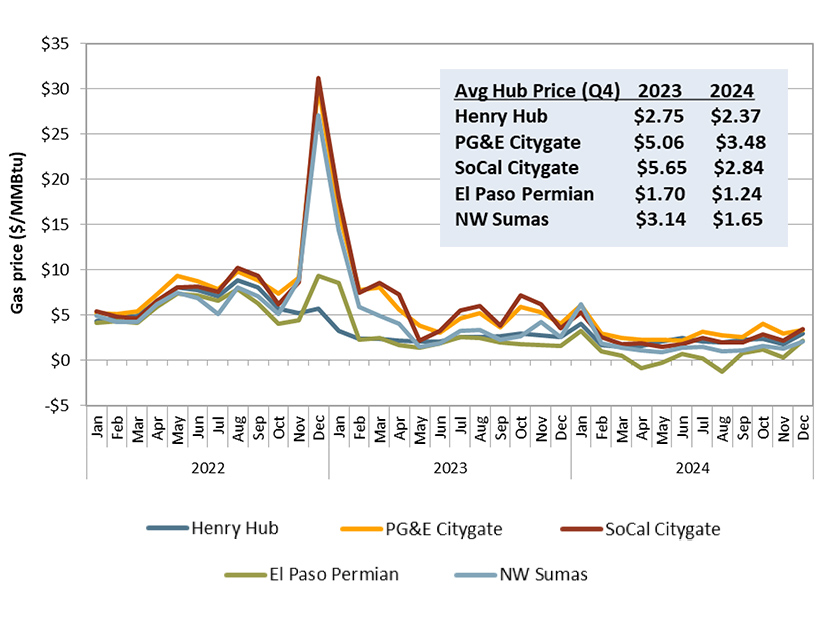

“Average fourth quarter prices at the two main delivery points in California (PG&E Citygate and SoCal Citygate) decreased by 31% and 50% compared to the same quarter of the previous year, respectively,” the DMM report stated.

Prices at the Henry Hub trading point, a reference point for natural gas markets, decreased by 14% in the fourth quarter of 2024 compared to the same quarter of 2023.

Prices at Northwest Sumas and El Paso Permian also dropped by 47% and 26%, respectively, during the same period, according to the DMM.

Compared to the rest of the WEIM region, California recorded the highest average energy price at about $45/MWh in the quarter, while other regions’ 15-minute market prices ranged between $32/MWh and $38/MWh, according to DMM.

“The greenhouse gas costs in California continue to be a significant contributor to the higher prices in California compared to other regions,” Kurlinski said.

The fourth quarter of 2024 also saw an upswing in generation from renewable resources in the WEIM footprint. Renewable output “increased by about 4,320 MW (14%) compared to the fourth quarter of 2023. Over 65% of this growth was from wind and solar generation, both of which increased in every region,” according to the report.

Average hourly battery discharge in the CAISO and Desert Southwest regions also increased by 490 MW (64%) and 300 MW (125%), respectively.

Meanwhile, the report pointed to a continued pattern of congestion revenue rights auction revenues underfunding CRR payments, with the fourth quarter marking a $1.7 million shortfall. (See Congestion Revenue Rents Still Underfunded, CAISO DMM Says.)

“These losses are borne by transmission ratepayers who pay for the full cost of the transmission system through the transmission access charge,” according to the report. “Changes to the auction implemented in 2019 have reduced, but not eliminated, losses to transmission ratepayers from the auction. The [DMM] continues to recommend further changes to eliminate or further reduce these losses.”