The authors of a new report released April 4 say better market integration and reduced interregional constraints in the U.S. transmission network would have saved as much as $12 billion in 2022 and 2023.

They note the importance of achieving better grid integration in an era when increasing amounts of renewable generation is coming online but flag the difficulty of achieving it, given the financial incentive existing generators have to delay or block such integration.

The working paper, “Power Flows, Part 2: Transmission Lowers US Generation Costs, But Generator Incentives Are Not Aligned,” was written by Dasom Ham, Owen Kay and Catherine Hausman as part of Resources for the Future’s Obstacles to Energy Infrastructure research project.

They write that geographic constraints and mismatched supply and demand are growing as intermittent wind and solar capacity come online, often far removed from high-demand areas.

Better integration of electricity markets could allow systemwide cost savings and therefore lower consumer costs, the paper says. Integration of existing supply across regions could have saved $5.8 billion to $7.1 billion under 2022 conditions (which included higher natural gas prices) and $3.4 billion to $5 billion under 2023 conditions.

Other savings that could be created by intraregional integration were not estimated, nor does the report offer a full cost-benefit analysis of building new transmission or look at the cost versus societal benefit of building renewables.

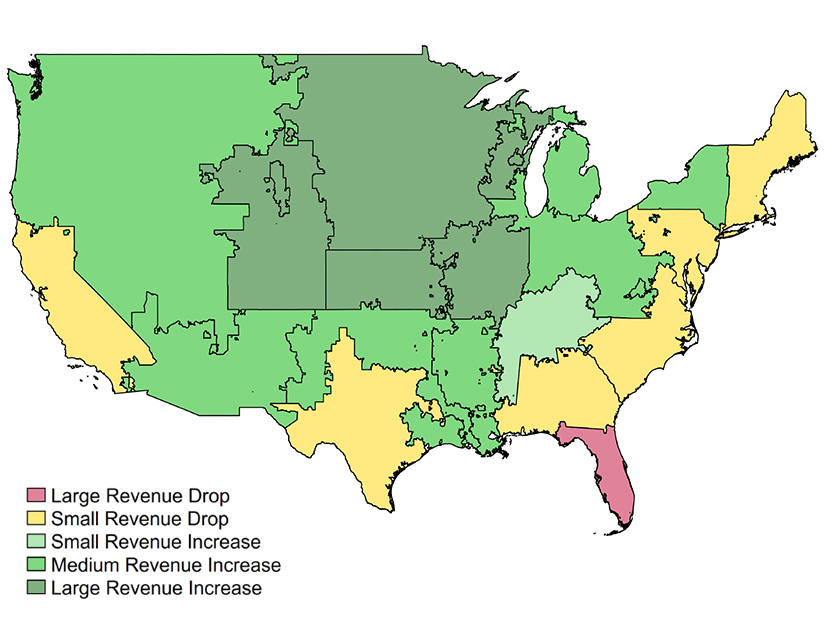

But such integration would also create winners and losers, as existing generators in high-demand markets see their net profits drop and renewables in high-supply markets avoid curtailment.

The structure and processes of markets give those incumbents many opportunities to delay or block transmission construction projects that would run counter to their interests, and the report highlights case studies in multiple regions where they appear to have done just that.

This opposition can be hidden within workings of RTOs or it can be publicly visible, such as NextEra Energy’s long-running but unsuccessful fight to thwart Avangrid’s construction of the New England Clean Energy Connect, which will bring up to 1.2 GW of cheap Canadian hydropower to a region where NextEra operates multiple power plants.

The analysis showed these dynamics vary substantially by region: Greater market integration would benefit existing power producers in the Great Lakes, Great Plains and Rocky Mountain regions but hurt producers in the Northeast and Southeast.

The barriers to siting, planning, permitting and construction of transmission are well known, and include cost allocation, land rights and environmental clearance. Importantly, transmission planning and changes to market structure for interregional electricity trade depends largely on the consensus of incumbent generation companies, who hold greater sway than stakeholders who would see cost savings.

Investment patterns in recent years show the result of these dynamics: Only 2% of new circuit miles installed from 2011 to 2020 were for interregional transmission lines, and the majority of all transmission investments were for local reliability concerns rather than generation cost savings.

The new report builds on “Power Flows: Transmission Lines, Allocative Efficiency and Corporate Profits,” a working paper written by Hausman and issued by the National Bureau of Economic Research in January 2024.

The earlier report focused on the MISO and SPP regions, but the new report looks at the entire continental U.S. The dynamics are similar and can be generalized, but MISO and SPP do have some distinctive features, and there were some limitations in extending the research design to the rest of the country.

Data was obtained primarily from the Energy Information Administration and EPA’s Continuous Emissions Monitors Systems datasets.