NERC’s Interregional Transfer Capability Study represents “a crucial input in development of a modern, reliable, grid” despite its limited congressional mandate and time frame, the agency said in responding to comments on the report March 25.

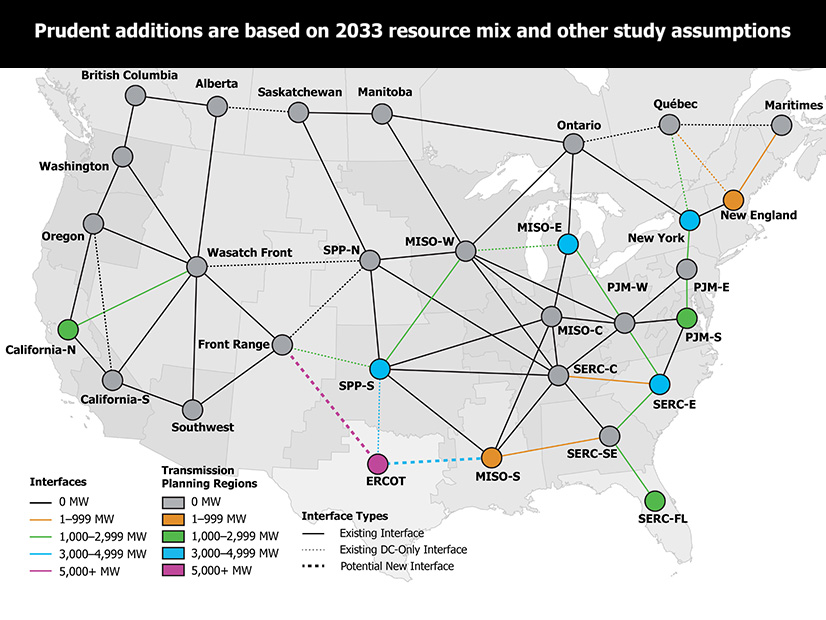

NERC filed the ITCS with FERC in November 2024 as directed by the Fiscal Responsibility Act of 2023. In accordance with Congress’ order, the study outlined current transfer capabilities across the U.S. grid, recommendations for prudent additions that could strengthen grid reliability, and recommendations to meet and maintain total transfer capability (AD25-4).

After the public comment period ordered by the FRA, FERC will submit recommendations for statutory changes, if any, to Congress.

The ERO’s recommendations included 35 GW of additional transfer capability across FERC’s planning regions, with more than 14 GW in ERCOT across the SPP-South connection and two entirely new connections. (See NERC Releases Final ITCS Draft Installments.) This suggestion prompted a comment from ERCOT, which pointed out that about 32 GW of solar and wind resources have come online in Texas since Winter Storm Uri in 2021 and said NERC’s analysis may not have fully accounted for these additions.

“The nameplate capacity these resources have added to the ERCOT system is more than double the 14 GW of interregional transmission the ITCS recommends for the ERCOT region,” ERCOT said. “The ITCS’ attempt to account for future resource growth on the ERCOT system likely underestimates the resource additions that will actually occur as ERCOT continues to commission new resources at a record pace, connecting over 12 GW of new generation in 2024 alone, on top of the 7 GW connected in 2023.”

ERCOT also cautioned that the ITCS “may be overly optimistic” in its expectations for the proposed transmission expansions, noting that “generation resources must still be available to provide power … over those transmission lines.”

The ISO said market incentives, which the ITCS did not take into account, “are an indispensable part of energy adequacy and future generation growth [and] are actively being examined and refined in the ERCOT region.”

In response, NERC said it recognizes the potential impact of market mechanisms on energy adequacy, although they were not a part of the ITCS. In addition, the ERO acknowledged that the effect of “connections such as ERCOT to” SERC Southeast — mentioned in the report — needed more study than Congress allotted time for. It pointed out the report contains a chapter with areas for future study to understand the relationship between transfer capability and grid reliability.

NERC also replied to a comment from the Eastern Interconnection Planning Collaborative, an association of 18 planning authorities from the Eastern and Central U.S., which argued for expanding the ITCS by “adding credit for transmission products and plans” and warned against using the study “as a metric for determining prudent additions.” (See EIPC: Transmission Studies Need More ‘Granularity’.)

The ERO observed that such a change “would have exceeded the scope of the” FRA and might even have usurped FERC’s responsibility to recommend regulatory action. However, NERC said it would continue separately to highlight the issues raised by EIPC and would urge policymakers and industry to take them under consideration.

Finally, NERC pushed back on a comment from sponsors of the South Carolina Regional Transmission Planning Process and the Southeastern Regional Transmission Planning Process, which between them comprise a number of utilities, including Dominion Energy South Carolina, Santee Cooper, Associated Electric Cooperative and Duke Energy. The SCRTP and SERTP sponsors claimed that while NERC facilitated stakeholder engagement during the first phase of analysis, for the most part the ERO could not engage stakeholders during the second phase “due to time constraints.”

NERC countered this assertion, saying it had engaged in outreach at every stage, including “consulting with transmitting utilities and other stakeholders” in the Southeast. The ERO also emphasized that its consultation process for the second phase of analysis consisted of multiple steps that continued through more than half of 2024, and that the ITCS Advisory Group of grid stakeholders “included two representatives from the Southeastern U.S.”